Google AI starts to deliver profits

AI 驅動下,谷歌 Q2 雲業務創新高,廣告主利潤提升 15%,廣告收入同比增長 11%。

本文作者:張逸凡

編輯:申思琦

來源:硬 AI

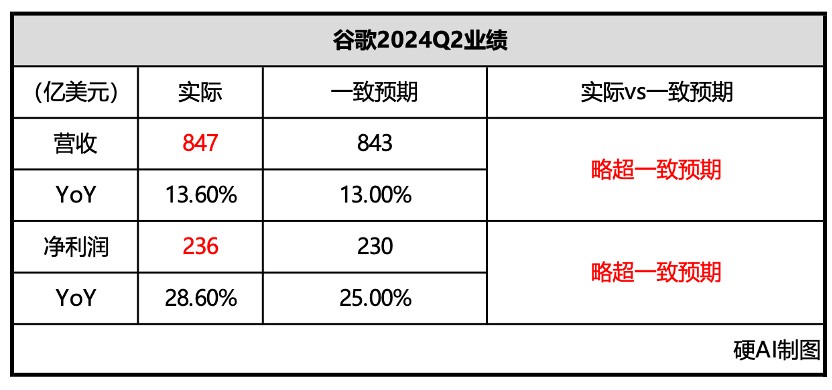

總體來看,2024Q2 谷歌的營收和利潤均略高於分析師一致預期。本季度谷歌 ——

1)雲業務創新高:受 AI 驅動,雲業務營收首次突破 100 億美元,營業利潤首次破 10 億美元;

2)AI 賦能廣告業務大幅提升:Q2 谷歌宣佈了超過 30 個新的 AI 賦能產品,廣告主平均提高 15% 的利潤,吸引了更多的廣告主。二季度搜索業務 485 億美元,同比增長 14%;YouTube 廣告收入 87 億美元,同比增長 13%;

3)資本開支(AI 基礎設施建設):公司二季度資本開支達到 130 億美元,主要用於 AI 基礎設施建設。公司預計全年每季度的資本支出將大致保持在或高於 120 億美元的 Q1 資本支出水平。面對投資過剩的問題,公司表示 AI“投資不足” 風險遠大於 “過度投資” 風險;

4)Youtube 廣告業務不及預期:YouTube 廣告收入 87 億美元,同比增長 13%,環比增長 7%。雖然同比、環比增長可觀,但市場對 AI 賦能後的 Youtube 預期更高(90 億美金),導致業績略不及預期。另外,數據顯示,Youtube Q2 使用量略微下滑;

5)營業利潤率再次提升:通過重組和人員優化、同時放緩招聘節奏,本季度員工人數減少 2216 個,運營成本再次降低。

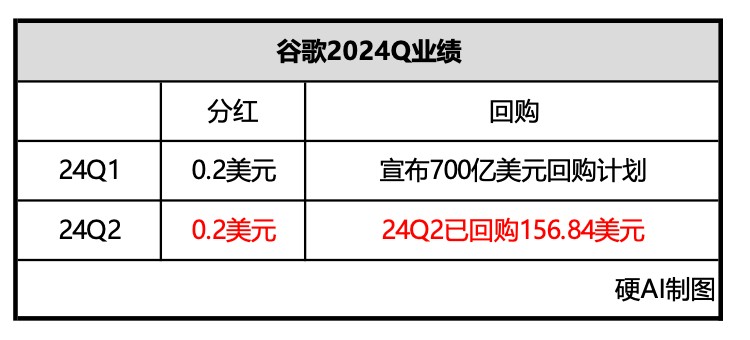

6)再一次宣佈分紅:繼上個季度破天荒推出分紅計劃後,本季度又一次宣佈 0.2 美元的每股分紅;

一、2024Q2 谷歌財務情況

1)營收為 847 億美元,同比增長 13.54%,超過一致預期的 843 億美元;

2)淨利潤為 236 億美元,同比增長 28.6%,超過分析師預期的 230 億美元;

分紅和回購方面,延續了一季度的方案。宣佈每股 0.20 美元的現金股息,第二季度回購股票金額為 156.84 億美元。

二、2024Q2 谷歌分業務收入

主要的廣告業務和雲業務實現同比、環比大幅增長,雲業務創新高,但 Youtube 廣告業務略不及預期。

1)谷歌服務收入 739 億美元,同比增長 11.5%。其中,

- 谷歌搜索及其他收入 485 億美元,同比增長 14%,環比增長 5%;

- YouTube 廣告收入 87 億美元,同比增長 13%,環比增長 7%;

- 網絡廣告收入 74 億美元,同比減少 6%,環比持平;

- 訂閲、平台和設備收入 93 億美元,同比增長 15%,環比增長 6.9%;

2)谷歌雲收入 103 億美元,同比增長 28%,環比 7.3%。雲業務表現強勁,首次季度收入超過 100 億美元,達到 103.47 億美元;首次實現季度運營利潤超過 10 億美元,為 11.72 億美元。

3)Other Bets收入 3.65 億美元,同比增長 28.1%,環比減少 27%。

三、2024Q2 谷歌電話會

1、雲業務創新高:季度收入首次突破了 100 億美元的大關,達到 103.47 億美元,同比增長 29%,環比增長 7.3%。同時,雲業務首次實現季度運營利潤超過 10 億美元,達到 11.72 億美元。增長主要受 AI 驅動,AI 基礎設施和生成式 AI 解決方案貢獻了雲業務數十億美元的收入(年初至今),並被超過 200 萬開發人員使用。

2、營業利潤率提升:營業利潤率較上一季度有所提升,主要是因為公司放緩了招聘速度,並通過重組和人員優化降低成本。同時,本季度法律事務相關費用減少,又進一步降低了管理費用。公司規劃 2024 年全年 Alphabet 運營利潤率相對於 2023 年有所擴張。

3、資本支出增長:2024Q2 資本支出為 130 億美元,主要用於技術基礎設施投資,其中最大的部分是服務器,其次是數據中心。公司預計全年每季度的資本支出將大致保持在或高於 120 億美元的 Q1 資本支出水平。24Q2,谷歌宣佈在馬來西亞建立了公司的第一個數據中心和雲區域,並在愛荷華州、弗吉尼亞州和俄亥俄州展開擴建項目。

4、多元化雲平台:最新的 NVIDIA Blackwell 平台將於 2025 年初進入 Google Cloud。同時,谷歌擴大了對第三方模型的支持,包括 Anthropic 的 Cloud 3.5 Sonnet 和開源模型如 Gemma 2、Lama 和 Mistral。

5、AI 賦能廣告業務:24Q2 谷歌宣佈了超過 30 個新的 AI 賦能產品,廣告主平均提高 15% 的利潤。同時,公司表示正在進行虛擬試穿和購物廣告的測試版,並計劃在今年晚些時候廣泛推出。反饋顯示,此功能比其他圖像獲得 60% 更多高質量瀏覽量,並且點擊轉跳至零售商網站的次數更高。零售商喜歡它,因為它推動購買決策並減少退貨。

6、訂閲業務增長:訂閲業務增長,主要是因為 YouTube(YouTube TV 和 YouTube Music Premium)訂閲收入的增長,但由於去年第二季度 YouTube TV 價格上調的影響,增長率有所放緩。

7、搜索業務增長:主要是得益於零售行業的強勁表現,其次是金融服務行業。

8、網絡安全:公司重申了網絡安全的重要性,但並未對市場傳出的 “230 億美元收購網絡安全初創公司 Wiz” 這一消息作出回應。

9、訴訟相關:去年穀歌因侵犯用户隱私被判賠償 6200 萬美元,產生過大額一次性費用。目前,由於大規模的重組和人員優化,分析師認為會出現遣散費等一次性費用。另外谷歌的反壟斷調查持續進行中,如果敗訴,將會導致其收入下降和市場份額減少,併產生法律費用等一次性費用。

10、新任首席財務官:新任 CFO Anat Ashkenazi 將於 7 月 31 日上任。預計她將在下一季度的財報電話會議上首次亮相。上一任 CFO Ruth Porat 不會完全離開公司,將在公司擔任新的角色。

11、Waymo 表現亮眼:6 月份,Waymo 在舊金山取消了等候名單,現在任何人都可以乘坐。到目前為止,Waymo 表現亮眼,已經提供了超過 200 萬次出行服務,並在公共道路上行駛了超過 2000 萬英里的完全自動駕駛里程。Waymo 現在每週提供超過 5 萬次付費公共乘車服務,主要在舊金山和鳳凰城地區。

四、谷歌 2024Q2 業績分析

1)搜索業務:搜索業務仍保持強勁增長,收入 485 億美元,同比增長 14%,環比增長 5%。增長主要由零售業增長帶動,其次是金融服務行業。

增長原因主要是因為,谷歌在搜索引擎中不斷應用 AI 技術,吸引了更多用户和廣告主。24Q2 谷歌宣佈了超過 30 個新的 AI 賦能產品,廣告主平均提高 15% 的利潤。

另外,根據 Statcounter 數據,谷歌在搜索引擎的市場份額受競爭對手(如 Bing、ChatGPT)影響不大。美銀也在 7 月份的報告中提到,截至六月,新興人工智能網站(如 Perplexity、Claude.ai等,不含 ChatGPT)的每日總流量,還不到谷歌每日訪問量的 0.3%。

2)Youtube 廣告業務:收入 87 億美元,同比增長 13%,環比增長 7%;儘管 Youtube 廣告業務同比、環比都大幅增長,但由於市場的高預期,導致該業務仍略低於市場預期。

增長主要受品牌推動,其次是直接回應廣告。同時,Shorts 的強勁表現也部分貢獻了 YouTube 廣告收入的 13% 同比增長。去年四季度,谷歌在 YouTube Shorts 上推出了廣告功能,隨後 Shorts 的貨幣化率穩步提升,特別是在美國市場。另外,購物相關視頻的觀看時間同比增長 25%,彰顯了 YouTube 在電商領域的投資潛力。

儘管 Youtube 廣告業務同比提升,但數據顯示,二季度 Youtube 的使用量較上一季度略微下降。

3)雲業務:雲業務表現強勁,首次季度收入超過 100 億美元,達到 103.47 億美元,同比增長 29%,環比增長 7.3%。同時,雲業務首次實現季度運營利潤超過 10 億美元,為 11.72 億美元。

主要由 AI 增長驅動。年初至今,AI 基礎設施和生成式 AI 解決方案已為 Cloud 貢獻了數十億美元的收入,超過 200 萬開發者正在使用這些 AI 解決方案。目前,谷歌的前 100 大客户中的大多數已經在使用 Google 的生成式 AI 解決方案。

4)營業利潤率:營業利潤率再次提升,至 32%。

提升的主要原因是:1)公司放緩了招聘節奏;2)通過重組和人員優化,本季度員工數量減少了 2216 人;3)法律事務相關的費用減少,降低了管理費用。

第三季度預計員工會有輕微增加,主要是因為新畢業生的加入。公司規劃 2024 全年的運營利潤率將比 2023 年有所擴大。

5)資本支出:資本支出再次增長,達到 132 億美元,環比增長 10%。

資本支出的持續增長,主要是因為 AI 基礎設施的建設。公司透露,資本支出主要用於技術基礎設施投資,其中最大的部分是服務器,其次是數據中心。公司預計全年每季度的資本支出將大致保持在或高於 120 億美元的 Q1 資本支出水平。

另外,公司的流量費用較上一季度也略有增長。