TSMC to release earnings report at 2 PM, will it boost chip stocks?

Overnight, the leveraged semiconductor ETF SOXL plunged more than 21%! Can Taiwan Semiconductor's performance stop the decline?

Overnight, chip stocks plummeted, with the Philadelphia Semiconductor Index (SOX) falling nearly 7%, and the triple leveraged semiconductor ETF (SOXL) plunging 21%.

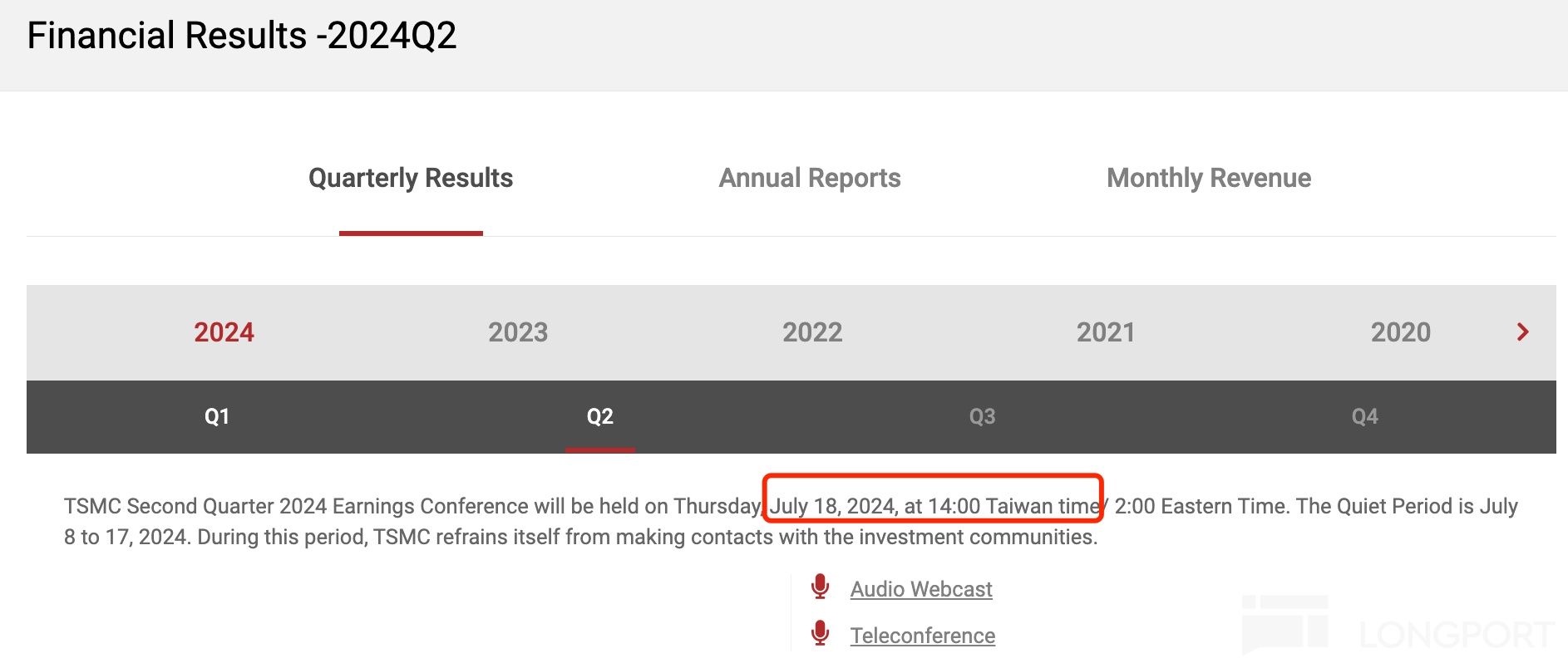

Today (July 18) at 2 p.m., leading chip manufacturer Taiwan Semiconductor is set to announce its financial results:

The overnight plunge was mainly due to slightly disappointing performance from lithography leader ASML, as well as escalating trade tensions.

Regarding trade tensions, the U.S. is considering stricter measures to pressure the Netherlands and Japan, restricting chip trade with China. The Ministry of Foreign Affairs responded: hoping that relevant countries will resolutely resist coercion.

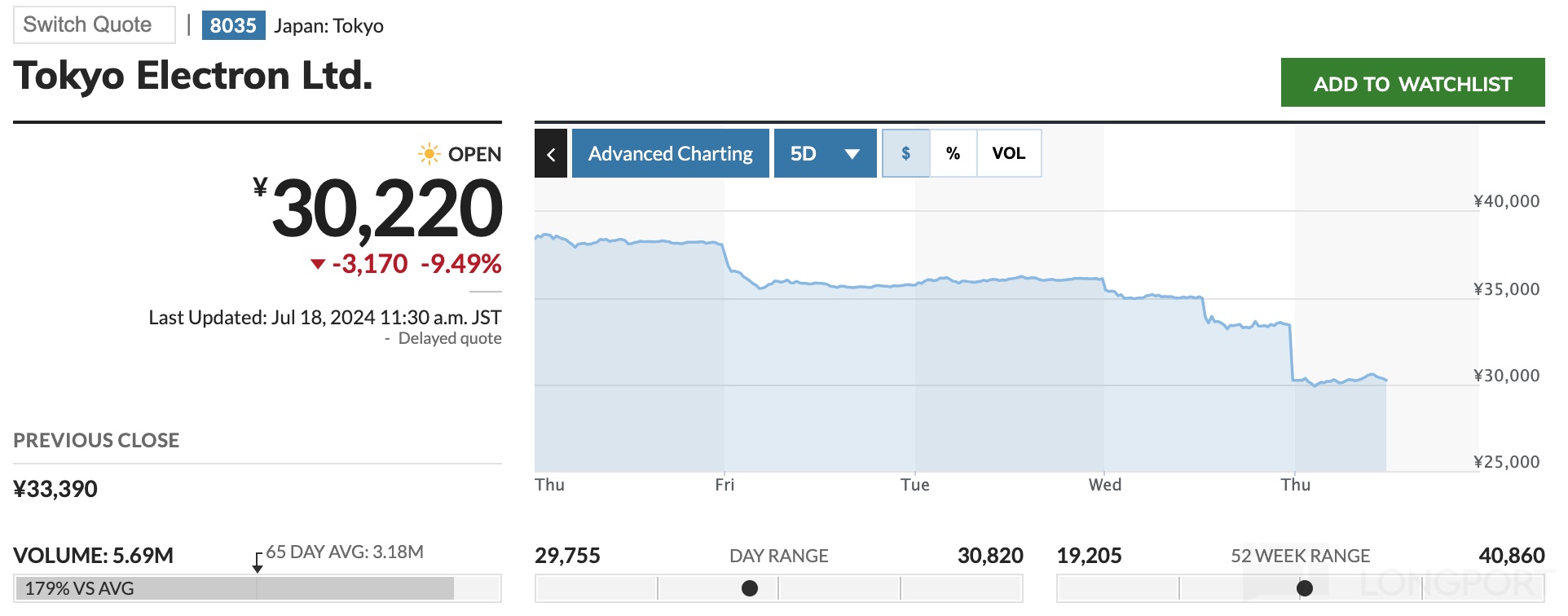

ASML from the Netherlands plunged nearly 13% overnight (nearly 50% of its revenue comes from China), while Tokyo Electronics from Japan fell 7.5% yesterday and continued to drop by about 9% today (around 40% of its revenue comes from China):

The market is also hoping that Taiwan Semiconductor's performance can prevent further declines in chip stocks.

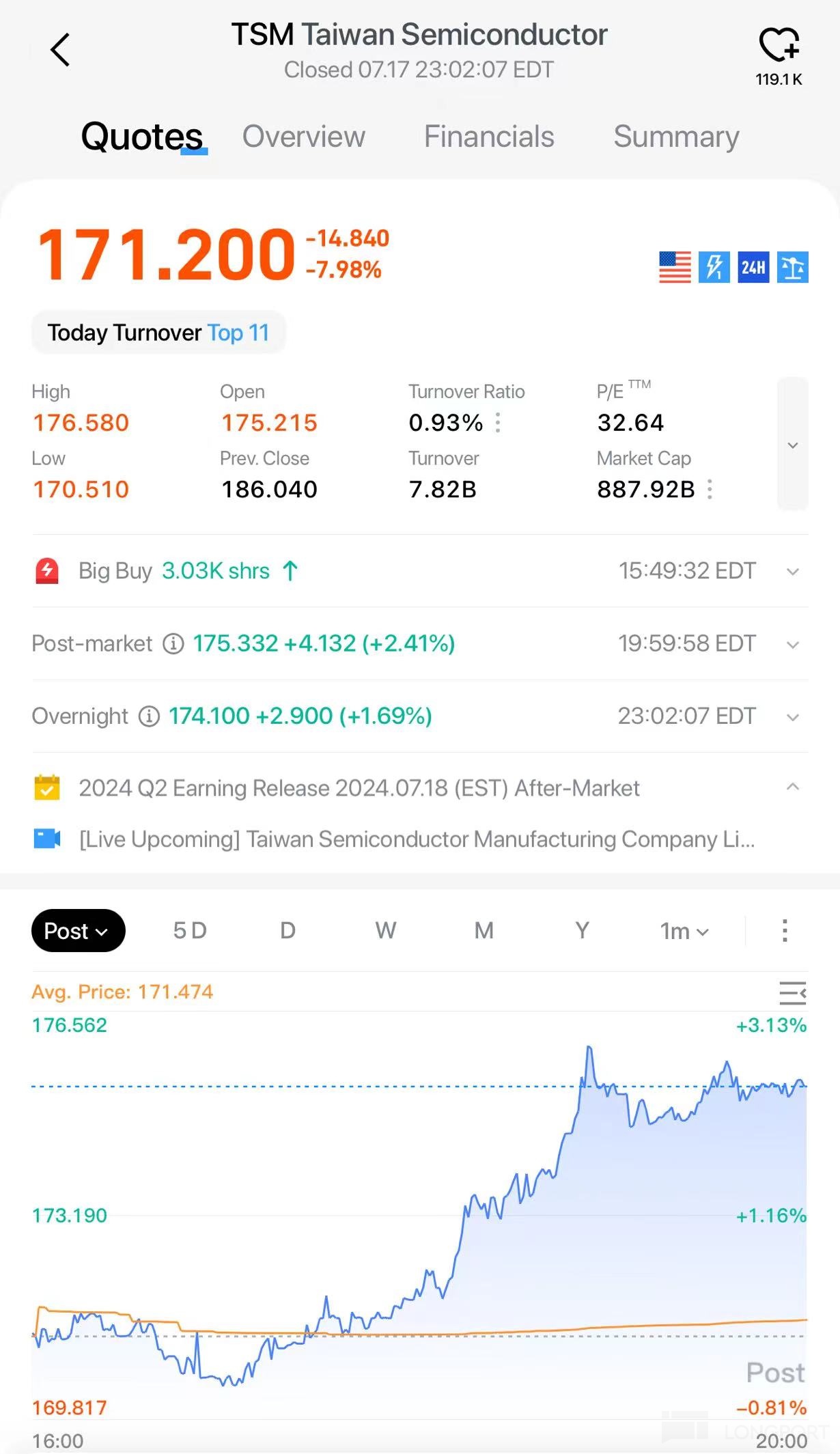

Although Taiwan Semiconductor also plummeted nearly 8% overnight, in early morning after-hours trading, it rose over 2.4%:

Recently, Taiwan Semiconductor surpassed a trillion-dollar market value, backed by multiple positive influences.

First, expectations of outstanding performance

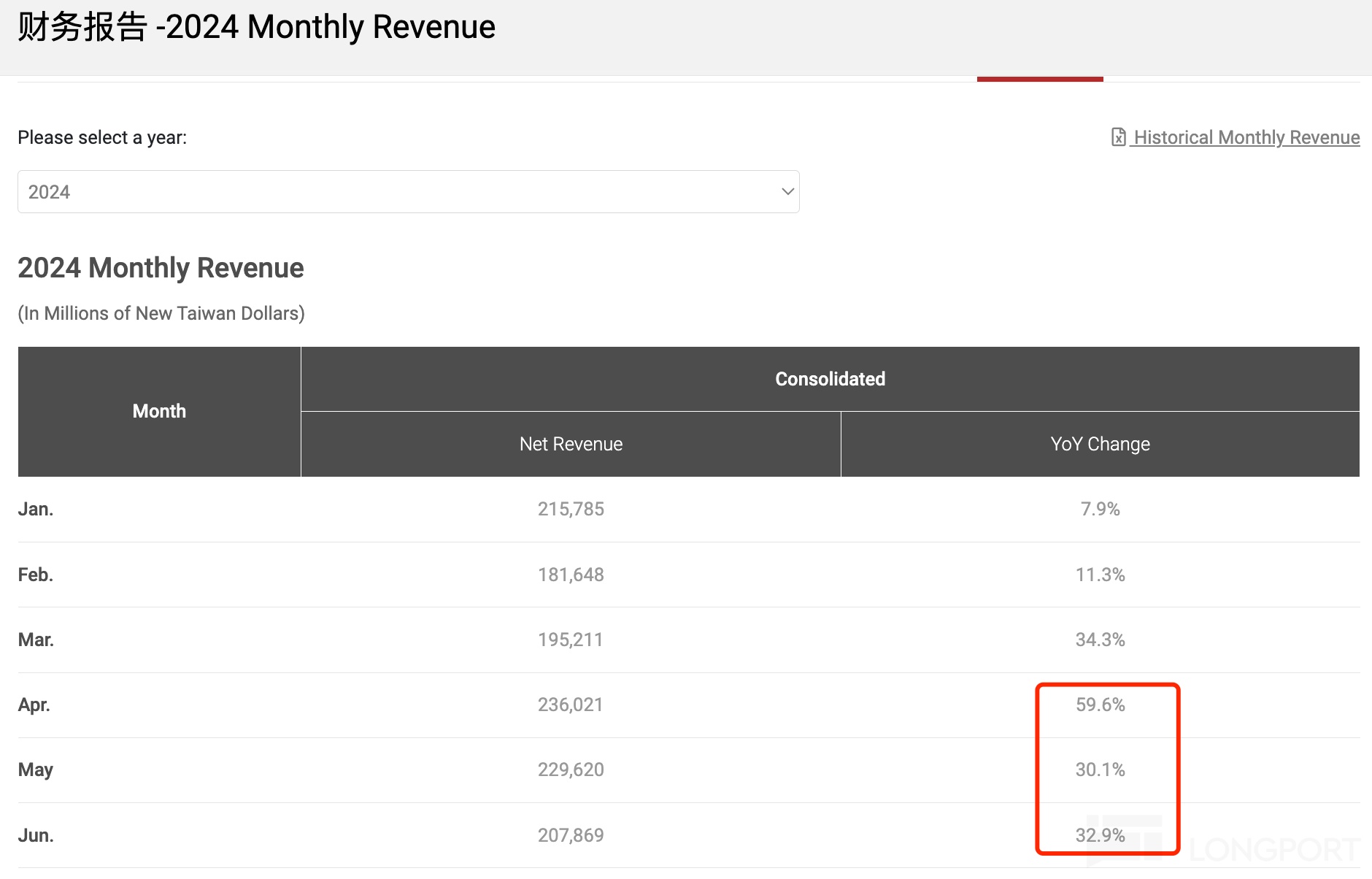

Taiwan Semiconductor announces sales figures every month, so the expectations for second-quarter performance are quite clear.

Monthly data released last Wednesday showed that the company's net revenue in June was NT$207.869 billion, a year-on-year increase of 32.9%;

This means that second-quarter net revenue reached NT$673.5 billion, a year-on-year increase of 40%, higher than the market's average expectation of 35.5%.

Market expectations for earnings per share are NT$45.83, a year-on-year increase of 29.13%.

Second, strong demand for orders from major customers NVIDIA and Apple

Industry insiders recently revealed that due to strong global demand for NVIDIA's upcoming Blackwell architecture AI GPU, NVIDIA has significantly increased its AI GPU foundry orders with chip giant Taiwan Semiconductor by at least 25%.

Insiders also pointed out that Taiwan Semiconductor's largest customer, Apple, will receive the first wave of orders for the most advanced process—namely the 2nm process—from Taiwan Semiconductor shortly after its launch, which will be used in the iPhone 17 in 2025 Wall Street analysts pointed out that the strong demand for advanced process chips being driven by the artificial intelligence boom will boost Taiwan Semiconductor's bargaining power. Top Wall Street investment banks such as Citigroup, Goldman Sachs, and Morgan Stanley have also raised their target stock prices for Taiwan Semiconductor as a result.

Thirdly, Taiwan Semiconductor raises prices

In early July, most of Taiwan Semiconductor's customers had agreed to increase foundry prices.

Morgan Stanley stated that the price hike will drive Taiwan Semiconductor's gross margin and profit performance to exceed expectations and rise year by year. Taiwan Semiconductor's gross margin is expected to climb to 55.1% by 2025, approaching nearly 60% in 2026, reaching 59.3%; and this year, the gross margin has already been raised to 52.6% due to improved production efficiency.

Furthermore, at Taiwan Semiconductor's shareholder meeting in early June, the "helmsman" C.C. Wei reiterated his expectation that the iterative development of artificial intelligence technology will drive a strong recovery in the chip industry by 2024. C.C. Wei also revealed at the shareholder meeting that almost all AI chips on the market are manufactured by Taiwan Semiconductor.

Risk factors

- Market expectations for performance are too high, with Taiwan Semiconductor's stock price rising by nearly 50% since its low point in April.

- Escalation of trade tensions, with a significant increase in the probability of Trump's re-election recently, leading to a rise in trade protectionism that is unfavorable for the globalization of chip trade