Goldman Sachs strategist: The downside threshold for US stocks remains high, with the potential to continue rising in the next four weeks

高盛表示,動量交易員和企業回購將推動美股在未來四周上漲。全球市場董事總經理 Scott Rubner 指出,儘管市場存在痛苦交易,但股市目前的倉位和資金流動將有助於反彈。他預計,標普 500 可能將在年底前上漲至 6000 點。此外,交易員的積極策略可能在市場波動中促進買入。

智通財經 APP 獲悉,高盛交易部門表示,動量交易員和企業回購的激增有望在未來四周推動美國股市上漲。

該行全球市場董事總經理兼戰術專家 Scott Rubner 在週一的一份報告中寫道:“股市痛苦交易的程度更高,在勞動節燒烤派對上保持看跌的門檻很高。” 所謂痛苦交易是指市場時不時地對大多數投資者施加最大程度的懲罰,即當一種受歡迎的資產類別或被廣泛遵循的投資策略出現了意想不到的轉折,讓大多數投資者措手不及時,就會出現痛苦交易。

Rubner 曾正確預測到夏末市場將出現回調,並在 6 月底建議在 7 月 4 日之後削減對美股的敞口,但他現在已轉為戰術看漲,稱目前的倉位和資金流動 “將成為助推器,因為賣家彈藥耗盡了”。

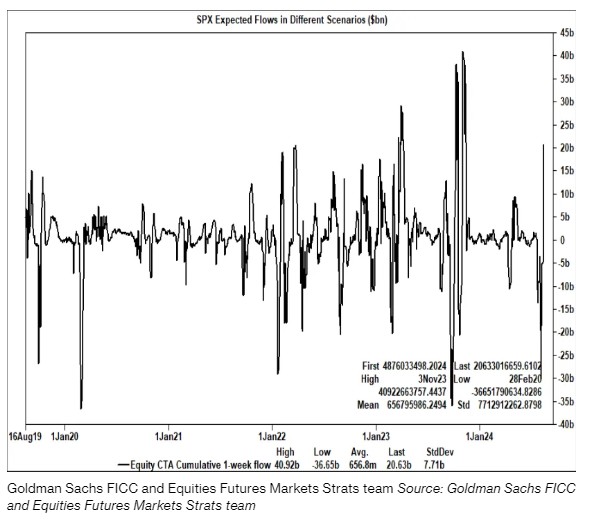

來自所謂的趨勢跟蹤系統性基金的資金可能會推動股市上漲。這些基金在將其總多頭敞口從 7 月份的 4500 億美元削減至目前的 2500 億美元后,又重新開始再槓桿化。考慮到 8 月份流動性下降的影響,這種資金需求流動將產生更大的影響。

這對試圖弄清楚股市走向的投資者來説是個好消息。8 月初的突然拋售吸引了逢低買入,這為今年最大的買入機會提供了動力。但 Rubner 表示,這種風險偏好的勢頭不會就此止步:在 11 月總統大選前的一段波動期過後,標普 500 指數可能會在年底前反彈至 6000 點,較上週五收盤價上漲約 8%。

Rubner 認為,大宗商品交易顧問 (CTA) 將進行所謂的 “綠色掃蕩”,即無論市場走勢如何,這些基金都很可能會買入股票。在芝加哥期權交易所波動率指數出現歷史上最大的九天波動率下降後,預計倉位與實際波動率相反的波動率控制基金將增加敞口。

最重要的是,交易員再次做多,這意味着他們基本上是在逆主流趨勢而動,在股價下跌時買入,在股價上漲時賣出。這應該會起到市場緩衝的作用,在出現拋售的情況下,會有逢低買入的投資者出現。過去三週,交易員的 gamma 交易在過去三週出現了高達 160 億美元的變動,從多頭變為空頭再變為多頭。“這是我們數據集中的最大規模變動,” Rubner 寫道。

企業需求也將起到推動作用。高盛估計,在 9 月 13 日約 50% 的公司關閉企業回購窗口期之前,每天的回購力度為 66.2 億美元。該行估計,2024 年,企業回購的授權總額為 1.15 萬億美元,執行總額為 9600 億美元。

他還預計,將有更多資金從貨幣市場流向股市。他指出,目前美國貨幣市場管理的資產約為 7.3 萬億美元。“貨幣市場收益率正開始大幅下降,美國大選後,這一大山將開始被部署到其他地方。”

然而,未來可能還會有更多的下跌。Rubner 警告稱,9 月 16 日之後,股市可能出現負面走勢,因為從歷史上看,9 月下半月是一年中最糟糕的兩週交易期。

在上週五標普 500 指數創下今年以來的最佳單週表現後,美國股市週一小幅上漲。交易員現在正將注意力轉向美聯儲在傑克遜霍爾舉行的年度會議,以尋找有關降息的潛在線索,此外,交易員還將關注相關零售商的財報,這些線索可能會提供更多有關美國消費者健康狀況的跡象。