Global market "eye of the storm", next week is crucial for the rise of the Japanese Yen

I'm PortAI, I can summarize articles.

日本央行和美聯儲利率決議主導日元走勢。

近幾周,投資者爭先恐後地買進日元,押注日本央行在下週三的利率決議上加息。然而,這一押注現在看起來並沒有那麼穩固。

互換市場顯示,日本央行在 7 月 31 日政策會議結束時加息 15 個基點的可能性為 41%,不到一半。一項媒體最新調查顯示,日本央行觀察家中只有 30% 預測會加息。

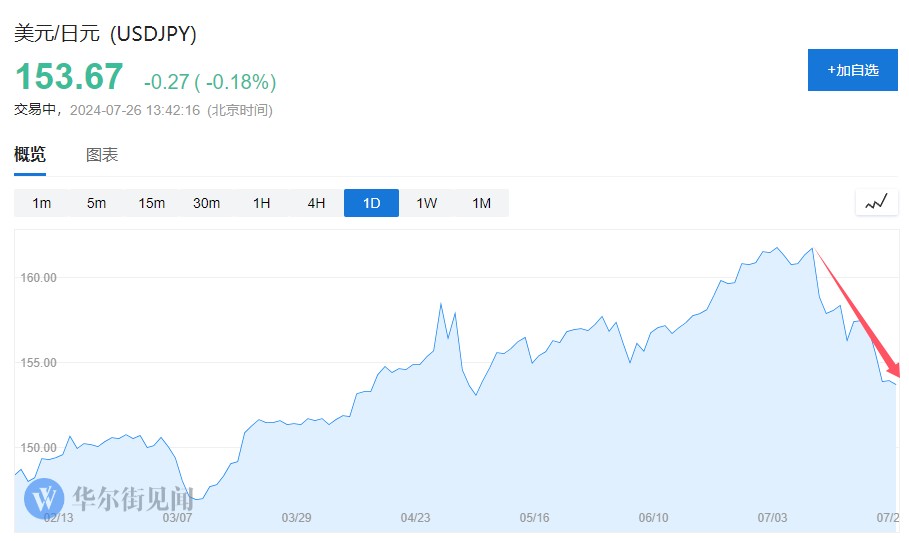

此前,受加息預期影響,日元自 7 月 11 日開始飆升,日本當局干預匯市,日元更是如虎添翼,截至目前漲幅已經達到 5%。在隔夜美國二季度經濟增長數據強於預期後,日元回吐部分漲幅。

分析認為,如果加息落空,特別是央行購債計劃未如期削減,日本多頭屆時很可能被打回原形。

“日元的漲勢太瘋狂了,” ATFX Global Markets 的 Nick Twidale 説,他從事日元交易已經有 25 年,“日本央行可能令人掃興,不會在緊縮政策中發揮自己的作用。”

Twidale 還説,如果日本央行未如市場預期,做空日元的套利交易 “可能捲土重來”。

值得注意的是,在日本央行公佈利率決議的第二天,美聯儲緊接着公佈 7 月利率決議,普遍預測美聯儲繼續按兵不動,但只要它有任何削弱降息預期的表態,日元將加劇承壓。

貝萊德、前日本央行官員紛紛預計,日本央行將在更長時間內維持利率不變,7 月製造業 PMI(滑至榮枯線下方)等一系列經濟數據證實了這個觀點。知情人士向媒體透露,日本央行官員認為消費支出疲軟會使他們在下週政策會議上決定是否加息變得更加複雜。

“如果日本央行不採取任何行動,美元兑日元匯率可能會再次飆升,” 30 多年來一直追蹤日本市場的 Asymmetry Advisors 策略師 Amir Anvarzadeh 表示。