Risk-averse buying fades, dragging down US Treasury yields, market focus shifts to the sale of billions of dollars in bonds

隨着全球對避險資產的需求下降,美國國債價格下跌,市場關注焦點轉向 580 億美元的拍賣。這是市場情緒的快速轉變。此前,美國經濟增長放緩的跡象,加上風險資產的拋售,引發了人們的猜測,即美聯儲將需要大幅降息,以幫助這個全球最大的經濟體。週一,美國 2 年期國債收益率一度下跌 20 個基點。而且由於短端收益率下降,美國 2 年期國債收益率自 2022 年 7 月以來首次低於 10 年期國債收益率。這對美國國債市場來説是一個重要的里程碑。

智通財經獲悉,隨着全球對避險資產的狂熱需求降温,美國國債價格下跌,市場關注焦點現在轉向 580 億美元的短期美國國債拍賣,作為對投資者需求的下一個考驗。週二,美國 2 年期國債收益率跳升 7 個基點,至略低於 4% 的水平。歐洲債券也有所下跌,不過跌幅較小。美國財政部將於北京時間週三凌晨 1:00 發售 580 億美元新的 3 年期美國國債。本週的標售週期還包括北京時間週四凌晨 1:00 競拍 420 億美元的 10 年期美國國債,以及北京時間週五凌晨 1:00 競拍 250 億美元的 30 年期美國國債。

這是市場情緒的快速轉變。此前,美國經濟增長放緩的跡象,加上風險資產的劇烈拋售,引發了人們的猜測,即美聯儲將需要大幅降息,以幫助這個全球最大的經濟體。週一,美國 2 年期國債收益率一度下跌 20 個基點。

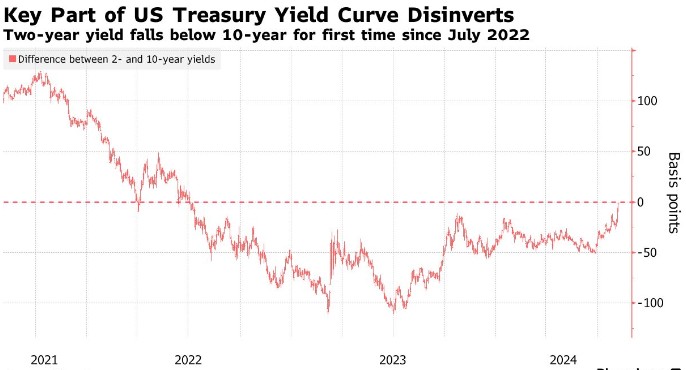

而且由於短端收益率下降,美國 2 年期國債收益率自 2022 年 7 月以來首次低於 10 年期國債收益率,原因是對經濟衰退的擔憂導致交易員押注美聯儲將大幅放鬆貨幣政策——進而壓低了對政策敏感的短端收益率。週一,美國 2 年期國債收益率一度下跌 23 個基點,至 3.65%,低於美國 10 年期國債收益率 3.68%。相比之下,2023 年 3 月,美國 2 年期國債比 10 年期國債高出 111 個基點,這是自上世紀 80 年代初以來最深的倒掛。

這對美國國債市場來説是一個重要的里程碑。自美聯儲於 2022 年 3 月開始連續 11 次加息 (總計超過 5 個百分點) 以來的大部分時間裏,美國國債的短期收益率一直高於長期收益率,形成了收益率曲線倒掛。

法國外貿投資管理公司 (Natixis Investment Managers) 投資組合策略師 Jack Janasiewicz 説:“情緒很可能過度了。證據肯定指向經濟放緩。但是減速和緩慢是兩個完全不同的概念。”

交易員們也紛紛回撤對美聯儲今年將大幅降息的預期。掉期合約顯示,市場押注美聯儲今年的降息幅度約為 110 個基點,而週一的押注高達 150 個基點。目前,貨幣市場已經排除了最早於本月緊急降息的可能性。