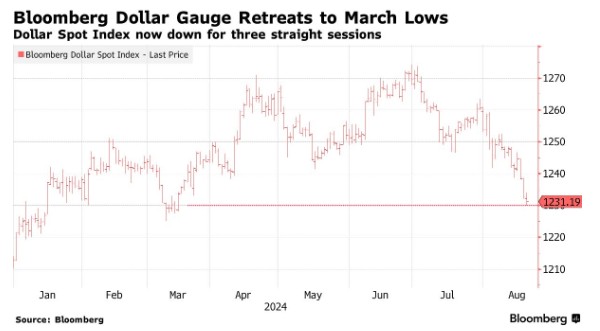

The US Dollar Index continues to decline, while the Euro and Pound exchange rates hit a new high in 2024

I'm PortAI, I can summarize articles.

美元暴跌推動歐元、英鎊匯率創 2024 年新高。彭博美元指數連續三日走低,當前跌幅約為 1.9%。歐元兑美元升至 1.1130,英鎊兑美元上漲 0.5% 至 1.3052,為今年最高水平。交易員關注美聯儲降息線索,預計將仔細研究鮑威爾週五的講話。市場對就業數據修正猜測,也可能進一步打壓美元。

智通財經 APP 獲悉,美元的暴跌正在推動其他主要貨幣的反彈,將歐元和英鎊推至 2024 年的新高,因為交易員們正在關注全球利率的未來走勢。

週二,彭博美元指數連續第三個交易日走低,跌至 3 月以來的最低水平,本月迄今為止的跌幅擴大至約 1.9%。在美聯儲主席鮑威爾和其他官員在懷俄明州傑克遜霍爾舉行的年度研討會上發表講話之際,交易員正在期待有關降息規模的任何線索。

美元疲軟推動歐元兑美元匯率週二升至約 1.1130,為今年以來的最高水平。英鎊兑美元匯率上漲 0.5%,至 1.3052,為 2023 年 7 月以來的最高水平,而瑞士法郎兑美元匯率則上漲逾 1%,達到日內高點 0.8540。美國國債全線上揚。

Aviva Investors 歐洲經濟與策略主管 Vasileios Gkionakis 表示:“如果美國經濟增長放緩,全球經濟增長保持相對穩定,這應該會導致美元走低。”

在傑克遜霍爾全球央行年會上,交易員將仔細研究鮑威爾週五的講話,以尋找美聯儲將在 9 月降息 25 個基點或更多的任何跡象。在此之前,美國勞工統計局週三發佈的初步就業基準修正數據可能顯示,美國就業增長不如此前估計的強勁。

巴克萊銀行外匯策略師 Skylar Montgomery Koning 表示,“外匯市場繼續對傑克遜霍爾全球央行年會可能令美元承壓的鴿派立場感到興奮”。週二,對就業數據大幅向下修正的猜測” 加劇了這種觀點。