Rate Hike? QT? Will the Bank of Japan perform a "hawkish" script on Wednesday?

尽管华尔街多数预计日本央行将继续按兵不动,但仍对加息的可能性充满期待,摩根大通、美银预计可能加息 15 基点。另据市场共识,日本央行将逐步减少长债购买规模,预计未来一年到两年半内降至每月 3 万亿日元的速度。

周二日本央行启动了 7 月份的重磅货币政策会议,华尔街预计,日本央行将维持利率不变,但会宣布量化紧缩(QT)计划,逐步减少购债规模。

7 月 31 日周三上午,日本央行将公布 7 月利率决议,稍后日本央行行长植田和男召开货币政策新闻发布会。

尽管华尔街多数预计日本央行将继续按兵不动,但仍对加息的可能性充满期待。荷兰国际集团(ING)分析师在上周的一份报告中预测,利率(上限)可能会从当前的 0.1% 提高到 0.15%,而美国银行和摩根大通预计利率可能会高达 0.25%,即加息 15 基点。

摩根大通指出,市场预计 7 月加息的可能性约为 40%,但如果日本央行选择不加息,日元利率可能会出现更积极地波动。

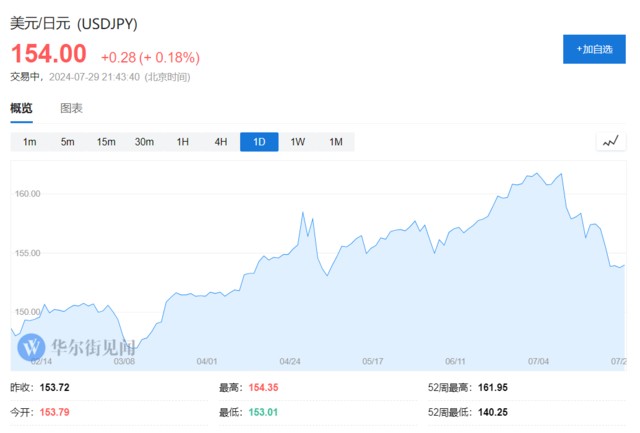

花旗指出,如果 7 月日本央行利率决议符合市场预期,日本股市将不会出现巨大波动,并预计未来几个月日元兑美元汇率重回 165 日元的低点。此前,受加息预期影响,日元兑美元汇率飙升,目前在 154 附近徘徊。

“良性循环” 尚未形成,日央行不愿冒险加息

据媒体此前报道,日本央行行长植田和男 6 月份对国会表示,央行可能会根据 “当时的经济、价格和金融数据及信息” 升息。

目前,日本 CPI 在 6 月份为 2.8%,与 5 月份持平,而剔除新鲜食品价格的核心 CPI 加速至 2.6%,从 2.5% 上升。整体通胀率已经连续两年多超过日本央行 2% 的目标。

所谓 “核心中的核心” CPI(剔除新鲜食品和能源价格)——日本央行衡量通胀的关键指标,从 2.1% 上升至 2.2%。

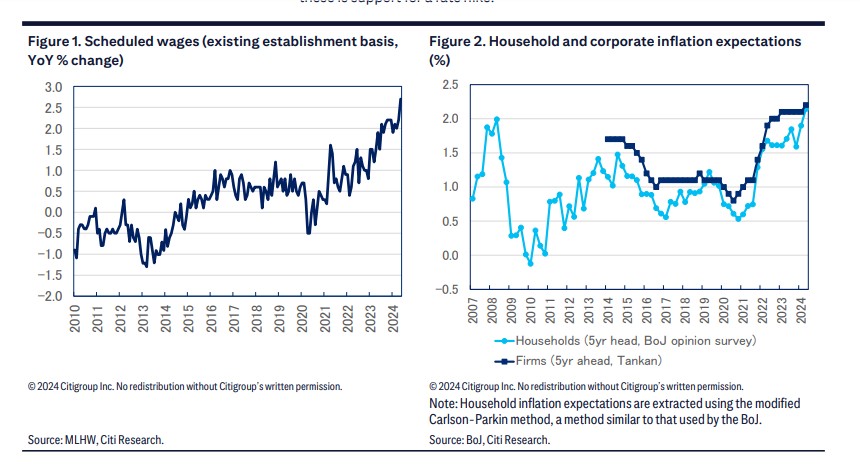

尽管通胀已经达到甚至超过了日本央行的目标利率,但央行一直专注于确认通胀是否处于 “良性循环”,即更高的工资持续推动价格上涨。

日本工会联合会(Rengo)曾在 7 月 3 日表示,拥有 300 名或更多工会支持员工的大型公司已经将工资提高了 5.19%,而小型公司提高了 4.45%。工会声称,这是三十三年来最大的工资增长。

野村证券最新报告指出,尽管企业方面出现了涨薪和涨价等渐进变化,但家庭支出对工资增长的反应不足,未能进一步推高商品价格,表明工资和价格尚形成 “良性循环”。

野村证券预计日本央行将在即将到来的货币政策会议上保持政策利率不变,花旗持相同观点。

花旗认为,如果日本央行决定维持利率不变,之后公布的展望报告和货币政策新闻发布会可能会传达基于工资上涨和通胀预期上升的通胀趋势展望的信心增强。

如果即将到来的数据符合预期,日本央行可能会明确表示 9 月加息是合适的。

QT 计划具体如何?

日本央行在 6 月份表示,将减少购买日本国债的规模,“以确保长期利率在金融市场中更自由地形成”。

市场普遍预期,日本央行将逐步减少长债购买规模,预计未来一年到两年半内降至每月 3 万亿日元的速度。

根据 3 月份发布的数据,日本央行目前每月购买约 6 万亿日元(390 亿美元)的日本国债,媒体计算显示,截至 7 月 19 日,日本央行持有的日本国债总额高达 579 万亿日元。

媒体援引消息人士的话报道:

日本央行可能会在几个阶段逐步缩减其债券购买,速度大致符合市场主导观点,以避免引起收益率的不受欢迎的飙升。

摩根大通也指出,如果日本央行公布的 QT 计划无论是比市场预期更鹰派,可能会导致掉期利差在曲线上收窄。

花旗的预测更为激进,估计预计未来一到两年,日本央行可能会计划逐步减少日本国债购买量至每月约 2 万亿日元。

野村证券认为,无论减少的规模和速度如何,关键是要提供透明度,以确保减少央行购债不会对日元利率产生意外的上行压力。