The ETF with the highest AI content: the concise and powerful AGIX

Based on the backtesting of the past six years, the index tracked by AGIX has an annualized return of 29%, with a year-to-date increase of 22.7%

What is AGIX ETF?

The ETF (AGIX) mainly tracks the AGIX Index (Bloomberg Ticker: SOLEAGIX).

The AGIX Index selects about 50 stocks from thousands of listed companies, and adjusts the number and weight as the industry develops.

The components of the AGIX Index include companies in the semiconductor and data center sectors, companies providing cloud and data services for AI training and deployment, and companies using AI to improve efficiency, reduce costs, and enhance customer experience.

Based on backtesting over the past six years, the AGIX Index has an annualized return of 29%, with a year-to-date (YTD) increase of 22.69% this year.

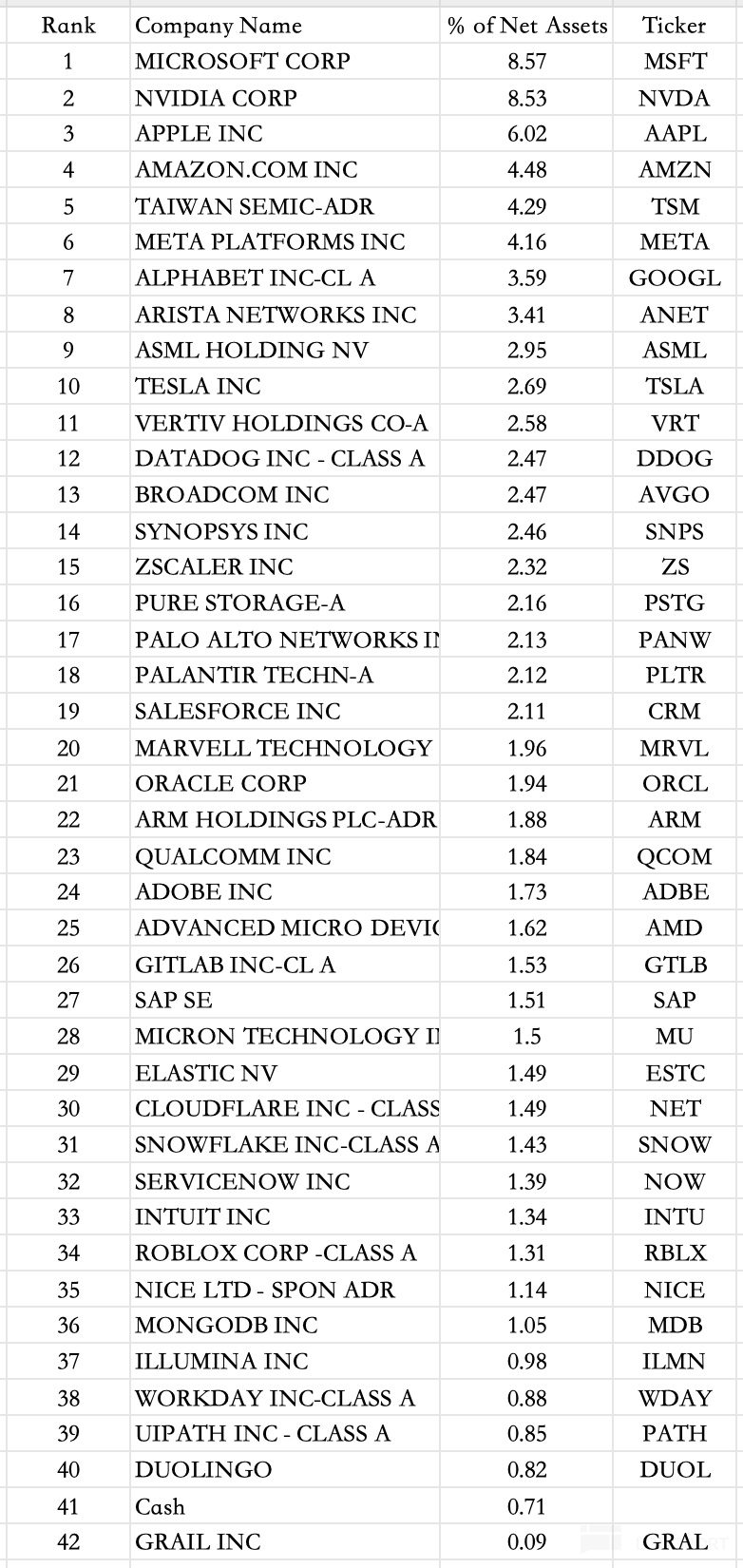

What are the components of AGIX?

AGIX components are divided into three categories: AI hardware, AI infrastructure, and AI application layer.

The top ten components are: Microsoft, NVIDIA, Apple, Amazon, TSMC, Meta, Google, ANET, ASML, Tesla, accounting for approximately 50%.

The complete list of components consists of 41 stocks:

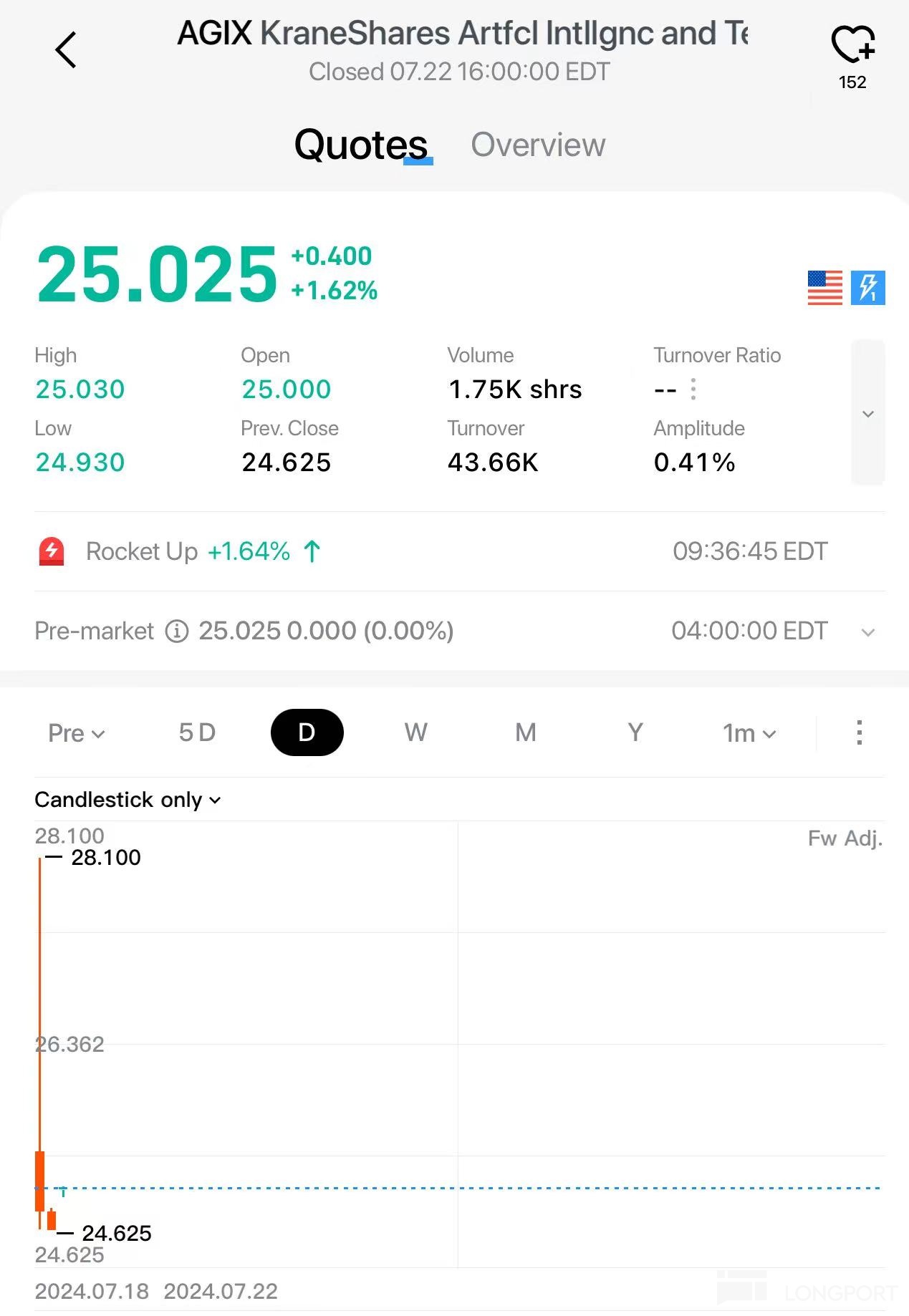

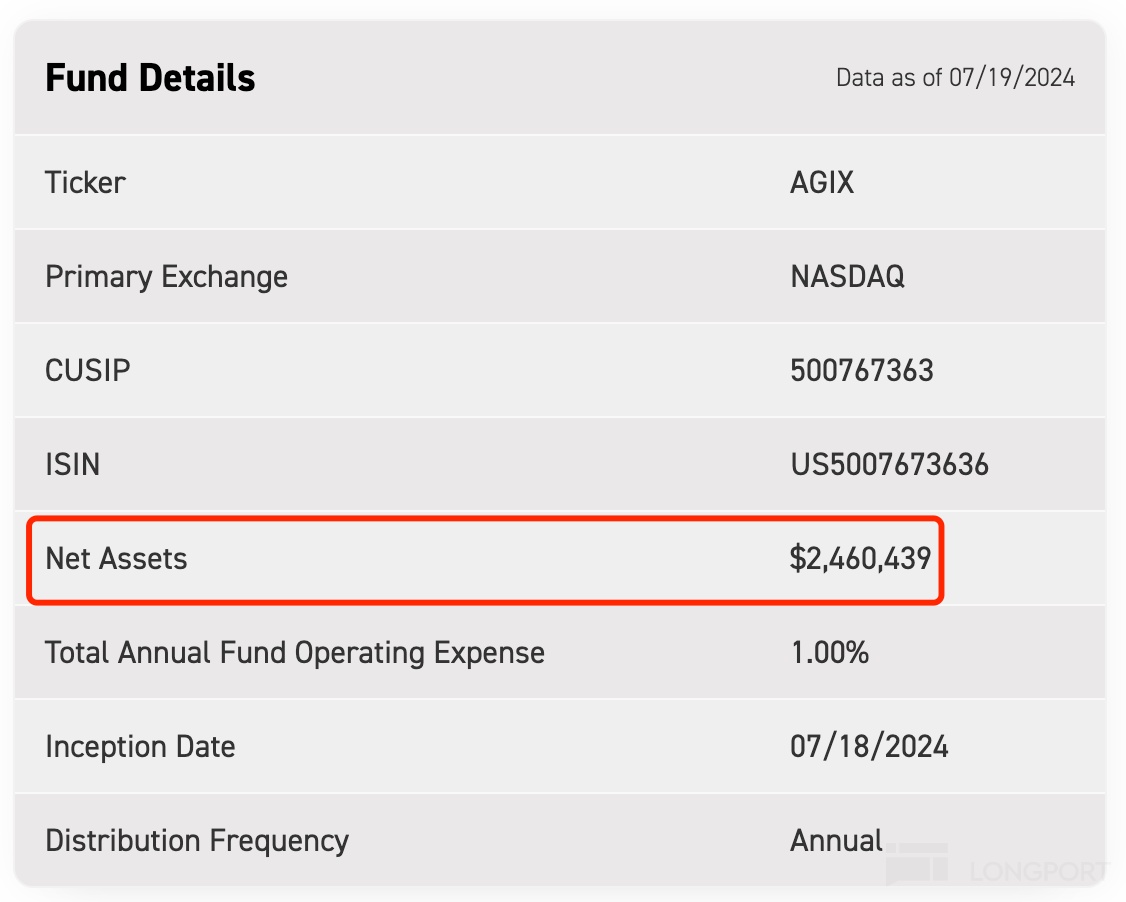

Asset Size

AGIX has a relatively small asset size, with net assets of $2.46 million.

Risk Warning

Although AGIX has a high AI content, due to its relatively small size, it currently has poor liquidity. Please be aware of liquidity risks.