Australian Q2 inflation may accelerate, increasing pressure on the Reserve Bank of Australia to raise interest rates

澳大利亞第二季度 CPI 預計同比上漲 3.8%,加大了澳洲聯儲加息的壓力。通脹率持續高企,可能導致澳洲聯儲無法實現明年年底的通脹目標。澳大利亞的政策謹慎使其接近全球週期的尾部。澳洲聯儲正在考慮加息,但加息可能會使經濟陷入衰退。

智通財經 APP 獲悉,澳大利亞將於週三公佈第二季度消費者價格指數 (CPI)。經濟學家預計,總體 CPI 同比上漲 3.8%,高於前一季度的 3.6%。關鍵核心指標——平滑價格波動的平均通脹率預計將保持在 4%。這高於澳洲聯儲最新預測的 3.8%,表明在控制價格方面進展有限。

GSFM 的投資策略師 Stephen Miller 表示:“如果通脹率在 4% 左右,而他們沒有加息,這將開始嚴重損害他們抗擊通脹的信譽。”“這可能意味着,澳大利亞較長期債券的收益率表現不佳,肯定會遜於美國債券。”

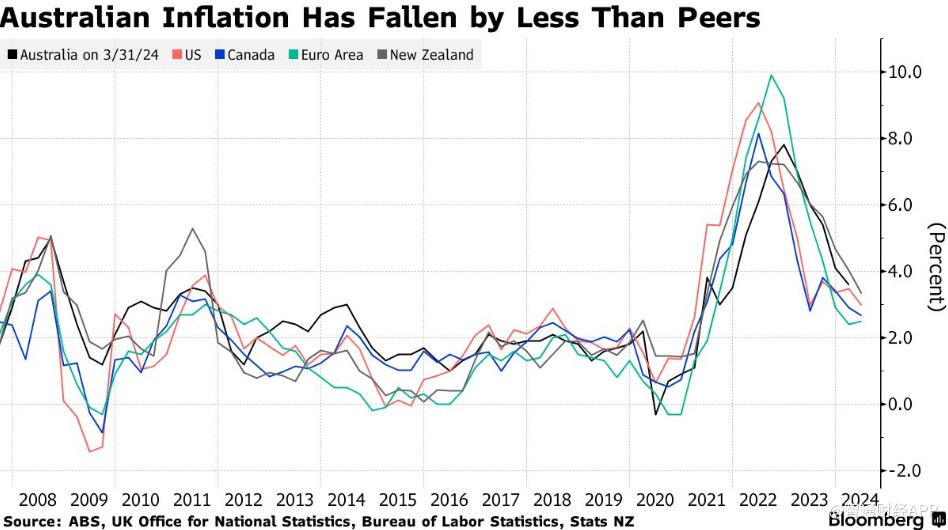

澳洲聯儲的加息幅度低於全球其他央行,因為它尋求保住就業增長,同時擔心負債累累的家庭的應對能力。頑固的通脹表明,澳洲聯儲可能無法實現明年年底將物價漲幅恢復到 2%-3% 的目標,這可能需要進一步加息,並有可能使疲弱的經濟陷入衰退。

澳大利亞降通脹進展落後於其他國家和地區

在價格報告發布之前,澳大利亞就業增長高於預期,零售銷售強勁,而企業調查指標仍保持彈性。5 月份,部分物價指數連續第三個月漲幅超過預期,引發了人們對政策是否 “足夠限制性” 的質疑。

澳洲聯儲承諾對價格上行風險保持 “警惕”,利率制定委員會在 6 月份考慮加息,但最終決定維持 4.35% 的利率不變。儘管加息的可能性較本月初有所降低,但貨幣市場仍認為,澳洲聯儲在 8 月 5-6 日會議上加息的可能性為五分之一。

AMP 公司的副首席經濟學家 Diana Mousina 表示:“相對於全球其他國家,澳大利亞的通脹率仍然很高。” 她認為 CPI 環比漲幅超過 1%“可能會導致澳洲聯儲加息”,因為這將遠離其通脹目標。

經濟學家預計澳大利亞第二季度 CPI 環比上漲 1%。

澳大利亞的政策謹慎使其接近全球週期的尾部,因為澳洲聯儲正在討論加息,而一些央行已經在放鬆貨幣政策。日本央行是一個例外,市場預測該行週三將加息。

相比之下,加拿大央行連續降息,歐洲央行也下調了利率。作為澳大利亞最大的貿易伙伴,中國一直在降低借貸成本。

美聯儲可能會在本週的會議上為 9 月份的政策轉向奠定基礎。一個特別鴿派的美聯儲可能會警告澳洲聯儲不要加息。

道明證券駐新加坡高級利率策略師 Prashant Newnaha 表示:“隨着中國放鬆政策,以及美聯儲和其他發達市場央行即將放鬆政策的風險,澳洲聯儲非常清楚,當趨勢轉向下行時,需要對貨幣政策進行微調。”

Newnaha 指出,近期澳元遭遇拋售,稱 “ CPI 不太可能挽救澳元跌勢。”

由於大宗商品價格下跌和對經濟的擔憂打擊了風險情緒,澳元兑美元本月下跌了近 2%,是表現最差的主要發達市場貨幣之一。這對澳元來説是一個逆轉,此前對澳洲聯儲加息的押注推動澳元表現出色。