After the Supermicro financial report plummeted, "AI servers" are really not profitable?

超威電腦 Q4 營收雖超預期,但 EPS 不及預期以及毛利率下滑,引發華爾街對其 AI 服務器業務長期盈利能力的擔憂,超威股價盤後跳水超 10%。

紅紅火火的 AI 界又彈出壞消息了,這次輪到超微電腦。

週二,服務器製造商超微電腦公佈第四財季業績報告,喜憂參半,營收超預期,但毛利率下降,而且 EPS 不及預期。具體來看:

營業收入:Q4 營收 53.1 億美元,同比激增 143.6%;

EPS:Q4 EPS 為 6.25 美元,同比增長 78.1%,不及預期的 8.14 美元;

毛利率:Q4 毛利率為 11.2%,同比下降 5.8 個百分點。

營收雖然超預期,但 EPS 不及預期以及毛利率下滑,讓超微電腦股價盤後先是大漲,然後跳水下跌超 10%。

超微電腦憑藉 AI 服務器加入 AI 戰場,可惜 “叫好不叫座”

超微電腦作為 AI 服務器的製造商,在過去兩年也吃到人工智能熱潮的紅利。今年以來,隨着 AI 服務器需求的增加,公司股價已翻倍,並被納入標普 500 和納斯達克 100 指數。而且超微電腦在週二的業績展望中預計,在截至 2025 年 6 月 30 日的財年裏,公司營收將達到 260 億至 300 億美元。分析師平均預計為 236 億美元。

雖然營收展望樂觀,但真正讓華爾街擔心的是它的長期盈利能力。

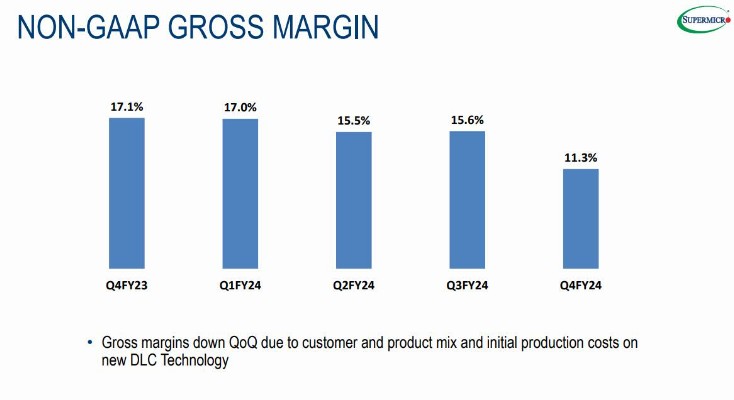

在與戴爾、惠普等服務器供應商對手激烈的降價戰中,超微電腦 Q4 的利潤率同比下降 580 個基點(環比下降 430 個基點),僅為 11.3%。

超微電腦的高管在業績發佈後表示,由於與大客户的業務以及新型液冷服務器供應鏈的增加投資,毛利率受到負面影響,因為大客户通常能夠通過大訂單獲得優惠價格。將通過在台灣和馬來西亞擴展新產品和製造供應鏈,達到 14% 至 17% 的毛利率目標區間。

但華爾街並不買賬,有分析師指出,超微在最近一個季度未能實現自己的盈利目標,很可能會加劇華爾街對其盈利能力的憂慮。這也是超微電腦盤後大跌的關鍵原因。

盈利能力不足似乎是 AI 服務器製造商的 “通病”

不僅是超微電腦,惠普及戴爾等服務器業務的競爭對手也存在盈利方面的問題。

在 5 月底公佈第一季度的財報時,戴爾公司預計 2025 財年調整後毛利率將下滑近 150 個基點,調整後 EPS 為 1.55~1.75 美元,遠低於分析師預期的 1.84 美元。

戴爾的管理層預測其 AI 服務器業務的高成本投入將拖累全年毛利率,屆時利潤將會承擔一定壓力,無法滿足外界的高預期。

而惠普二季度的毛利率為 33%,也同比下降了 3 個百分點,環比下降了 3.4 個百分點。

超微、戴爾以及惠普等 AI 服務器供應商的毛利率下滑,普遍也反應出這些硬件巨頭為了爭奪 AI 服務器市場所增加的投資,以及彼此間激烈的價格戰,但他們的管理層普遍看好對 AI 業務的未來。

超微電腦的 CEO Charles Liang 在週二也表態稱:“我們已做好準備,成為最大的 IT 基礎設施公司”。