Breakfast | US stocks sell off more widely, all three major indexes fall together, chip stocks rise and fall unevenly

Thursday saw a general decline, with only the energy sector rising among the 11 sectors of the S&P. The Dow Jones Industrial Average had only 3 constituent stocks rising, while the VIX volatility surged 10% to its highest level in two and a half months. Leading the decline in the healthcare sector were Eli Lilly and Novo Nordisk, with Taiwan Semiconductor closing higher after significant fluctuations. NVIDIA turned higher by 2.6%, while Intel and AMD also rose. However, Apple, Amazon, and Google fell by about 2%. Netflix's third-quarter revenue guidance fell short of expectations, dropping nearly 7% after hours before turning higher

Good morning! A great day starts with making money.

Overnight Morning Market

Overnight, major U.S. stock indices opened higher, but fell deeper after midday. The tech-heavy Nasdaq fell the most, dropping over 1.3%, the S&P 500 fell nearly 1.2%, the Dow Jones fell almost 1.5%, the Russell 2000 small-cap index fell over 2.2%, and the Nasdaq 100 fell over 1.1%.

Sell-off panic spread to almost all assets, with the U.S. dollar rebounding from a nearly four-month low. Both U.S. stocks and bonds saw selling pressure intensify in the afternoon, with precious metals and industrial metals seeing expanded declines. Bitcoin also dropped over 1%. The VIX volatility index surged 10% to its highest level in two and a half months.

All 11 sectors of the S&P index performed poorly, with the healthcare sector down 2.29%, consumer discretionary and financial sectors down 1.28%, materials sector down over 1%, telecom sector down about 0.3%, information technology/tech sector down over 0.2%, and energy sector up over 0.3%.

Blue Chips and Hot Stocks

The "Tech Seven Sisters" had mixed performances: Meta rose by 3%, NVIDIA rose by 2.6%, Tesla closed up by 0.3%; Apple fell by 2%; Microsoft fell by 0.7%, Google A fell by 1.8%, and Amazon fell by 2.2%.

Apple continued to fall by over 2%. Analyst Ming-Chi Kuo, known as the "Apple Whisperer," expects no significant changes in iPhone 16 orders.

On Thursday, Ming-Chi Kuo, an analyst at TF International Securities, stated that despite rumors of increasing iPhone 16 orders after Apple's global developer conference, recent earnings conference calls from Apple's major suppliers Taiwan Semiconductor and Largan Precision hinted that iPhone 16 orders may not have increased.

Roche continued its rise by 0.6% after a 5% surge: Early trial results for oral weight loss drugs were optimistic, while Novo Nordisk and Eli Lilly saw their stock prices fall together, with Eli Lilly dropping by 10% over two days and Novo Nordisk dropping by 8% over two days.

Taiwan Semiconductor saw volatile stock prices, closing slightly higher: Taiwan Semiconductor's Q2 sales increased by 40% year-on-year, with net profit and gross margin exceeding expectations. The company raised its annual sales growth guidance in U.S. dollars to above the mid-20% range. Revenue from advanced processes in the second quarter rebounded from the previous quarter, with 3nm and 5nm processes contributing half of the second-quarter revenue. Taiwan Semiconductor stated that the construction of the N2 factory is progressing smoothly, with plans to achieve mass production of N2 processes by 2025; demand for N3 chips is very strong, and more N5 technology may be converted to N3. According to media reports, Taiwan Semiconductor's 3nm monthly production capacity may reach 125,000 wafers in the second half of the year, with mass production of 2nm expected in Q4 2025, targeting a monthly production capacity of 30,000 wafers.

Chips and Artificial Intelligence

Chip stocks had mixed performances.

The Philadelphia Semiconductor Index opened higher but turned lower multiple times during the day, ultimately closing up by over 0.5%; the industry ETF SOXX rose by 0.37%; NVIDIA's double long ETF rose by 5.55%; Broadcom rose by 2.91%, Intel rose by about 1.2%, AMD rose by about 0.4%, while Qualcomm fell by about 0.1%, ASML ADR fell by 0.85%, Micron Technology fell by over 1.7%, AMD fell by 1.8%, Arm Holdings fell by about 2.1%, and AMD fell by 2.3%, while Nan Ya Semiconductor fell by 8.35% Bank of America stated that, just like in past bubble periods, retail investors holding AI concept stocks will get hurt.

**Jim Covello, stock research director at Goldman Sachs, said that AI will not trigger an economic revolution, and bubbles will eventually burst. Companies spending billions in the AI field will not spark the next economic revolution, not even comparable to the benefits of smartphones and the internet. Throughout history, most technological transformations, especially those revolutionary ones, have replaced very expensive solutions with very cheap ones. When this becomes clear, all stocks that have surged due to the prospects of AI will also decline.

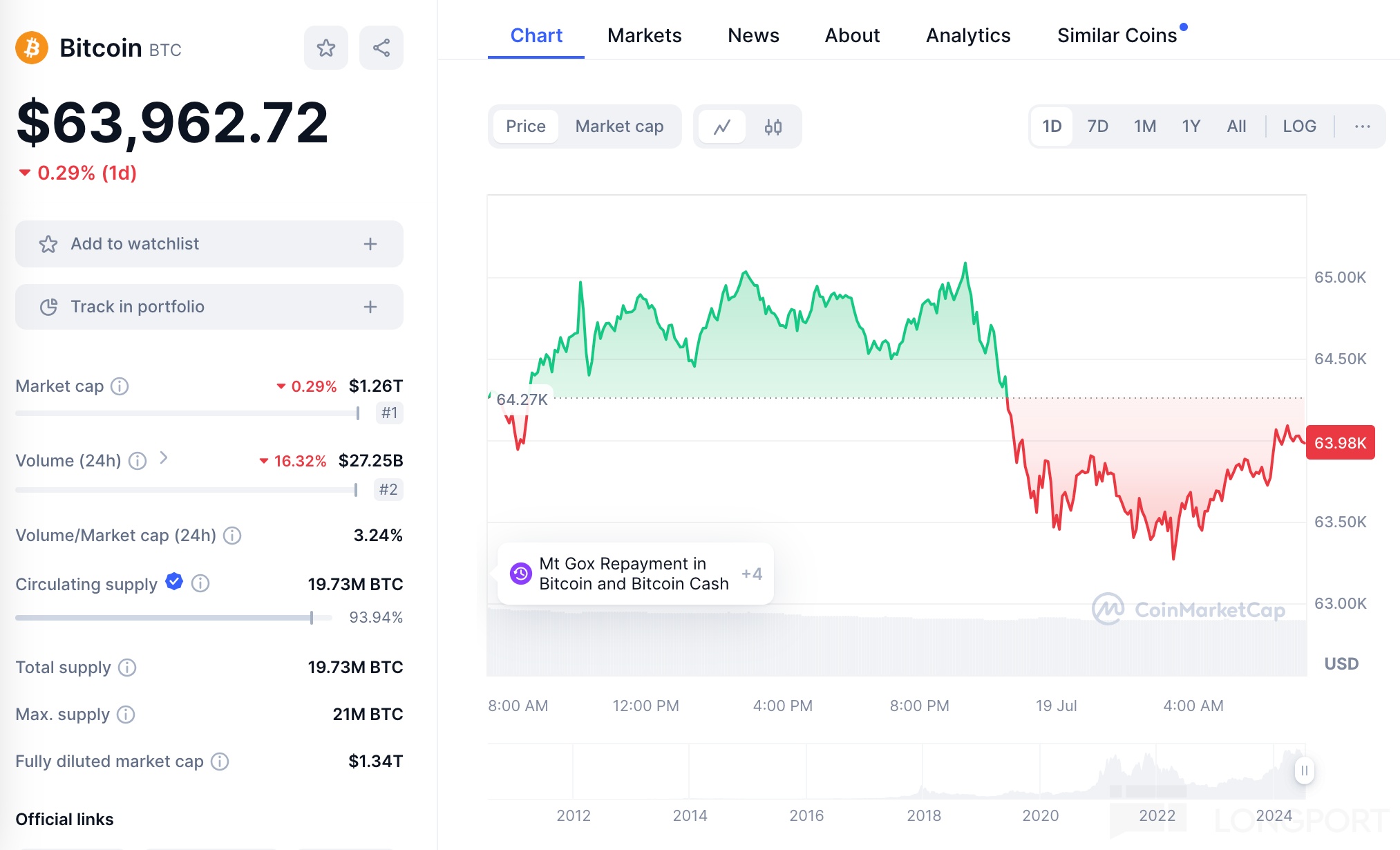

Cryptocurrency

BTC slightly fell back, with prices dropping below $64,000, concept stocks generally falling, with COIN and MARA dropping over 6%, and MSTR falling 2%.

Macro: Taking You Around the World

Last week in the U.S., initial jobless claims saw the largest increase since early May, continuing claims hit a two-and-a-half-year high, confirming a weakening labor market and strengthening the Fed's reasons for future rate cuts in the coming months. However, the Philadelphia Fed manufacturing index rebounded beyond expectations, uncertainty increased regarding Biden's re-election prospects, and U.S. bond yields rose across the board at the close.

The European Central Bank maintained its benchmark interest rate unchanged in July, stating that inflation pressures "remain high." Subsequently, reports indicated that ECB officials are considering whether it is feasible to cut rates only once more this year, contradicting market expectations of rate cuts in September and December. Short-term German bond yields rose nearly 2 basis points, turning higher overall during the day, with ECB President Lagarde stating that the actions to be taken in September are open-ended.

Biden is surrounded by calls for a change within the party, even Obama is pouring cold water, with reports suggesting that senior Democrats expect Biden to withdraw as early as this weekend. Pelosi told Biden he can't win, market expectations continue to favor Trump and the Republicans with significant victories in the presidential and congressional elections, U.S. bond yields rise, but Pelosi later denied reports of media misinterpretation, and Biden plans to restart his campaign next week