Morgan Stanley Q2 still adds fuel to tech giants like NVIDIA, heavily increasing holdings in Chinese concept stocks such as Full Truck Alliance

摩根大通在第二季度增持了英偉達等科技巨頭股票,持倉市值增長 3%。前五大重倉股中,微軟持倉最多,較上季度增長 3.81%。

智通財經 APP 獲悉,根據美國證券交易委員會 (SEC) 披露,摩根大通遞交了截止至 2024 年 6 月 30 日的第二季度持倉報告 (13F)。

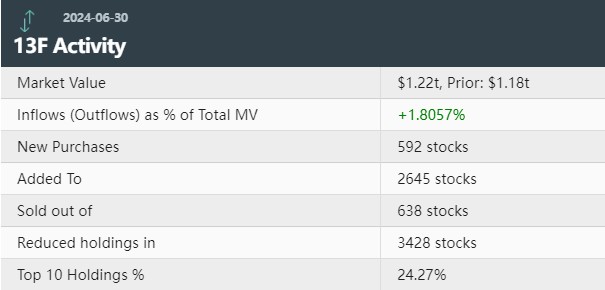

據統計,摩根大通第二季度持倉總市值為 1.22 萬億美元,上一季度總市值為 1.18 萬億美元,環比增長 3%。該基金在第二季度的投資組合中新增了 592 只個股,增持了 2645 只個股,減持了 3428 只個股,清倉了 638 只個股。其中前十大持倉標的佔總市值的 24.27%。

在摩根大通的第二季度前十大重倉股中,大型科技巨頭仍佔多數。在前五大重倉股中,微軟 (MSFT.US) 位列第一,持倉 1.33 億股,持倉市值約 592.68 億美元,佔投資組合比例為 4.87%,較上季度持倉數量增長 3.81%。

英偉達 (NVDA.US) 位列第二,持倉 3.91 億股,持倉市值約 482.77 億美元,佔投資組合比例為 3.97%,較上季度持倉數量增長 2.94%。

蘋果 (AAPL.US) 位列第三,持倉 1.81 億股,持倉市值約 380.77 億美元,佔投資組合比例為 3.13%,較上季度持倉數量增長 15.85%。

亞馬遜 (AMZN.US) 位列第四,持倉 1.73 億股,持倉市值為 334.07 億美元,佔投資組合比例為 2.74%,較上季度持倉數量增長 0.66%。

SPDR 標普 500 指數 ETF(SPY.US) 位列第五,持倉 0.56 億股,持倉市值為 306.55 億美元,佔投資組合比例為 2.52%,較上季度持倉數量下降 6.68%。

摩根大通第二季度建倉了 Blackrock Flexible Income ETF(BINC.US)、GE Vernova(GEV.US)、UL Solutions(ULS.US) 等股票,清倉了 JP Morgan Active Bond ETF(JBND.US) 、Pioneer Natural Resources 等股票。

值得注意的是,該機構本季度增持了微軟、英偉達、蘋果、亞馬遜、META、谷歌 (GOOGL.US) 等科技巨頭,同時大舉加倉滿幫 (YMM.US) 2670 萬股,以及愛奇藝 (IQ.US)、嗶哩嗶哩 (BILI.US) 等中概股,本季度該機構還減持了 Nuwellis(NUWE.US) 等股票。

從持倉比例變化來看,前五大買入標的為:英偉達、蘋果、谷歌、微軟、博通 (AVGO.US)

前五大賣出標的包括:賽富時 (CRM.US)、摩根大通、施貴寶 (BMY.US)、SPDR S&P 500 ETF(SPY.US)、前進保險 (PGR.US)。