市场反弹很脆弱!鲍威尔可能令多头 “扫兴”?

市場觀察人士預計美聯儲主席鮑威爾將在週五講話中定調 9 月降息,但若其發言偏離預期,股市反彈可能面臨威脅。傑克遜霍爾經濟政策研討會將於 8 月 22 日至 24 日舉行,鮑威爾的講話受到高度關注。過去 20 年中,標普 500 指數在會議期間的平均回報率為 0.4%。分析師預期鮑威爾將為降息鋪路,但也可能重申對通脹目標的信心。

市場觀察人士普遍預計,美聯儲主席鮑威爾週五在傑克遜霍爾經濟政策研討會上發表講話時,將為 9 月降息定調。

但是,如果講話走向不同的方向,股市最近的反彈可能就會受到威脅。

鮑威爾將於北京時間週五晚上 10 點就經濟前景發表講話。按照慣例,美聯儲主席幾乎總是在這個定期吸引美國和全球央行高層參加的備受矚目的年度會議上發表主題演講。該活動將於 8 月 22 日至 24 日在懷俄明州的大提頓國家公園舉行。

雖然傑克遜霍爾會議通常不是美聯儲主席用來刻意引導對即將到來的利率決定的預期的場所,但鮑威爾今年的講話將受到密切關注。

畢竟,今年的會議是在市場劇烈波動之後召開的,交易員們已經大幅調整了對美聯儲利率路徑的預期。

在美聯儲 7 月份會議結束的兩天後,一份不及預期的 7 月份就業報告引發了股市的大幅下挫,下一份就業報告將在美聯儲 9 月份會議前的噤聲期開始前一天發佈。法國巴黎銀行的經濟學家最近指出,這種情況限制了決策者影響市場預期的能力。

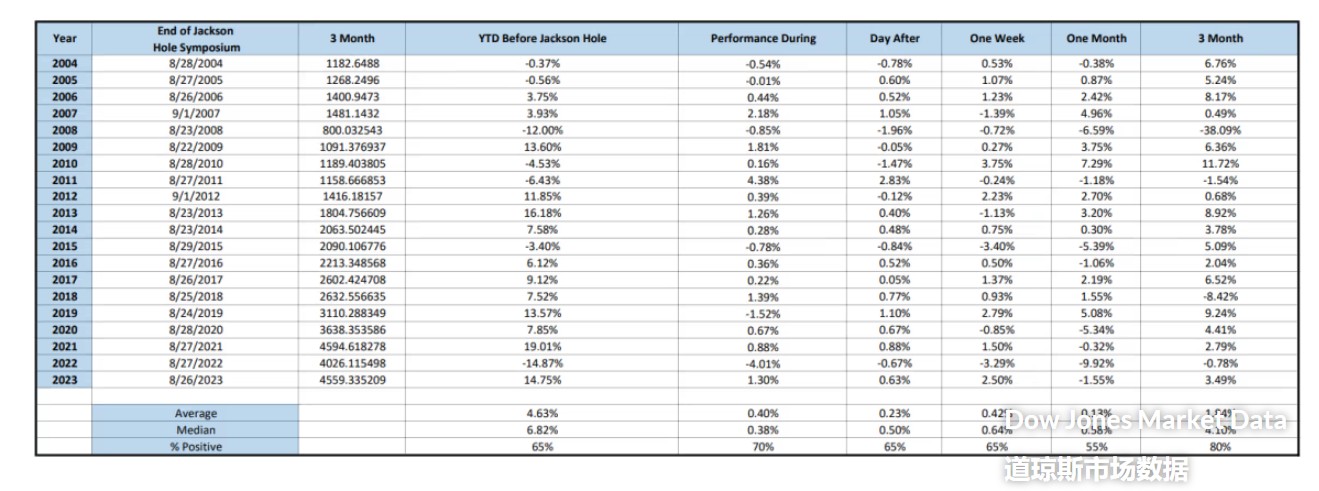

回顧過去,股市對美聯儲主席在傑克遜霍爾會議上的講話的平均反應平平,但大部分時候是積極的。

道瓊斯市場數據顯示,在過去 20 年中,標普 500 指數(SPX)在該會議期間的平均回報率為 0.4%。該指數在會議結束後的一個月平均上漲 0.1%,會議結束後三個月的平均上漲 1.8%。

但美聯儲主席有時也會發表一些引起巨大反響的言論。2022 年 8 月 26 日,鮑威爾打破了投資者對美聯儲迅速結束加息行動的希望,標普 500 指數下跌了 3.4%。

今年,分析人士普遍預計鮑威爾將為 9 月份降息鋪路。荷蘭國際集團(ING)首席國際經濟學家詹姆斯 - 奈特利(James Knightley)認為,鮑威爾很可能會強調通脹正朝着正確的方向發展,從而使美聯儲更有信心實現 2% 的目標。

奈特利説,鮑威爾可能會發出這樣的信號:通脹放緩使美聯儲能夠更加專注於其他任務,即充分就業。

奈特利在電話中説:“我猜他會説,鑑於失業率的惡化,我們確實應該更早一些開始降息。”

不過,Interactive Brokers 首席策略師史蒂夫 - 索斯尼克(Steve Sosnick)則表示,他擔心投資者可能對鮑威爾的講話設定了過高的鴿派門檻。

索斯尼克説:“如果鮑威爾出來,只是説我們可能想把利率調低一點,但我們不需要大幅降息,那該怎麼辦?”

這一點尤其令人擔憂,因為根據 CME 的 FedWatch 工具,聯邦基金利率期貨交易員目前對美聯儲在今年剩餘三次會議上的累計降息幅度預期達到近 100 個基點,這暗示將有一次大幅降息。

索斯尼克指出,鮑威爾有可能發出這樣的信號:雖然美聯儲可能會在必要時考慮進一步降息,但在數據顯示經濟形勢更加暗淡之前,美聯儲將保持適度的降息步伐。

索斯尼克認為,無論如何,鮑威爾的講話都可能阻礙股市從本月早些時候的大跌中反彈。隨着對經濟衰退的擔憂近期加劇,股市目前正處於將經濟方面的壞消息簡單視為壞消息的階段。以前,壞消息之所以往往被視為市場的好消息,因為它有可能促使美聯儲降息。

索斯尼克説:“在傑克遜霍爾會議之前,我宣揚要謹慎行事。尤其是市場越是提前反彈,可能就越脆弱。” 美股三大股指上週均創下自去年 11 月底以來的最大單週漲幅。

除了鮑威爾在傑克遜霍爾的講話外,投資者還將關注美聯儲將於北京時間週四凌晨 2 點公佈的 7 月份會議紀要,以及當日晚些時候的上週初請失業金數據。

在週三,美國勞工統計局還將公佈 3 月份就業人數調查的年度基準修訂初值。奈特利指出,這一數據值得關注,因為如果該數據大幅下修,可能表明勞動力市場並不那麼強勁。

奈特利説:“美聯儲必須承認,勞動力市場並沒有官方數據所顯示的那麼好。同樣,這也是他們重新評估敍事的理由,並決定是否將重點放在減少貨幣政策限制的必要性上。”