Fitch Ratings: Electrification process may continue to support electricity demand

中國電力需求增速超過同期 GDP 增速,受電動汽車和數據中心等行業增長的支撐,電氣化進程將繼續支撐電力需求。中國預計到 2025 年將電力佔能源結構的比重提升至 30% 以上。然而,棄風棄光率的上升可能對太陽能和風電利用小時數帶來壓力。惠譽預估,2024 年各省非水可再生能源的電力消納責任權重將較 2023 年增加 4 個百分點。

智通財經 APP 獲悉,惠譽評級表示,由於電氣化程度不斷加深,2024 年上半年,中國電力需求增速超過同期 GDP 增速。受能源轉型相關的製造業以及電動汽車、充電和數據中心等下游行業強勁增長的支撐,電氣化進程或將繼續支撐電力需求。

2024 年上半年,全國用電量同比增長 8.1%,其中工業、商業、住宅和農業用電需求分別同比增長 6.9%、11.7%、9% 和 8.8%,而同期 GDP 同比增長 5%。中國預期到 2025 年將電力佔能源結構的比重自 2023 年的 28% 左右提升至 30% 以上。

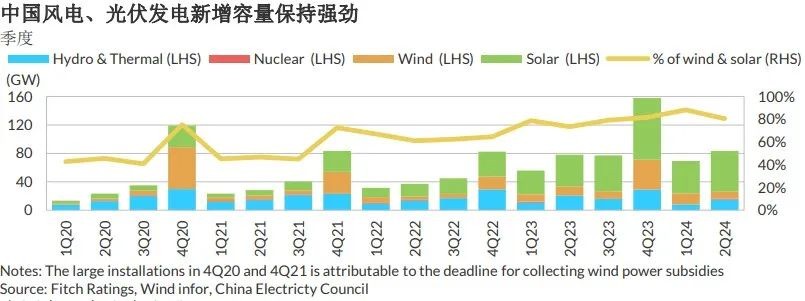

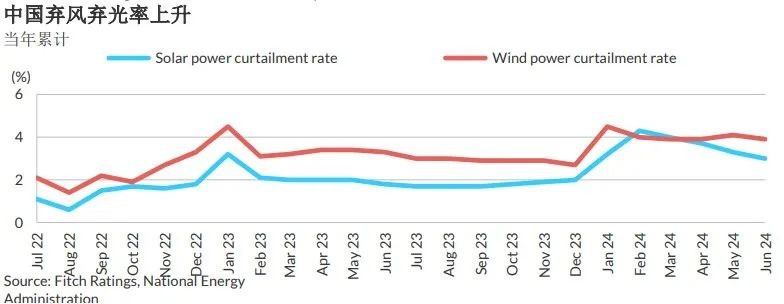

截至 2024 年上半年末,中國的太陽能和風電裝機容量之和首次超過煤電裝機容量。然而,可再生能源裝機的強勁增長也推高了棄風棄光率。2024 年上半年,棄光、棄風率同比分別上升 1.2 個百分點、0.6 個百分點,導致其設備利用小時數分別同比減少 32 小時和 103 小時。

惠譽預期,由於設備價格走低導致單位資本支出顯著下降,進而抵消電價和利用小時數下行所帶來的回報率壓力, 中國太陽能和風電裝機容量新增或將仍將保持高位。中國計劃在 2024 年新增約 300 吉瓦風電和太陽能發電裝機,這與 2023 年龐大的新增規模近似。惠譽認為,高棄風棄光率或將繼續令太陽能、風電利用小時數承壓,直至 2025 年後儲能容量和省間輸電能力大幅爬坡才能得到有效緩解。

惠譽預估,2024 年,各省平均非水可再生能源的平均電力消納責任權重將較 2023 年高出 4 個百分點。