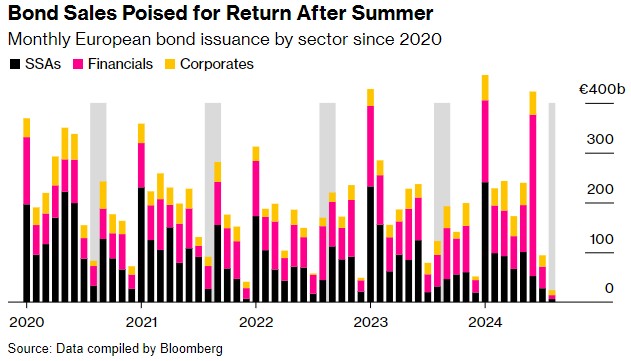

European bond market enters a warm period after the summer, with the weekly bond issuance expected to reach 20 billion euros

本週,歐洲債券市場迎來回暖,預計發行量將達 150 億至 200 億歐元。近 40% 的市場參與者對此做出積極預期,近期市場波動使得借款人需抓住發行窗口。數據顯示,8 月最後一週債券發行量大幅攀升,總體同比增長 28%,創歷史新高。投資者希望在央行降息前鎖定更高收益率,市場對債務銷售復甦充滿期待。

智通財經 APP 注意到,銀行家和借款人正為本週債券銷售的回暖做準備,希望在市場平靜時達成交易。

接受調查的近 40% 市場參與者預計本週債券發行量將達到 150 億歐元 (165 億美元) 至 200 億歐元。數據顯示,過去兩週歐洲新發債券發行量總計僅為 35 億歐元。

摩根大通歐洲、中東和非洲地區及亞太地區銀團主管 Marc Lewell 表示:“市場為夏季後發行浪潮做好了準備。近期的波動凸顯了發行人的恐懼因素,並提醒他們在發行窗口到來時要充分利用。”

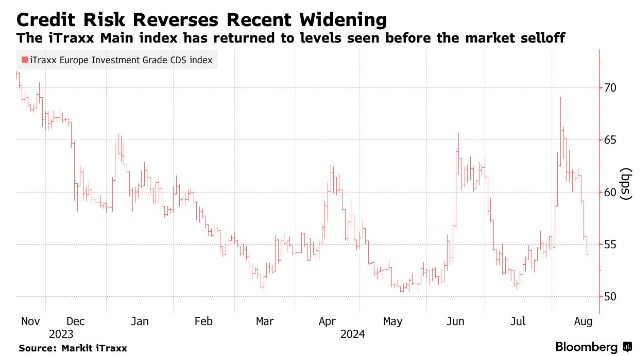

由於美國就業數據疲軟引發市場拋售,投資級信用風險指標在 8 月初擴大至今年最高水平,提醒投資者仍有出現負面意外的空間。

數據顯示,債券發行量在 8 月最後一週趨於大幅增加,2022 年和 2023 年的債券銷售額均超過 300 億歐元。

排行榜數據顯示,歐洲債券發行量總體同比增長 28%,創下歷史新高,這得益於降息前的部分債券發行以及借款人對波動性的擔憂。

美國銀行使用 EPFR 數據的報告顯示,上週投資級基金的資金流出主要集中在中期和長期部分,而此前六週資金一直流入。

在央行可能進一步降息之前,投資者將迫切要求達成交易,將前幾周積累的現金投入使用,並鎖定更高的收益率。

Lewell 表示,假設投資者將現金投入貨幣市場基金,今年到目前為止不會錯過太多回報。“但害怕錯過機會是一個驅動因素,許多人都想在信貸浪潮退去之前趕上它”。

夏季過後債券銷售有望回升