Japanese stocks ride the "roller coaster": foreign investors withdraw first, retail investors rush in

外國投資者繼續拋售日本股票,擔心日元升值對出口企業利潤產生影響。日本央行加息進一步支撐了日元。然而,散户投資者持續買入日股。外國投資者今年已淨撤出 1.14 萬億日元,與去年淨買入形成鮮明對比。散户連續第四周淨買入日本股票,為自 2023 年以來最長時間。日元大漲導致日經 225 指數下跌 4.67%。日本央行上調利率至 15 年來最高水平,推動日元兑美元大漲。在工資上漲的支撐下,日本國內需求仍然強勁。

智通財經 APP 獲悉,截至 8 月 2 日當週,外國投資者繼續拋售日本股票,因為他們擔心日元升值給出口依賴型企業的利潤前景蒙上陰影,而日本央行歷史性加息進一步支撐了日元。不過,散户仍在持續買入日股。

日本證券交易所數據顯示,外國投資者上週拋售了價值 1.07 萬億日元 (73.3 億美元) 的日本股票,此前一週淨拋售 1.58 萬億日元。

總體來看,外國投資者今年從日本股市淨撤出 1.14 萬億日元,與去年淨買入 7.91 萬億日元形成鮮明對比。

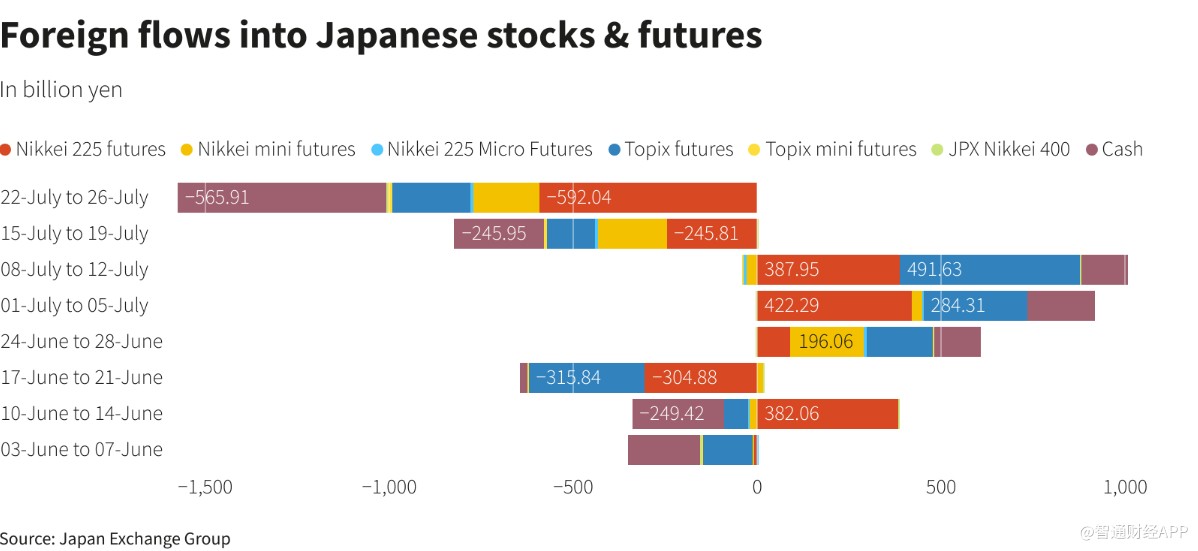

外國投資者淨賣出 5154.1 億日元衍生品合約,為連續第三週淨賣出。他們還出售了約 5524.3 億日元的現金股票。

外國投資者繼續拋售日本股票及期貨

相比之下,散户投資者上週繼續搶購日本股票,為連續第四周淨買入,也是自 2023 年 1 月初以來持續時間最長的淨買入。據日本交易所集團的數據,散户通過現金和期貨交易淨買入 4692.1 億日元 (合 32 億美元)。

散户持續買入日股

日股坐上 “過山車”

受日本央行緊縮政策路徑不確定性和美國經濟放緩擔憂影響,日元大漲,日經 225 指數上週下跌 4.67%。

週一,日經 225 指數暴跌 12.4%,創下 1987 年黑色星期一以來的最大單日跌幅。次日該指數暴力反彈超 10%,創下有史以來最大單日漲幅。

日興資產管理首席策略師 Naoki Kamiyama 表示:“目前的水平似乎是市場為復甦之路建立立足點的地方。”

“在工資持續上漲的支撐下,日本國內需求依然強勁,我們認為工資上漲可能成為日本股市復甦的催化劑。”

日本央行上週將利率目標上調至 0.25%,為 15 年來的最高水平,推動日元兑美元週一飆升至約 141.66 日元兑 1 美元,隨後幾個交易日回吐了部分漲幅。

日債也不 “香” 了

日本財務省的數據顯示,在債券市場,跨境投資者連續第八週成為日本債券的淨賣家。外國投資者拋售價值 9535 億日元的短期日本債券,為連續第八週淨賣出。

日本長期債券出現 1.16 萬億日元的外國資金流出,扭轉了前一週 1.21 萬億日元的流入。

在連續三週淨拋售後,日本投資者購買了價值 6697 億日元的長期海外債券,併購買了約 71 億日元的短期債券。

日本投資者淨買入價值 1.29 萬億日元的外國股票,是至少自 2005 年 1 月以來的最高水平。