Financial Report Preview | Llama 3.1 Emerges, Meta is dubbed as the "Linux of the large model field"! Will the performance help boost the stock price?

Wall Street analysts expect Meta Platforms to report significant year-on-year revenue and profit growth, with investors focusing on the strength of its advertising business. Following the launch of the new open-source artificial intelligence mega-model Llama 3.1, discussions may revolve around its AI revenue opportunities. Meta, dubbed as the "Linux of mega-models," sees a rebound in its stock price. Meta is set to announce its second-quarter performance data on July 31. Investors are keen on the revenue scale of the digital advertising business underpinned by Meta's AI technology and updates on CEO Mark Zuckerberg's AI development plans. Wall Street analysts estimate Meta's total revenue for the second quarter to be around $38.35 billion, with a net profit of approximately $12.31 billion

According to the financial news app Zhitong Finance, after the recent release of the open-source large model Llama 3.1 series benchmarking the performance indicators of GPT-4 AI large model, Meta Platforms (META.US), the parent company of social media platforms Facebook and Instagram, has received positive feedback in the secondary market. This has led to a rebound in Meta's stock price, which has been following the sharp decline of major US tech giants such as Nvidia and Microsoft since July. Meta is set to announce its second-quarter financial results after the US market closes on July 31. Investors will focus on the revenue scale brought by Meta's digital advertising business under the enhancement of AI technology. The Meta management may discuss the revenue opportunities of the company's AI with the launch of the new open-source AI large model Llama 3.1. If Meta, which holds a higher weight in the S&P 500 index, achieves strong performance and optimistic outlook, it is expected to drive the rebound of the seven giants and the S&P 500 index.

In addition to the overall advertising revenue growth that Meta heavily relies on, after the recent release of the latest open-source large AI model, Meta has been praised by AI industry leaders as the "Linux of the large model field". Therefore, investors are also focusing on the updates and progress of Meta CEO Mark Zuckerberg and other executives in the development planning of artificial intelligence (AI). The focus is on how Meta, as the developer of the open-source large model Llama 3.1 series, can achieve a positive AI revenue outlook.

According to Wall Street analysts' expected data compiled by research firm Visible Alpha, Meta Platforms, the parent company of Facebook, is expected to report total revenue of approximately $38.35 billion in the second quarter of 2024, an increase of about 20% compared to the same period last year. Analysts generally expect a net profit of about $12.31 billion, or earnings per share of $4.71, a significant increase of 58% compared to the same period last year.

Meta's advertising revenue in the second quarter is of great interest to investors, as advertising is also Meta's core revenue engine. Analysts at Citigroup expect this figure to achieve a year-on-year growth of 20.5%, reaching $37.95 billion. The main logic behind this is the strengthening of the macro environment for advertising placement and the expectation that the AI technology embedded in Meta's advertising tools will promote more efficient advertising placement by advertisers, covering more groups. The significant expansion of the adoption scale of Instagram Reels, which is as popular as TikTok, and Meta's new technology products for advertisers are also expected to drive the growth of advertising revenue.

Furthermore, a survey conducted by the renowned Wall Street investment firm Wedbush found that with the support of Meta's AI chatbot, advertisers hope to use this tool to reach a larger range of potential user groups. Therefore, most advertisers plan to increase or maintain their advertising spending on Meta's digital advertising platform. This may help the company achieve stronger-than-expected performance in the second quarter and put the company on a positive growth trajectory in the second half of the year.

It is understood that this tech giant earlier this year significantly expanded its advertising tools powered by strong artificial intelligence technology provided to advertisers, as well as Meta AI similar to ChatGPT, which can more accurately answer user questions and recommend products users need.

Meta Releases Most Powerful Open Source AI Large Model Llama 3.1, NVIDIA and Cloud Giants Join Forces

Meta recently unveiled its developed Llama 3.1 series of open-source artificial intelligence large models. Analysts from Morgan Stanley stated that the release of this open-source AI large model may lead Meta AI to become the "largest AI assistant in terms of user scale by the end of the year."

In the eyes of many Wall Street analysts, Meta, with over 3 billion users globally, may introduce Meta AI chatbots that could become the most popular AI chatbots globally, surpassing ChatGPT in popularity. This is also the core logic behind analysts' optimism about Meta's stock price, as advertising and software applications are undoubtedly the areas where Meta excels the most, and with a massive user base of up to 3 billion, Meta is in the best position for AI monetization.

This performance report will also provide Meta with a significant opportunity to greatly boost investors' confidence in the stock, assuring investors that even with increased investment in AI, the company will not miss the significant opportunity to achieve substantial performance growth under the global trend of enterprise AI deployment.

Last week, Meta released three Llama 3.1 open-source AI large models, with Llama 3.1 405B containing 405 billion parameters, making it the largest model Meta has developed to date. Meta CEO Mark Zuckerberg referred to Llama 3.1 as the "starting point of art," with performance metrics comparable to the most powerful models published by OpenAI and Google. Additionally, Meta, NVIDIA, and cloud giants Amazon AWS and Microsoft have joined forces, with NVIDIA AI Foundry and cloud giants providing customized services for the global enterprise deployment of the Llama 3.1 model.

The Llama 3.1 405B model contains 405 billion parameters, making it one of the largest models in terms of parameter scale in recent years. Typically, the number of parameters corresponds to the model's ability to solve real-world problems, with models having more parameters generally performing better. The model was trained using up to 16,000 NVIDIA H100 GPUs, benefiting from new AI training and large model development technologies. Meta claims that Llama 3.1 405B can compete with OpenAI's closed-source large model GPT-4o and Anthropic's Claude 3.5 Sonnet in various AI large model performance metrics. For example, Llama 3.1 405B outperforms GPT-4o in tasks such as text-to-code generation and chart generation, achieving a "mixed bag" result in a comprehensive performance comparison with GPT-4o and Claude 3.5 Sonnet. **

Executives at Meta stated that the open-source large model is mainly used to provide technical support for AI chatbots for both internal and external developers at Meta, with a wide range of new features, including improved powerful reasoning capabilities to help solve complex math problems or instantly summarize entire books. This open-source large model has powerful generative AI capabilities and can generate images based on text prompts.

Zuckerberg stated that Meta's Meta AI chatbot has a massive user base of over 1 billion and is expected to become the most widely used AI chatbot in the world by the end of the year. He hopes that companies outside of Meta can also use the Llama open-source large model to train their own AI chatbots, thereby driving more global enterprises to participate in the development of this new generative AI software ecosystem, ultimately achieving a significant improvement in corporate operational efficiency and financial forecasting efficiency.

Meta CEO Zuckerberg has repeatedly expressed since last year his hope that more third-party developers will use the Meta AI toolbox to develop diverse AI chatbots for global enterprises and creators. These chatbots will be designed for enterprises and creators to efficiently communicate, interact, and accurately recommend products to users on Meta's applications (such as Facebook, Instagram), enabling advertisers to reach a larger potential user base with the support of AI technology.

In short, as the developer of the most powerful open-source AI large model Llama, Meta has a much more finely tuned and low-threshold large model tuning and AI software deployment tools compared to other tech companies. Therefore, it encourages third-party developers worldwide to utilize its platform's powerful Meta Llama open-source large model tool library and large model resource library to develop diverse Meta AI chatbots that can effectively communicate among users with different product preferences, enhance corporate operational efficiency and user experience, thereby comprehensively enhancing the experience of 3 billion users and supporting Meta's advertisers' digital business projects and the global enterprise AI software development ecosystem.

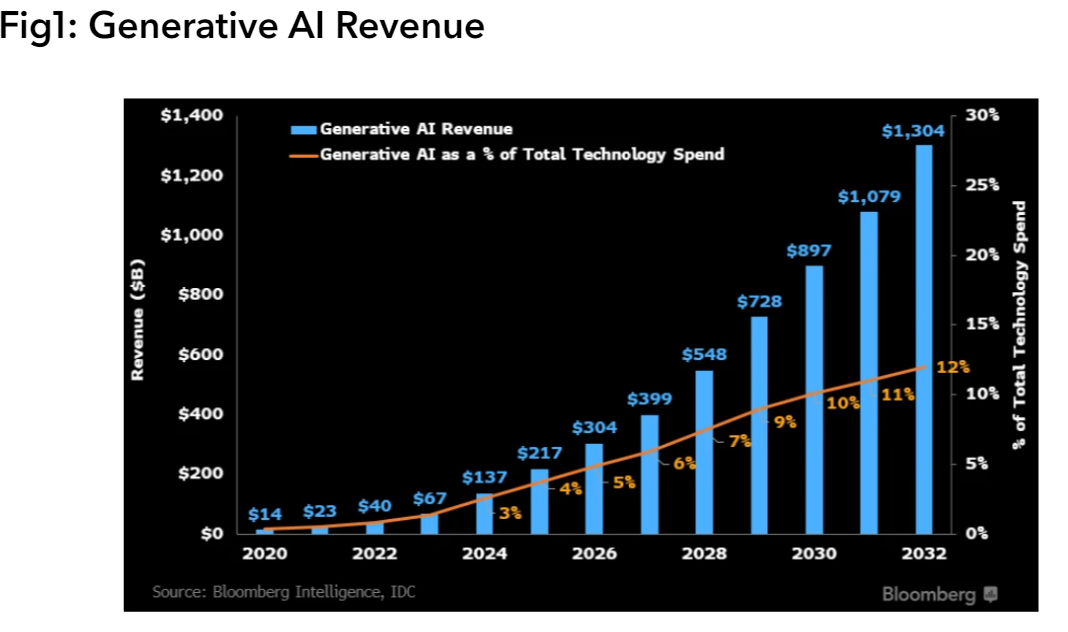

With user-centric generative AI applications like ChatGPT and Sora emerging one after another, global enterprises are actively participating in the trend of generative AI technology, which may drive a decade-long era of AI prosperity. According to a recent report released by Bloomberg industry research analysts, it is estimated that by 2032, the total revenue of the generative AI market will increase from $40 billion in 2022 to $13 trillion, a 32-fold increase over 10 years, growing at a high compound rate of up to 42%. In the application ecosystem targeting B/C users such as advertising and software applications, Meta and cloud giants are undoubtedly the most proficient, even AI chip leader NVIDIA is seeking a share.

In the field of digital advertising that Meta relies on, Meta, with 3 billion users, has launched a powerful open-source large model and various developer tools, enabling advertisers to reach a larger potential user base. This brings a new AI-based advertising recommendation experience for Meta advertisers and users, which is an important logic for the continued rise of Meta's stock price according to Wall Street.

Well-known Wall Street institution Wedbush reiterated its 12-month target price for Meta at $570 on the eve of the performance release, reaffirming its "outperform" rating, implying a potential upside of up to 23%; another institution, Bernstein, raised its 12-month target price for Meta from $565 to $575, reaffirming its "hold" rating. TD Cowen is even more optimistic, significantly raising Meta's target price from $530 to $600.

Investment institutions such as Wedbush, Bernstein, and Oppenheimer have updated their stock ratings and 12-month target prices for Meta before the release of Q2 performance. According to these latest Wall Street analyst ratings, Meta Platforms has an implied upside potential of up to 19.46% in the next 12 months