After the turbulence in the US stock market, what are the "buying opportunities"?

美國股市動盪,分析師建議投資者關注防禦性投資,如大型科技股、醫療保健股和高收益股。雖然市場已有所回升,但仍存在宏觀經濟和地緣政治擔憂,市場波動性將持續。投資者可考慮半導體行業,特別是人工智能和內存方面的機會,如美光科技、AMD、博通等。投資者需注意交易風險,長期投資者可保持投資組合穩定。

8 月份開局市場動盪不安,美國股市整體受到經濟緊張情緒、企業財報表現平平以及全球日元套利交易平倉的打擊,這促使華爾街尋找可能受到不公平懲罰的市場角落。

儘管標普 500 指數從上週開始的 3% 跌幅中收復了幾乎所有失地,但在連續四周下跌後,該指數仍較歷史高點低 6% 左右。

由於對宏觀經濟和地緣政治背景的擔憂,市場波動性將持續,分析師鼓勵投資者建立防禦頭寸,並利用機會買入仍遭受重創的市場板塊。Wealth Alliance LLC 首席執行官兼董事總經理 Rob Conzo 説:“我認為,當市場回落時,對投資組合進行一點再平衡,利用一些下跌的機會,這從來都不是一個壞主意。”

當然,試圖在一個不穩定的市場中進行交易是有風險的——股票可能會再次下跌導致未來的折價,或者迅速上漲奪走機會。LPL Financial LLC 首席全球策略師 Quincy Krosby 表示,對於長期投資者來説,圍繞波動性進行交易可能沒有意義。她説:“如果你有一個長期增長的投資組合,你可以堅持下去,安然度過波動。”

以下是市場觀察人士認為股市的機會所在:

半導體

花旗分析師説,半導體在近幾周遭受重創後,現在看起來很有吸引力。受宏觀經濟壓力、高收益預期和汽車終端市場下行風險的影響,該行業基準指數承壓。費城半導體指數已較 7 月份的峯值下跌了約 20%。

以 Christopher Danely 為首的花旗分析師在週四的一份報告中寫道:“我們仍然看好這一領域,因為我們看好的主要原因——人工智能和內存強度——仍然沒有改變。”

美光科技 (MU.US) 是花旗的首選。該領域其他獲得花旗買入評級的公司包括 AMD(AMD.US)、博通 (AVGO.US)、亞德諾 (ADI.US)、微芯科技 (MCHP.US)、英偉達 (NVDA.US) 和科磊 (KLAC.US)。

醫療保健

醫療保健類股通常被視為防禦性股,因此當市場其他板塊出現超買時,投資者就會轉投該板塊。上個月,標普 500 醫療保健指數 (S&P 500 Health Care Index) 上漲了約 3%,跑贏了跌幅超過 4% 的大盤。Summit Global Investments 首席投資官 David Harden 在談到對醫療股的投資時表示:“我認為這還沒有結束。”

Harden 還看到了減肥藥行業的上升空間。禮來公司 (LLY.US) 就是一個例子,該公司股價在拋售中大幅下挫。週四,該公司公佈了超過預期的收益,並提高了其肥胖藥物銷售的 2024 年收入預期,此後該公司股價飆升。持有禮來股票的 Harden 表示:"漲勢尚未結束,有一條清晰的賽道,很多能量被壓抑了。"

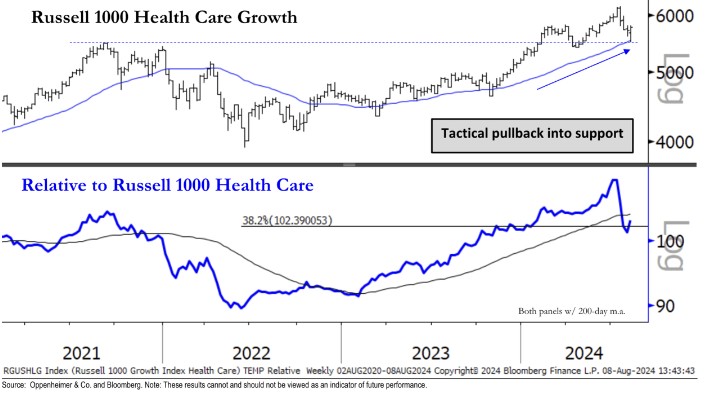

其次,投行 Oppenheimer 在其 OPCO Trifecta 名單中列出了一些突出的行業建議,其中一個建議是買入羅素 1000 指數醫療保健成長型股票。更廣泛地説,Oppenheimer 認為,標普 500 指數近期的疲軟"是上升趨勢中的一次修正",因為它不認為股市週期會以 7 月交易中出現的那種廣泛廣度結束。

Oppenheimer 技術分析主管 Ari Wald 表示:“雖然利率和領導力的崩潰表明股市週期正在成熟,但我們的研究表明,在季節性挫折之後,年底應該會出現反彈。我們將觀察這輪反彈的質量,以衡量我們對 2025 年的展望。”

Oppenheimer 表示,羅素 1000 醫療保健成長類股表現出看漲趨勢特徵,建議在此次回調時買入。Oppenheimer 的 OPCO Trifecta 名單上的股票基本上被評為 “跑贏大盤”,其趨勢工作顯示積極,並受到自上而下的利好因素的支持。在技術分析報告中,有四隻醫療保健股被推薦,包括 HCA 醫療 (HCA.US)、Merit Medical Systems (MMSI.US)、Neurocrine Biosciences (NBIX.US)、Viking Therapeutics (VKTX.US)。

大型科技股

最近幾周,科技板塊和所謂的 “瑰麗七大盤股” 遭受重創。跟蹤該集團的彭博指數較 7 月份的峯值下跌了約 15%。股價暴跌也抑制了該集團的市盈率,對一些投資者來説,該集團的股價此前過於昂貴。該集團目前的預期市盈率約為 28 倍,低於 30 倍的 5 年平均水平。

Wayve Capital Management LLC 首席策略師 Rhys Williams 表示:“如果你一直減持,現在是開始增持的好機會。”

利率敏感性股票

對宏觀經濟背景的擔憂往往會使公用事業、房地產投資信託基金和派息股等對利率敏感的股票對投資者更具吸引力。

目前,標普 500 公用事業指數的收益率略高於 3%。今年以來,該指數上漲了約 16%,跑贏大盤。Oppenheimer 在其報告中也推薦了四隻共用事業股,包括 Pentair (PNR.US)、Republic Services (RSG.US)、Waste Connections (WCN.US)、XPO (XPO.US)。

其次,房地產行業可能是下一個。美林和美國銀行私人銀行首席信息官市場策略主管 Joe Quinlan 表示:“隨着時間的延長和進入 2025 年,房地產可能是一匹讓人們驚訝的馬,因為美聯儲正在暗示他們將降息,抵押貸款利率已經下降。”

此外,在動盪的市場中,持有 (或買入) 派息股票以幫助平衡波動的交易也是有意義的。Quinlan 表示:“高收益股息為你的投資組合中的股票部分提供了平衡。在不確定的經濟時期,如果你能從分紅人羣中獲得穩定的收入,你晚上就能睡得更安穩。”