Trader data shows: a 60% probability of a rate cut within a week, the Fed may take early action due to the sharp decline

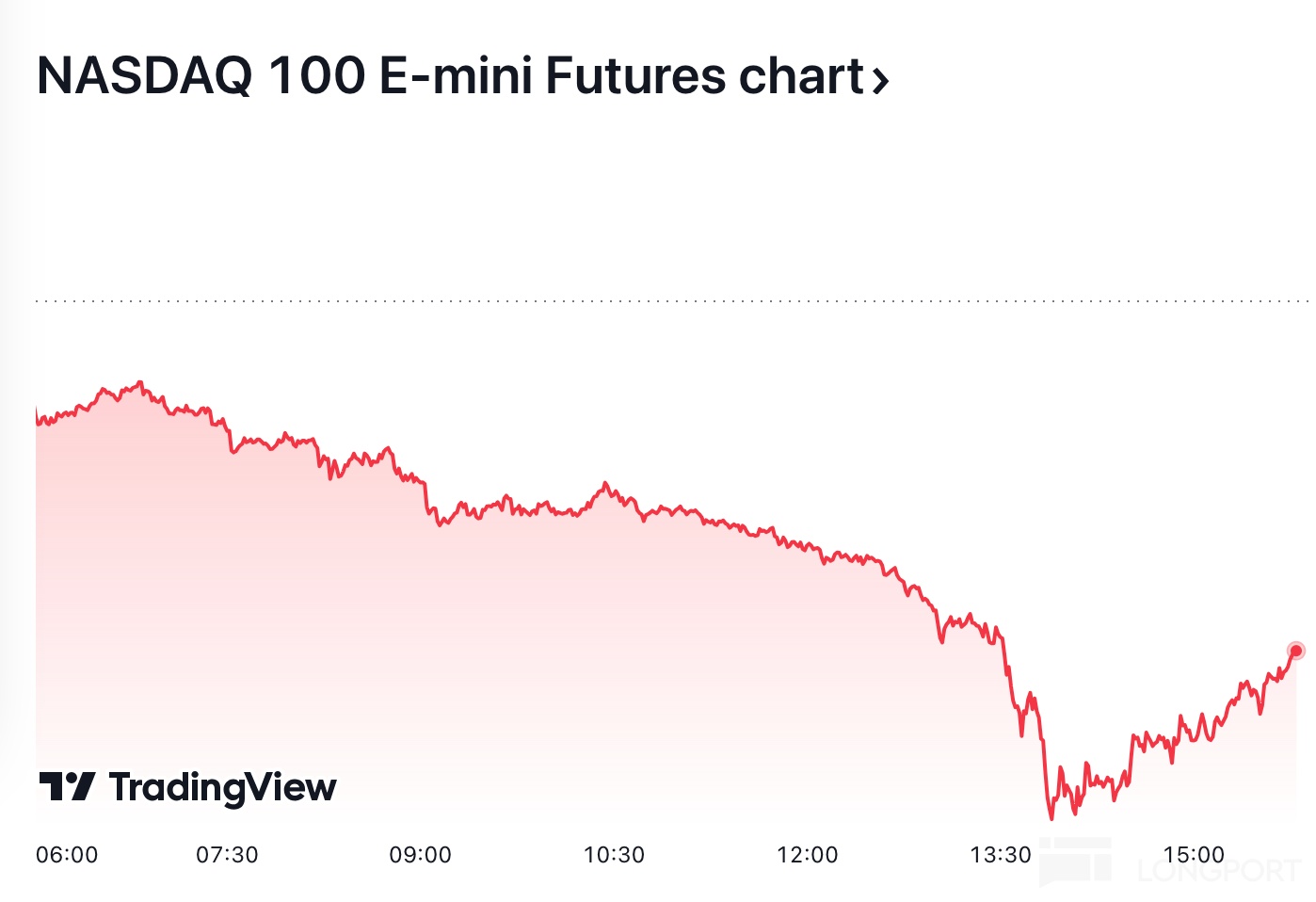

To deal with unexpected situations, the Federal Reserve has a precedent of cutting interest rates early; the overnight drop in US stocks narrowed, with Nasdaq futures falling from nearly 6% to the current 4%

Traders' expectations indicate a 60% chance of a 25 basis point rate cut by the Federal Reserve within a week.

Global stock markets plummeted today, with the Japanese and South Korean markets dropping by 10%, and tech stocks such as Apple, Microsoft, NVIDIA, and Tesla plummeting by over 10% during the night session in the US.

In response to the sharp decline, traders expect data to show that the Federal Reserve may cut rates earlier.

Furthermore, the US announced an increase of 206,000 non-farm payrolls in June, a significant drop from May's 272,000, with the unemployment rate unexpectedly rising to 4.1%, hitting a new high since December 2021. The unemployment rate has been rising for three consecutive months, indicating a gradual cooling of the labor market, making a rate cut by the Federal Reserve in September almost certain.

As of noon on August 5th, the Federal Reserve's rate observation tool shows that traders are predicting a 100% probability of a rate cut in September, with a high 74% probability of a 50 basis point cut. This expectation has also been recognized by some Wall Street giants including Morgan Stanley and Citigroup.

In response to unforeseen circumstances, the Federal Reserve has a precedent of cutting rates early.

On March 3, 2020, in response to the pandemic, the Federal Reserve made an "emergency rate cut" of 0.5%. However, the US stock market experienced two sharp declines and circuit breakers on March 9th and 12th of the same year.

On March 15, 2020, the Federal Reserve announced another "emergency rate cut" with a more aggressive move, directly cutting rates by 100 basis points to a historic low of 0-0.25%.

The decline in US stock futures has narrowed during the night session, with Nasdaq futures falling from nearly 6% to around 4% currently.