Prospect of Fed Rate Cut + Strong Exports, Korean Won Expected to Rebound

韓元有望在美聯儲降息前景和出口強勁的影響下實現反彈,預計到年底將至少升值 2%。韓國債券和股票已吸引了 25 億美元的資金流入,韓國出口持續保持強勁。然而,韓元下跌的風險仍在增加。韓國政府最新的税收提案可能有助於提振金融市場和經濟。投資者將密切關注貿易數據和通脹數據,以衡量韓國央行降息的前景。韓元的疲軟使央行對過早降息持謹慎態度。

智通財經 APP 獲悉,韓元是亞洲新興市場今年表現最差的貨幣。但隨着韓國國內外因素帶來的有利影響,韓元有望實現反彈。法國外貿銀行和韓國國民銀行預計,到今年年底,韓元將至少升至 2%,美聯儲降息將是一個關鍵推動因素,出口的強勁和韓國加入全球指數的可能性也將起到支撐作用。

韓國國民銀行預計,韓元兑美元匯率最高將達到 1 美元兑 1350 韓元。該行經濟學家 Moon Junghiu 表示,由於美國大選和美聯儲政策的不確定性,“8 月初可能是韓元最艱難的時期”。他表示,隨着出口保持增長步伐、以及投資者對美國大選的看法更加明確,預計此後韓元將走高。

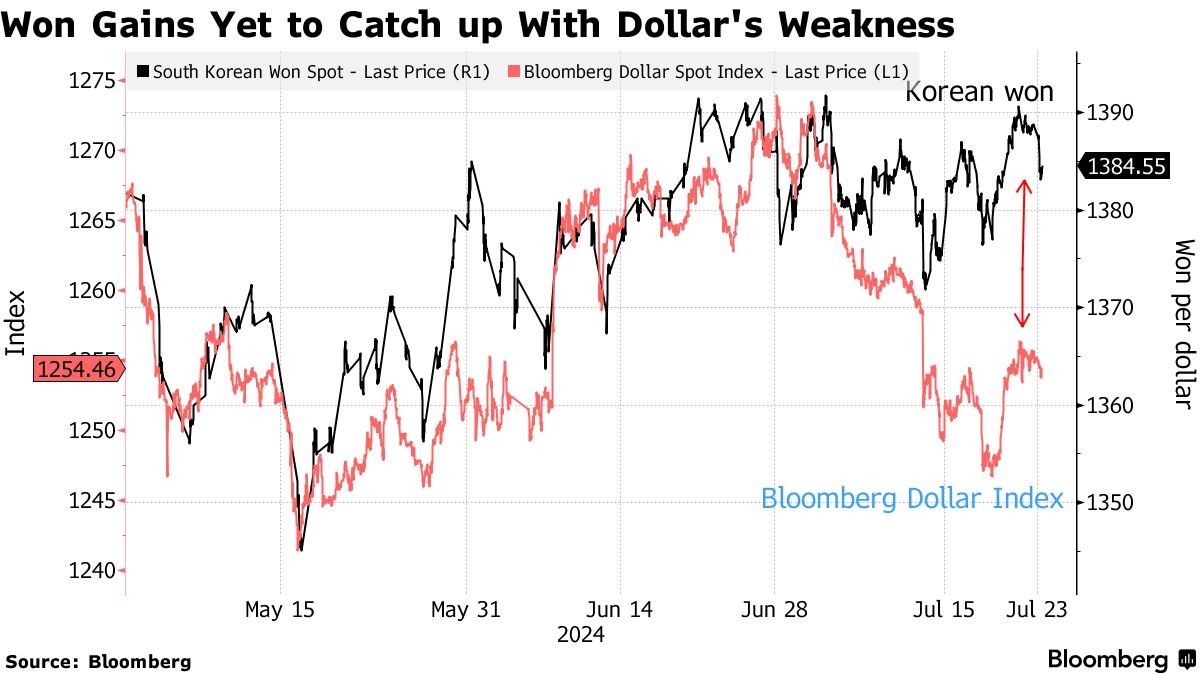

韓元今年以來下跌了近 7%,韓元兑美元匯率上週收於 1 美元兑 1383.95 韓元。隨着美聯儲政策轉向的臨近,新興市場資產的復甦似乎近在眼前。韓國債券和股票本月已吸引了 25 億美元的資金流入,且有可能在 9 月被納入富時羅素全球政府債券指數。

此外,受芯片出貨量提振,韓國出口繼續保持強勁。全球人工智能的繁榮對韓國來説是一個利好,因為韓國是兩家半導體制造商巨頭三星電子和 SK 海力士的所在地。

不過,韓元下跌的風險似乎正在增加。美元兑韓元匯率在本月達到的高點——1 美元兑 1391.95 韓元——作為初始阻力位仍然存在。而根據趨同散度移動平均線 (一個不祥地形成一系列低點的趨勢指標) 來看,韓元的看漲時刻似乎正在減弱。

值得一提的是,韓國政府最新的税收提案包括延長對芯片製造商的支持和削減遺產税,可能有助於提振韓國的金融市場和經濟。投資者將密切關注週四的貿易數據和週五的通脹數據,以衡量韓國央行降息的前景。韓元的疲軟使韓國央行對過早降息持謹慎態度。

韓國投資證券分析師 Moon Dawoon 表示:“從韓國的經常項目和股市趨勢來看,當地的供需狀況對韓元有利。”“除非出現一些韓國特有的風險,否則韓元進一步走軟似乎將有些過頭了。”