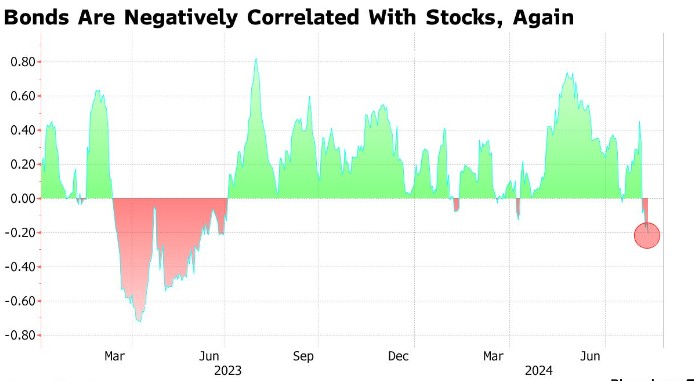

U.S. stocks and bonds return to negative correlation! Safe-haven assets are in demand, with U.S. bonds returning to a "defensive position."

債券重新成為對沖工具,投資者湧入債券市場,對債券的避險需求飆升。股債收益負相關關係重新迴歸,固定收益在市場混亂時起到對沖作用。股票和債券之間的傳統反向關係受質疑。股市暴跌引發對經濟衰退的擔憂,降息預期升温,債券表現良好。股市企穩後,債券漲幅將抹去大部分。

隨着大量投資者湧入債券,對多年來一直在為債券——以及更廣泛的資產多元化——“敲鑼” 的基金經理來説是個勝利。長期以來,這是一個明顯不受歡迎的建議。直到本月股市開始下跌,對債券的避險需求迅速飆升,此前一度將 10 年期美國國債收益率推至 2023 年年中以來的最低水平。

這次反彈令華爾街的許多人感到意外。股票和債券之間由來已久的關係——在股市暴跌時,固定收益上升以抵消損失——近年來受到了質疑。尤其是在 2022 年,這種相關性完全崩潰,因為債券在股市下跌時根本無法提供任何保護。(事實上,那一年美國國債出現了有記錄以來最嚴重的損失。)

不過,儘管當時的拋售是由通脹爆發和美聯儲試圖通過提高利率來抑制通脹引發的,但最近的股市暴跌在很大程度上是由對經濟陷入衰退的擔憂引發的。因此,降息預期迅速升温,債券在這種環境下表現非常好。

標普 500 指數在 8 月份的前三個交易日下跌了約 6%,而美國國債市場卻上漲了近 2%。這使得將 60% 的資產投資於股票、40% 的資產投資於債券的投資者 (這是一種建立波動性較小的多元化投資組合的歷史悠久的策略) 的表現優於僅持有股票的投資者。

隨着股市在過去幾天企穩,債券最終將抹去大部分漲幅,但更廣泛的觀點——固定收益在市場混亂的時刻起到了對沖作用——仍然存在。

TwentyFour Asset Management 投資組合經理 George Curtis 説:“我們一直在購買政府債券。這是一種對沖。” 實際上,Curtis 幾個月前就開始增持美國國債了——一方面是因為現在美國國債的收益率更高,另一方面是因為他也預計,隨着通脹的消退,舊有的股票 - 債券關係將回歸。

美國股債收益負相關關係正在迴歸

從另一個角度來看,這兩種資產類別之間的傳統反向關係——在本世紀頭幾十年基本上是如此——又回來了,至少目前是這樣。

上週,股票和債券之間的一個月負相關性達到了自去年地區銀行危機以來的最高水平。讀數為 1 表示資產完全同步移動,而- 1 則表示它們完全朝相反方向移動。一年前,該指數超過 0.8,為 1996 年以來的最高水平,表明債券作為投資組合的 “壓艙水” 實際上毫無用處。

隨着美聯儲從 2022 年 3 月開始的激進加息導致兩個市場暴跌,這種關係發生了翻天覆地的變化。所謂的 60/40 投資組合在那一年損失了 17%,是自 2008 年全球金融危機以來的最差表現。

如今,市場背景已轉回有利於債券市場,通脹得到更多控制,市場焦點轉向美國可能出現衰退,而美國國債收益率仍遠高於 5 年平均水平。

未來一週,看漲債券的投資者將面臨大量風險。美國 7 月份 CPI 和 PPI 報告即將出爐,任何通脹回升的跡象都可能推高收益率。本週四,在周度初請失業金人數意外下降後,收益率已經開始走高,這緩和了勞動力市場正在走弱的信號。隨着經濟衰退擔憂的加劇,這一數據突然引起人們的關注。

儘管如今債券市場令人興奮,但仍有許多像摩根大通債券基金經理 Bill Eigen 這樣的人對重返市場持謹慎態度。

Eigen 管理着規模 100 億美元的摩根大通戰略收入機會基金 (JPMorgan Strategic Income Opportunities Fund)。過去幾年,他持有的基金中有一半以上是現金,主要是投資於美國國債等現金等價物的貨幣市場基金。美國短期國庫券的收益率僅略高於 5%,至少比長期債券高出整整一個百分點。Eigen 不相信通脹真的足夠温和,也不相信經濟疲軟到值得美聯儲採取寬鬆措施來改變這種局面。

他表示:“降息幅度將是小而漸進的。債券作為對沖工具面臨的最大問題是,我們仍面臨通脹環境。”

儘管如此,彭博策略師 Ira F. Jersey and Will Hoffman 表示:“進入衰退時,收益率曲線往往會變得更陡。8 月 5 日,美國 2 年期/10 年期國債收益率曲線異常短暫的反轉,可能預示着債券走牛的趨陡趨勢,我們預計隨着經濟放緩,這種趨勢將持續下去。與此同時,我們認為股票/債券的相關性可能正在正常化。”

越來越多的投資者像 Curtis 一樣,將通脹置於次要地位。在上週市場波動最劇烈的時候,債券投資者發出了一個短暫的信息,即他們對經濟增長的擔憂正在變得可怕。美國 2 年期國債收益率兩年來首次低於美國 10 年期國債收益率,表明市場正準備迎接衰退和快速降息。

太平洋投資管理公司首席投資官 Daniel Ivascyn 表示,"隨着通脹趨低,且風險更加平衡,甚至傾向於對經濟放緩的擔憂,我們確實認為債市將更多地表現出防禦性特徵。"