What did 'Smart Money' see again? Hedge funds are selling heavily, betting on a decline in US consumer spending

對沖基金正在用腳投票,上週美股消費股出現了淨賣出,名義去槓桿規模創下了過去一年的第二高紀錄。同時,對沖基金拋售工業股的數量創下了五年來的新高,並且連續第四周增持了能源股,目前持有的能源股比例達到了今年的最高水平。

美國經濟數據釋放樂觀信號的同時,對沖基金正在用腳投票。

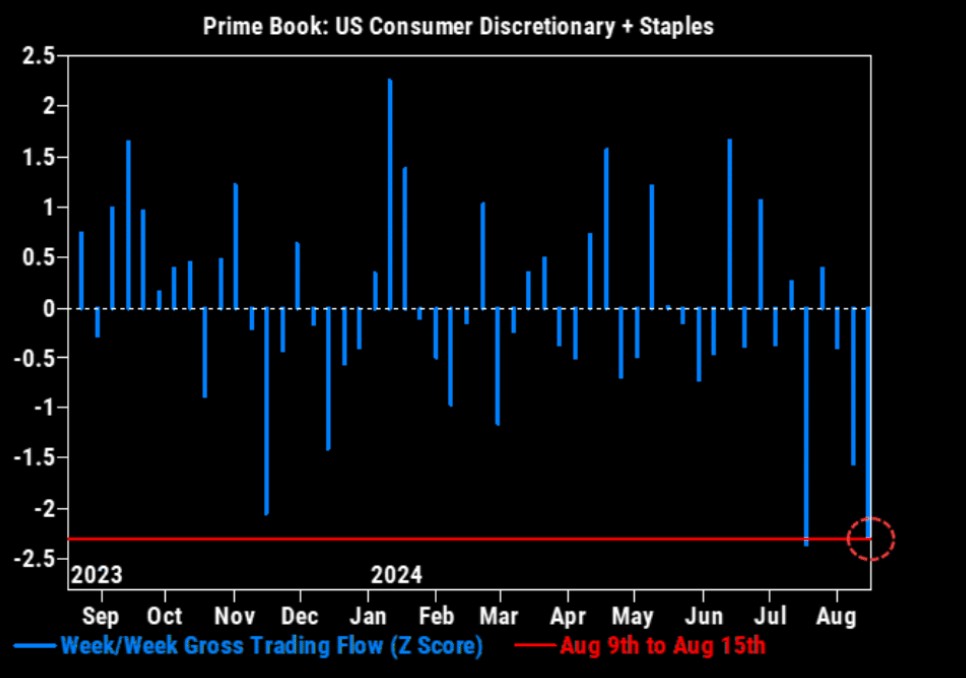

高盛 Prime Book 數據顯示,上週美股消費股出現了淨賣出,多頭賣出超過了空頭回補,消費股的名義去槓桿——多頭賣出和空頭回補的總和——是過去一年中的第二高記錄,從過去五年的回顧來看,排在 96 百分位的高位。對沖基金對餐廳股也持相當謹慎的態度。

對沖基金大舉拋售,表明它們仍對美國消費的韌性存疑。然而,從最近一週公佈的經濟數據來看,消費目前還沒有出現衰退的跡象。

稍早前公佈的數據顯示,美國 7 月零售銷售環比增加 1% 超預期,創 2023 年初以來最高紀錄,美國 8 月密歇根大學消費者信心指數,五個月來首次上升,通脹預期持穩。

全球零售巨頭最新財報也釋放了積極信號。沃爾瑪二季度營收、淨利潤雙雙超預期,並上調全年業績指引 ,全球最大 “先買後付” 服務商表示,美國消費者沒有任何減少支出跡象。

摩根士丹利分析師 Sarah Wolfe 在最新報告中寫道:

我們一直表示,由於緊縮的貨幣政策和消費行為的更廣泛正常化,2024 年消費者支出將有所下降。但我們認為,消費的基本驅動因素仍然支持穩定支出;既不會重新加速也不會出現衰退。7 月份的零售銷售數據證實購買力仍然存在。

根據華爾街見聞此前文章,高盛表示,消費板塊公司的業績與宏觀數據保持一致。標普 500 指數中,有 60% 的消費公司二季度業績超過預期,這一結果表明美國消費仍存在一定韌性。高盛開發的消費指標——美國消費者儀表板——更是顯示,美國消費狀況當前十分健康。

阿波羅資產也認為,美國消費依然強勁:

……零售額強勁,失業救濟申請下降,餐廳預訂強勁,航空旅行強勁,酒店入住率高,銀行信貸增長加速,破產申請呈下降趨勢,信用卡消費穩健,百老匯演出觀眾人數和票房收入強勁。

零售支出和失業救濟金的最新數據平息了人們對美國經濟的部分不安情緒,部分經濟仍受到利率上升的制約。7 月份零售額創下 2023 年初以來的最大增幅,零售額普遍上漲,而沃爾瑪上調業績指引(增長晴雨表)也表明,消費者雖然變得更加謹慎,但仍在消費。

押注 “美聯儲降息” 及 “特朗普交易”,能源股成 “香餑餑”

高盛週一最新報告顯示,對沖基金上週以自去年 12 月以來最快的速度減持工業股,同時連續第四周增持能源股,具體包括石油、天然氣及可消耗燃料,以及能源設備和供應公司的股票。而且,他們目前持有的能源股比例創今年來新高。

高盛上週五的報告顯示,對沖基金上週拋售的工業股數量達到五年來的最高水平,儘管在空運和國防股中有一定程度的買入,但對沖基金集中押注於提供專業服務、地面交通、機械製造以及客運航空業務的公司股票。

這一調整背後的邏輯是,一方面,他們預測美國的利率可能會下降,降息通常會刺激經濟增長,能源行業可能會因為經濟的復甦而受益,所以自然成為了對沖基金的寵兒。財富管理公司 Bentley Reid 的首席投資官 Paul O'Neill 認為:

“如果美聯儲成功實現軟着陸,全球經濟增長將好於預期,這可能就是這些交易員轉變策略的原因。”

因此考慮到降息前景,交易員正緊盯美聯儲主席鮑威爾週五在傑克遜霍爾發表講話,以尋找未來幾個月降息規模的線索。

另一方面,對沖基金押注於 “特朗普交易”。有媒體指出,有投資者在 7 月下旬透露稱,這些對沖基金相信,如果特朗普當選,能源行業的監管可能會放鬆,從而有利於能源公司的發展。然而,另一方面,在特朗普可能重新當選的預期下,一些歐洲汽車製造商的股票受到了負面影響,因為他們可能會面臨美國對外國進口汽車徵收的關税。