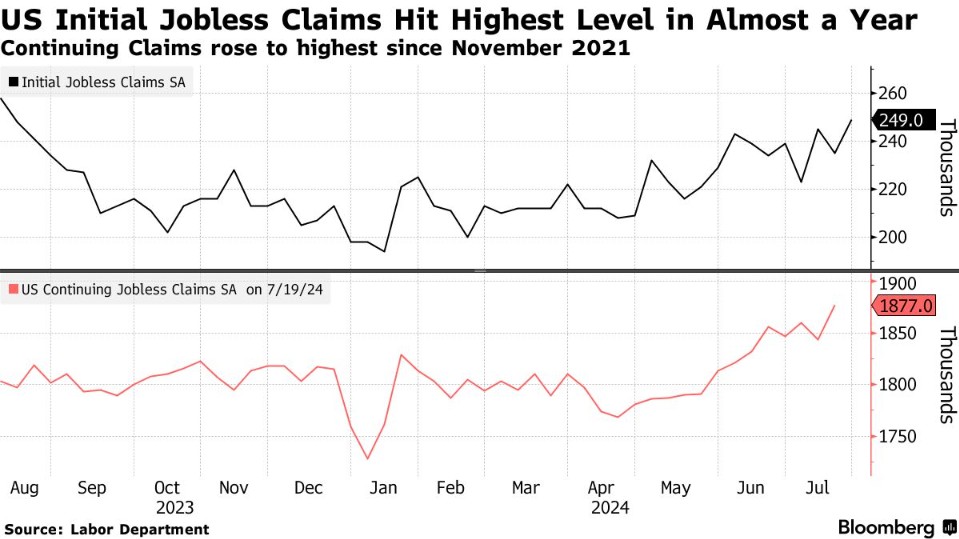

Labor market shows signs of slowing down, with initial jobless claims in the United States soaring to nearly a one-year high last week, exceeding expectations

美國勞動力市場出現放緩跡象,上週初請失業金人數飆升至近一年高點,達到 249,000 人,超過預期。持續申請失業救濟的人數也增加至 188 萬,為 2021 年 11 月以來最高點。近幾個月來,招聘速度放緩,勞動力市場顯示出恢復到疫情前水平的跡象。美聯儲主席鮑威爾表示,就業增長放緩,失業率上升,但當前失業率仍然較低,上半年數據並不預示經濟疲軟。同時,裁員人數上升了 9%,但大多數行業的裁員人數低於去年同期水平。今年迄今為止的招聘計劃是自 2012 年以來的最低水平。

智通財經 APP 獲悉,美國勞動力市場的最新動態顯示了一些放緩的跡象。根據美國勞工部最新公佈的數據,截至 7 月 27 日的一週內,美國首次申請失業救濟的人數增加 14,000 人,達到 249,000 人,這一數字不僅高於經濟學家們預期的 236,000 人,也是近一年來的最高水平。密歇根州和密蘇里州報告的增幅尤為顯著。

同時,持續申請失業救濟的人數——這項數據反映了持續領取失業救濟的人數——也增加至 188 萬,為 2021 年 11 月以來的最高點。儘管在過去兩年的多數時間裏,申請和領取失業救濟的美國人數量接近歷史低點,但近幾個月這一趨勢有所改變,招聘速度放緩,勞動力市場顯示出恢復到疫情前水平的跡象。

美聯儲主席傑羅姆·鮑威爾在最近的新聞發佈會上承認勞動力市場的風險正在上升,他指出就業增長已經放慢,失業率有所上升。儘管如此,他強調當前的失業率仍然很低,今年上半年的數據並不預示着經濟的疲軟。

為了更平滑地觀察趨勢,四周移動平均的初請失業金人數增加了 2,500 人,達到 238,000 人。而經過季節性調整的初請失業金人數則下降了約 10,000 人,至 215,827 人,德克薩斯州報告了最大的降幅。值得注意的是,每年的這個時候,由於學校放假和汽車工廠的季節性重組等因素,失業金申請數據容易出現較大波動。

根據高管培訓公司 Challenger, Gray & Christmas Inc.的數據,儘管裁員人數依然較低,但 7 月份美國僱主宣佈的裁員人數為 25,885 人,同比上升了 9%。Challenger 報告稱,除製造業外,大多數行業的裁員人數都低於去年同期的水平。此外,今年迄今為止宣佈的招聘計劃是自 2012 年以來的最低水平。

另一方面,美國勞工部還發布了第二季度非農生產率及勞動力成本數據。報告顯示,第二季度勞動生產率的增長超出預期,達到 2.3%,而單位勞動力成本的增長則為 0.9%,較第一季度的 3.8% 有所下降。這一數據顯示企業正在努力減輕運營成本上升的影響,對通脹壓力的緩解提供了進一步的證據。

這些數據的發佈對金融市場產生了即時影響,美國 10 年期國債收益率跌至 4.016%,為 2 月初以來的最低水平,而兩年期國債收益率也降至 4.235%,為六個月來的低點。

值得一提的是,美國 7 月非農數據將於北京時間週五 20:30 公佈。經濟學家們預計,即將發佈的 7 月非農就業報告將顯示就業增長放緩,預測失業率將保持在 4.1% 不變。這些指標將繼續為政策制定者和市場參與者提供關於美國經濟狀況的重要信息。