UK unemployment rate unexpectedly drops sharply, pound surges challenging central bank's rate cut path, market focuses on Wednesday's inflation data

英國失業率意外下降至 4.2%,給英國央行的降息策略帶來難題。儘管失業率降低可能增加降息的難度,但市場普遍將這一數據視為經濟強勁和潛在通脹的信號。英鎊匯率應聲上漲 0.3%,突破 1.28 美元關口,成為十國集團中表現最佳的貨幣。然而,工資增長已降至 5.4%,這可能使英國央行保持謹慎態度。本週發佈的經濟數據預計將為英國央行在 9 月 19 日的政策決定定下基調。投資者預計央行可能在 11 月進一步降息。

智通財經 APP 獲悉,英國國家統計局最新數據顯示,英國失業率出現意外下降,這一積極跡象可能給英國央行的降息策略帶來難題。截至 6 月的三個月內,英國失業率下降了 0.2 個百分點至 4.2%,與經濟學家預計的小幅上升背道而馳。同時,就業人數激增 97,000 人,遠遠超出了預期的 3,000 人。

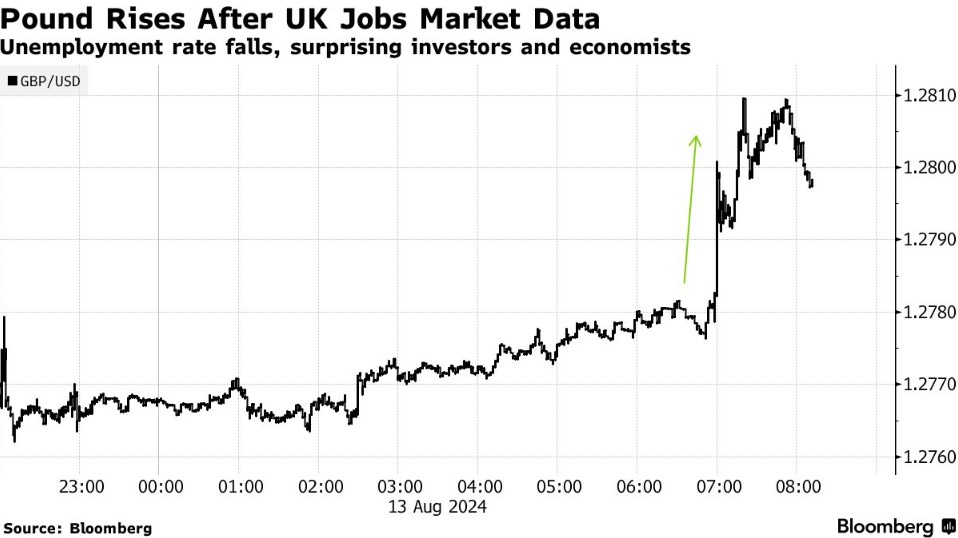

圖 1

儘管對勞動力調查的可靠性存在疑問,但投資者普遍將這一數據視作經濟強勁和潛在通脹的信號。總體失業率不僅低於預期,甚至低於英國央行對第二季度 4.4% 的預測。

在這一背景下,英鎊匯率應聲上漲 0.3%,突破 1.28 美元關口,成為十國集團中表現最佳的貨幣。這一點與美國近期就業數據的疲軟形成了鮮明對比,後者在近幾周內引發了市場不安。

英國央行貨幣政策走向

野村證券的高級經濟學家安德烈·什切帕尼亞克指出,英國似乎沒有受到美國勞動力市場的疲軟和歐元區 GDP 增長乏力的影響。他認為,英國勞動力市場和經濟活動的數據依舊強勁,這一現象支持了他關於美聯儲和英國央行政策分歧的觀點。

儘管如此,對於英國央行而言,失業率的降低反而可能增加了降低利率的難度。央行官員持續關注工資數據,以尋找通脹的跡象,並考慮就業市場對工資和物價的潛在推動能力。然而,最近的數據顯示,常規工資增長已從上一季度的 5.8% 降至 5.4%,這是自 2022 年夏季以來的最低水平。

圖 2

彭博經濟學家 Dan Hanson 評論,儘管有理由支持英國央行今年進一步放鬆貨幣政策,但失業率的下降可能表明,就業市場的快速復甦將使市場重新收緊,這可能使央行保持謹慎態度。

本週將發佈的經濟數據預計將為英國央行在 9 月 19 日的下次政策決定定下基調。投資者預計央行可能在 11 月進一步降息,但央行官員表示,他們將謹慎評估國內價格壓力的強度。

此外,英國央行鷹派利率制定者凱瑟琳·曼恩警告稱,工資和物價的上漲趨勢將需要很長時間才能消除。瑞穗策略師 Evelyne Gomez-Liechti 也指出,英國央行降息主要是由公共部門工資增長推動,而私人部門工資增長可能是央行更擔憂的因素。

英國國家統計局去年暫停勞動力調查後,英國央行官員對就業數據的解讀持謹慎態度。統計局目前正在對調查進行全面改革,但新的數據發佈被推遲到明年。央行預計未來幾年失業率將達到 4.8%,仍低於疫情和金融危機時期的峯值。

凱投宏觀副首席英國經濟學家露絲·格雷戈裏表示,對數據準確性的擔憂使得央行在解讀時必須更加謹慎,因此,儘管失業率有所下降,但今天公佈的數據對央行決策的影響可能有限。

市場聚焦週三通脹數據

值得一提的是,貨幣市場由於英鎊匯率上漲而減少了對 2024 年剩餘時間內降息的預期,從週一的 42 個基點降至 40 個基點。英鎊的這一漲勢幫助其從過去一個月的下跌中恢復,儘管全球市場的動盪曾導致投資者減少淨多頭倉位。

圖 3

TJM Europe 的外匯銷售員 Neil Jones 根據最新的失業數據指出:“英鎊有望進一步升值,並保持買入基調。” 他還提到,工資的上漲對英國央行而言是一個令人擔憂的信號,這可能不利於進一步降息。

作為本週一系列經濟數據的開端,就業市場數據將對決策者決定利率走向起到關鍵作用。8 月初,英國央行貨幣政策委員會以 5 比 4 的投票結果決定將利率下調 25 個基點至 5%。

緊接而來的是週三的通脹報告,預計隨着能源賬單利好因素的消退,7 月份的消費者價格增長將首次回升至 2.3%,而前兩個月的漲幅為 2%。

Equiti Capital 首席宏觀經濟學家 Stuart Cole 表示,英國央行擔憂的是,這些數據可能傳遞出勞動力市場潛在的實力信號。他預測,即將發佈的 CPI 數據可能顯示通脹壓力再次上升,這可能會改變市場對今年進一步降息的預期。