Breakfast | Chip stocks plummeted by 7%, Nasdaq fell by 2.8%, while Dow continued to hit new highs

The Philadelphia Semiconductor Index plunged nearly 7%, marking the largest drop since the outbreak of the pandemic. NVIDIA fell 6.6%, ranking the worst among the "Tech Seven Sisters". ASML plummeted nearly 13%, triggering a circuit breaker. Applied Materials, AMD, and Lam Research all fell by over 10%, while Intel and IBM bucked the trend and closed higher. The U.S. stock market showed significant divergence, with the Dow hitting new highs. Healthcare and financial stocks performed well, with UnitedHealth soaring 11% over two days, Johnson & Johnson rising 4.8% over two days, JPMorgan Chase hitting new highs, and Berkshire Hathaway rising for 7 consecutive trading days, steadily approaching a market value of nearly $1 trillion

Good morning! A great day starts with making money.

Overnight Morning Market

Geopolitical tensions escalated, coupled with ASML's lower-than-expected performance guidance, causing a sharp drop in technology and chip stocks. The Nasdaq plummeted by 2.8%, with the Nasdaq 100 falling nearly 3%. The Dow Jones continued its six-day winning streak to hit a new high, while the Russell 2000 small-cap stocks ended a five-day rally. Overall stock indices saw significant declines, mainly concentrated in the technology, communication, and non-essential consumer goods sectors, while consumer goods, energy, and financial sectors performed relatively well.

Nasdaq 100 Index down 2.94%; Nasdaq Technology Market Cap Weighted Index (NDXTMC) measuring the performance of Nasdaq 100 technology sector components down 4.29%; Russell 2000 small-cap stocks closed down 1.06%; VIX fear index rose 9.70% to 14.47, approaching the May 2 peak of 16.09.

Philadelphia Stock Exchange KBW Bank Index rose 0.61% to 114.67 points. Dow Jones KBW Regional Bank Index rose 1.58% to 114.29 points.

Philadelphia Semiconductor Index plunged nearly 7%, with NVIDIA dropping 6.6% as the worst performer among the "Tech Seven Sisters". ASML fell nearly 13% and was temporarily halted, while Applied Materials, AMD, Lam Research all fell by over 10%. On the contrary, domestic companies like Intel and IBM rose against the trend.

US stocks showed significant differentiation, with the Dow Jones Index rising for six consecutive trading days. Among its components, healthcare and financial stocks continued to strengthen. UnitedHealth surged 11% in two days since announcing its financial report, while Johnson & Johnson rose by 4.8% over two days. Financial stocks continued to perform well, with JPMorgan hitting new highs, Berkshire Hathaway rising for seven consecutive trading days and gradually approaching a market value of nearly $1 trillion.

Blue Chips and Hot Stocks

The "Tech Seven Sisters" suffered a complete rout, with a total market value loss of up to $1.1 trillion in the past five days. NVIDIA led the decline with a 6.64% drop, maintaining the third position with a market value below $3 trillion; Tesla fell by 3.14%; Apple dropped by 2.53%, maintaining its first place with a market value of $3.51 trillion; Microsoft fell by 1.33%; Google Class A fell by 1.58%; Amazon dropped by 2.64%; "Metaverse" Meta fell by 5.68%.

Chip stocks almost across the board suffered defeat, with ASML dragging the chip index down by over 6.8%. Philadelphia Semiconductor Index fell by 6.81%; industry ETF SOXX dropped by 7.11%; NVIDIA's double long ETF fell by 13.37%; ASML ADR dropped by 12.74%, while Applied Materials, AMD, Marvell Technology, Lam Research all fell by over 10%, KLA dropped by 9.85%, Arm Holdings fell by 9.55%; Qualcomm dropped by 8.61%, Taiwan Semiconductor fell by 7.98%, Broadcom fell by 7.91%, Micron fell by 6.27%.

Tesla: Barclays raised its target price from $180 to $225. "Wood Sister" Cathie Wood stated that Tesla's development of an autonomous taxi platform will cause the stock price to soar tenfold. The autonomous taxi ecosystem represents an "$8 trillion to $10 trillion global revenue opportunity", with platform providers like Tesla potentially capturing up to half of it Investors are no longer purely valuing Tesla as an electric car manufacturer, but are starting to factor in the potential of autonomous taxi services.

Qualcomm: HSBC downgraded Qualcomm's rating from Buy to Hold, with a target price of $200.

United Airlines (UAL): UAL's second-quarter revenue roughly met expectations, with a downward revision of full-year capital spending expectations. It is expected that the adjusted EPS for the third quarter will be $2.75-2.35, lower than analysts' expectations of $3.38. The company's stock price fell by about 5% after hours.

Chips and Artificial Intelligence

ASML, the giant of lithography machines: The company's stock price was suspended at one point during the day. ASML announced its second-quarter performance, with both profit and sales exceeding expectations. The booming demand for AI chips drove Q2 orders to €5.57 billion, far exceeding the expected €4.41 billion. ASML still expects the industry to continue to recover in the second half of the year, but the company's outlook for the third quarter is lower than expected, with projected net sales of €6.7 billion to €7.3 billion, compared to the market's expectation of €7.46 billion.

Geopolitical tensions escalated, causing a sharp drop in chip stocks despite the second-quarter report exceeding expectations due to AI demand. ASML ADR fell to a circuit breaker during trading, closing down 12.74%, leading to a global decline in chip stocks.

On the geopolitical front, there was news yesterday that led to the sharp decline in chip stocks:

The United States is considering taking stricter measures to pressure Japan and the Netherlands, restricting trade in chips with China. The Ministry of Foreign Affairs: Hope relevant countries resolutely resist coercion.

According to Global Times, on the 17th, Foreign Ministry spokesperson Lin Jian presided over a regular press conference. A Bloomberg reporter asked that the United States is considering taking stricter measures to pressure companies in Japan and the Netherlands, restricting their trade in chips with China. What is China's comment on this?

Lin Jian responded that China has repeatedly expressed a firm stance on the U.S.'s malicious blockade and suppression of China's semiconductor industry. The U.S. has politicized, generalized, and instrumentalized economic, trade, and technological issues, continuously escalating chip export controls to China, coercing other countries, suppressing China's semiconductor industry, seriously undermining international trade rules, damaging the stability of the global supply chain, and not benefiting any party. China has always resolutely opposed this.

Lin Jian stated that he hopes relevant countries will distinguish right from wrong, resolutely resist coercion, jointly uphold a fair and open international economic and trade order, and truly safeguard their long-term interests.

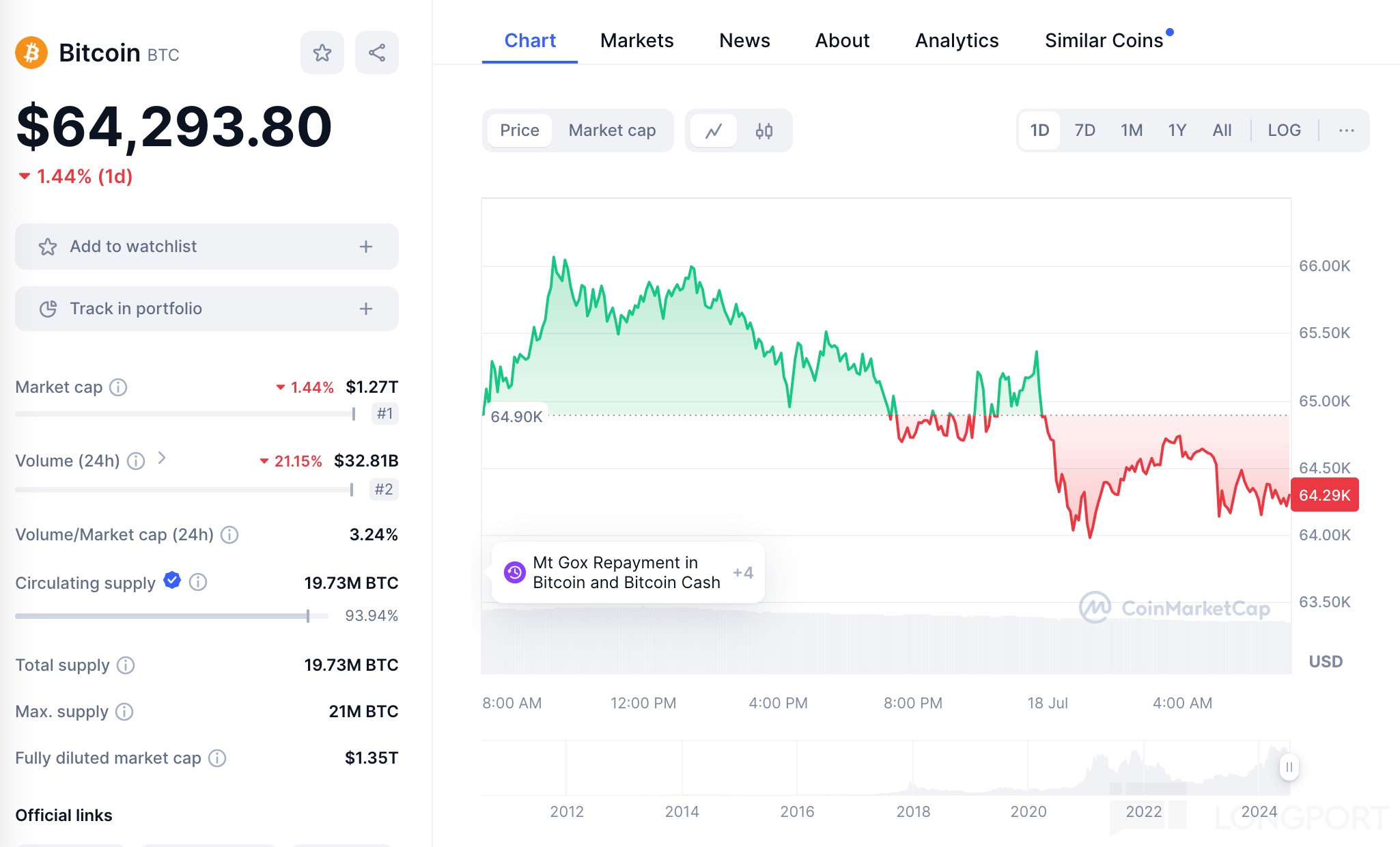

Cryptocurrency

BTC fell slightly below $65,000 due to the impact of the tech stock downturn:

Macro: Taking You Around the World

Federal Reserve Board Governor Waller said that it is getting closer to the time to cut interest rates. William Williams, the President of the Federal Reserve Bank of New York, who enjoys permanent voting rights in the FOMC and is known as the "third in command" of the Federal Reserve, stated that the Fed is close to cutting interest rates but is not yet ready to do so. Both of them, along with Richmond Fed President Barkin, mentioned that the encouraging inflation data in recent months needs "more" evidence to prove that inflation is slowing down

Expectations for interest rate cuts remain mild, with expectations for rate cuts in 2025 heating up

Powell's slightly hawkish remarks did not have a significant impact on the market, as the market has fully priced in a rate cut in September. In the bond market, pre-market trading in the US saw US Treasury yields rise due to better-than-expected June housing starts and industrial output data, but later, as US stocks were sold off, a large amount of funds flowed into the bond market, causing US bond yields to retreat from their highs and slightly rebound towards the end of the session.

In the foreign exchange market, the US dollar weakened further, falling to its lowest level since March, with the yen rising 1.4% against the dollar to 156.2, hitting a new high since June 12, sparking speculation in the market that the Japanese authorities may intervene again to buy yen. Commodities saw mixed movements. US crude oil inventories fell sharply last week, coupled with the weak US dollar, leading to a 2.5% surge in US oil prices. Rate cut expectations, risk aversion sentiment, central bank gold purchases, and other factors drove gold prices to test new highs during the session, with spot gold closing down 0.4% off its historical high, while spot silver fell nearly 4%.

In other data, US mortgage rates fell to 6.87%, the lowest level since early March, also boosting bets on a rate cut in September. The Federal Reserve's Beige Book showed that due to reasons such as the US election, domestic politics, geopolitical conflicts, and inflation, it is expected that the US economic growth rate will slow down in the next six months