日央行 “反复横跳” 引发市场动荡 未来政策决定料复杂化

日本央行通過加息引發了全球市場動盪,但隨後通過傳達穩定加息的信號平息了投資者的情緒。然而,這種溝通策略的改變可能會限制央行在擺脱對經濟過度支持方面的決心。央行行長表示若價格展望成為現實,將再次加息。週一,日元飆升、日本股市暴跌,加上對美國經濟衰退的擔憂,引發了全球金融市場的動盪。但副行長表示,若金融市場不穩定,政策制定者將暫時維持寬鬆的貨幣政策。

智通財經 APP 獲悉,在日本央行出人意料的加息引發了全球市場動盪之後,日本央行通過傳達穩定加息的信號成功地平息了投資者的緊張情緒。然而,這種溝通策略的改變可能會考慮日本央行逐步退出持續數十年的刺激政策的決心。如果因過去 25 年的政策失誤和逆轉而傷痕累累的日本央行聽任市場擺佈,那麼該央行在擺脱所謂的對日本經濟過度支持方面——即實現貨幣政策正常化——可能會受到限制。

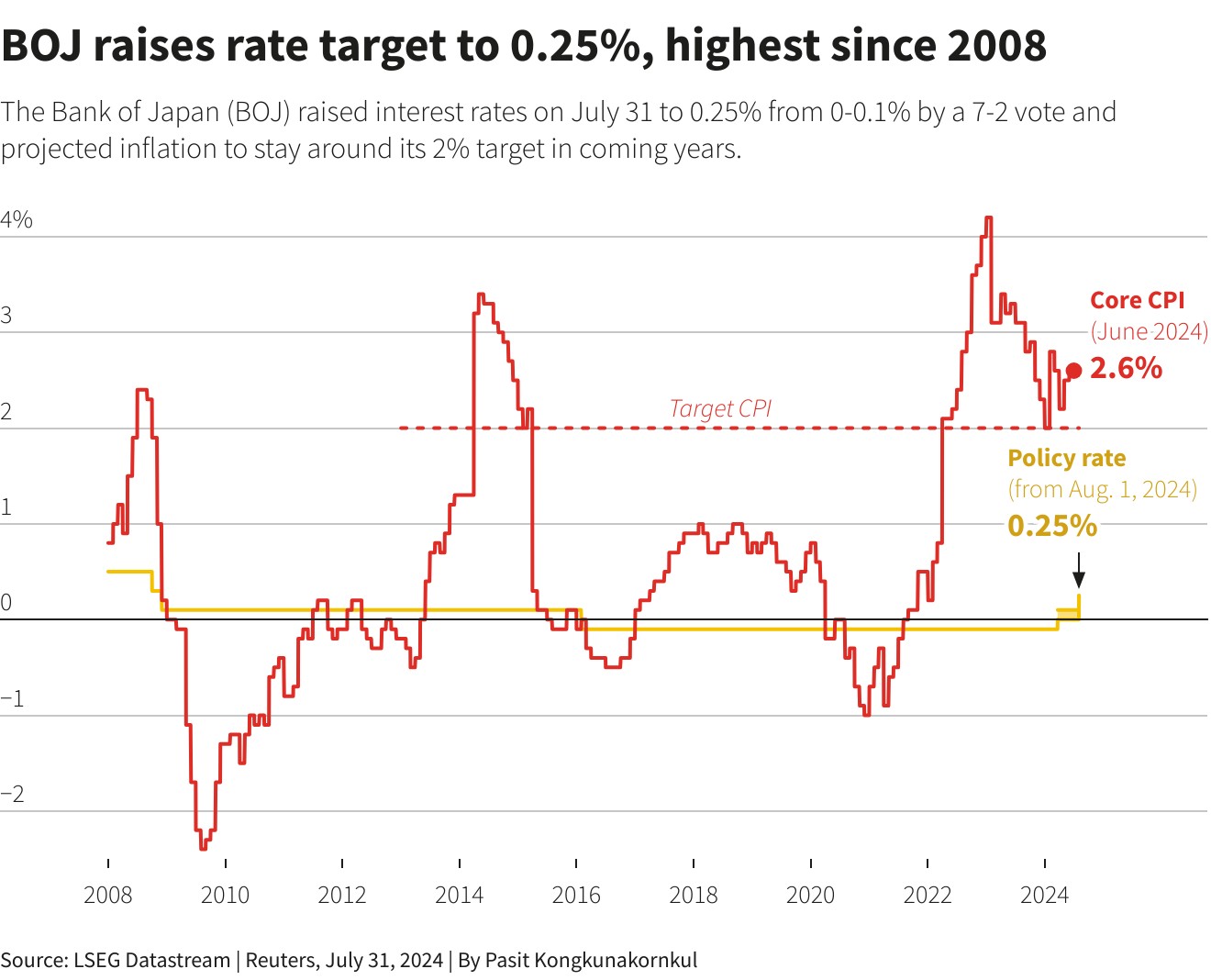

數月以來,日本央行一直試圖暗示將進一步穩步加息。然而,日本央行在上週意外地提高了利率,並公佈了削減大規模債券購買計劃的詳細計劃。日本央行將政策利率上調 15 個基點至 0.15%-0.25%,而市場此前預期維持不變。日本央行還宣佈,到 2026 年第一季度,將每月購債規模減少至 3 萬億日元,每季度約縮減 4000 億日元。

此外,日本央行行長植田和男在利率決議公佈後的新聞發佈會上再度 “放鷹”。植田和男表示,如果價格展望成為現實,日本央行將再次加息。他還表示,0.5% 不是特定利率上限,“日本的自然利率仍有很多不確定性。我們能説的是,短期利率仍然遠遠低於可能讓人懷疑我們是否接近中性水平的水平”。

在日本央行的鷹派表態下,日元飆升、日本股市暴跌——日經 225 指數在週一創下 1987 年以來的最大單日跌幅,再加上投資者對美國經濟潛在衰退的擔憂,這些因素引發了全球金融市場的動盪。

而到了週三,日本央行副行長副行長內田真一 (Shinichi Uchida) 表示,如果金融市場不穩定,政策制定者將不會提高基準利率。他表示,近期市場走勢 “極不穩定”,央行需要暫時維持寬鬆的貨幣政策。他補充稱,由於通脹保持温和,日本央行有能力等待加息。

內田真一的言論幫助穩定了市場人氣。但週四混亂再起,因為日本央行 7 月會議紀要顯示,政策制定者聚焦於一系列加息,以防止通脹過高。

Gaitame.com 研究所分析師 Takuya Kanda 表示:“日本央行之所以提高利率,是因為它不喜歡日元疲軟。現在它似乎暗示暫停加息,因為它不喜歡股市下跌。”“如果日本央行在制定政策時如此關注市場,那麼它有可能無法大幅加息。”

Meiji Yasuda Research Institute 經濟學家 Kazutaka Maeda 表示,內田真一的言論雖然穩定了市場,但其表現出來的態度大轉變 “最終也放大了市場波動”。他指出,日本央行的溝通引起如此大的波動是不可取的。

SMBC 日興證券經濟學家 Yoshimasa Maruyama 表示:“日本央行近期加息的可能性已經消失。事實上,今年再次加息的可能性已經大大降低。”

掉期交易顯示,日本央行在 12 月政策會議前加息 25 個基點的可能性只有 30% 左右,低於一週前的 60%。此外,在日本央行上週加息後一度升至 0.46% 的兩年期日本國債收益率最近也下降到了 0.27%。

外界批評日本央行在制定政策時是根據市場走勢、而非數據作出反應。而內田真一週三堅稱,日本央行關注的是經濟。他表示:“如果市場波動改變了我們對觸及目標價格可能性的預測、風險和看法,那麼市場走勢將影響我們的決定。”“很明顯,我們的目標是實現價格穩定,從而促進經濟健康發展。我們將在制定政策時關注經濟發展。”

似曾相識的感覺

日本央行以前也經歷過這種情況。2000 年 8 月,日本央行加息至 0.25%,僅兩週後,互聯網泡沫破裂,納斯達克指數開啓了超過兩年的跌勢,這打擊了日本依賴出口的經濟。8 個月後,日本央行改弦易轍,推出了一項新的試驗——量化寬鬆政策:向市場投放大量日元,以支持經濟並對抗通縮。幾年之後,日本央行於 2006 年 7 月和 2007 年 2 月兩次加息。而幾個月後,美國次貸危機爆發,引爆全球金融危機。

在這兩種情況下,日本央行都因過於倉促地退出刺激政策而招致激烈的政治批評。而這一次,很少有日本政界人士要求日本央行放鬆貨幣政策。在日本央行於 7 月加息的前幾天,日本首相岸田文雄表示,日本央行的政策正常化將支持經濟復甦。尋求在 9 月自民黨黨魁選舉中取代岸田文雄的主要候選人 Shigeru Ishiba 表示,他支持日本央行逐步加息的計劃。

在過去兩年裏,隨着日元跌至 38 年低點、並有可能將通脹率推高至日本央行 2% 的目標之上,日本政界人士改變了立場,不再要求日本央行放鬆政策。

一些分析師表示,如果日本央行的鷹派立場被視為屈服於政府壓力,那麼它可能會付出代價。前日本央行官員 Nobuyasu Atago 表示:“近期數據均顯示日本經濟疲弱,因此日本央行在未來加息路徑上態度如此強硬不符合邏輯。它與市場的溝通本可以做得更好。”

令日本央行任務複雜化的是,在美聯儲可能開始降息之際加息可能加劇美元兑日元匯率的波動,並損害日本企業的信心。日本央行前董事 Takahide Kiuchi 指出,日本央行歷來避免採取與美聯儲相反的行動,因為擔心這會損害出口並引發市場無序波動。他表示:“這一次,日本央行可能過於關注公眾和政界對日元過度下跌的憤怒。正是日本央行退出刺激措施的時機使其在一開始就極具挑戰性。”

東京 SBI 證券公司首席債券策略師 Eiji Dohke 表示:“自上週的政策會議以來,日本央行對其政策立場進行了相當大的修改。” 他表示,如果金融市場平靜下來,日本央行最早可能重啓 12 月進一步加息的討論,不過日元的反應可能使日本央行的政策決定複雜化。