全球匯市動盪之際 歐元成為贏家

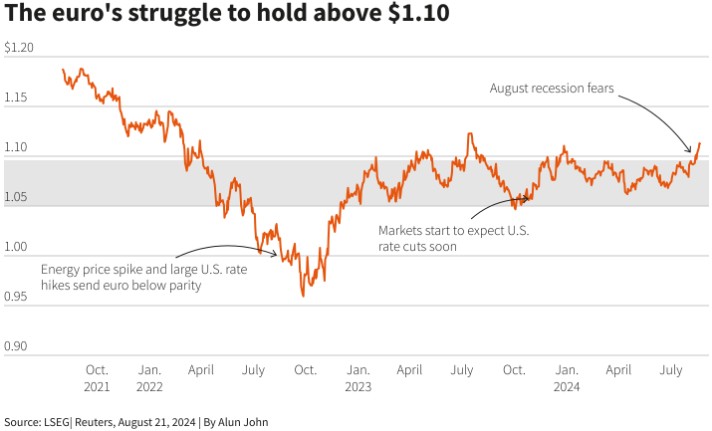

歐元在全球外匯市場震盪中表現突出,兑美元匯率在 8 月突破 1.10 美元關口,創下超 2.5% 的最大單月漲幅。市場動盪源於日元與美元的波動,加息與降息預期影響匯率走勢。分析師認為,匯率走強受利差收窄的支持,同時預期歐洲央行和美聯儲的降息動作將進一步影響市場情緒。

智通財經 APP 獲悉,近日,全球匯市動盪動搖了強勢美元,並阻止了日元的持續下滑。歐元兑美元匯率在 8 月突破了具有象徵意義的 1.10 美元關口,漲幅超過 2.5%,創下去年 11 月以來最大單月漲幅,成為近期全球外匯市場震盪的明確贏家。

此前,交易商被擾得心煩意亂,7 月 31 日日本央行意外加息後日元突然飆升,以及美國降息預期升温令美元全線下挫,而目前他們正密切關注後續走勢。

值得一提的是,歷史表明 1.10 美元並非一個容易突破的水平,就在 4 月,部分分析師還猜測歐元可能跌至平價。今年以來,歐元兑美元的表現僅次於英鎊。

儘管如此,由於美聯儲的降息言論恰逢市場猜測歐洲央行的進一步寬鬆政策或受到粘性服務業通脹的限制,市場預計歐元將從目前水平開始温和上漲。

德國商業銀行外匯分析師 Volkmar Baur 表示:“這是一個利率差異的故事。大西洋兩岸的通脹都在下降,但美聯儲預計會在下降的過程中採取更積極的行動,這將縮小利差,為歐元走強讓路。”

市場定價顯示,6 月降息的歐洲央行可能至少再降息兩次,每次 25 個基點。相比之下,交易員預計美聯儲在今年剩下的三次會議中將降息 94 個基點,這意味着三次降息 25 個基點,很可能還會有一次更大的降息。這與 8 月初相比變化了約 30 個基點,歐洲央行的定價變化則要小得多。

在此之前,美國就業市場數據疲弱,引發對經濟衰退的擔憂,並令股市和債市震盪。自那以來,市場已收復失地並回歸平靜,但政策寬鬆預期依然存在。

可以肯定的是,歐元兑美元極具吸引力絕不僅是由於 8 月的走強,對於尋求相對安全外匯押注的交易員來説,歐元還是最不復雜的貨幣。

在大規模套利交易解除後,日元波動劇烈。法國政治風險在 6 月對歐元造成了傷害。在英國降息和法國政治風險緩解後,英鎊在 8 月的漲幅有所減少。

富達國際宏觀和戰略資產配置全球主管 Salman Ahmed 表示:“我們看到歐元的一些風險被消除,比如法國大選。而現在,央行的故事變得更加清晰了。”

變得越來越困難

然而,從現在開始,歐元可能難以取得進一步進展。分析師表示,歐元目前處於近期交易區間的頂部,利差進一步向有利於歐元的方向轉變的空間已經縮小。

德國商業銀行預計,年底前歐元兑美元匯率為 1.11 美元,與當前水平持平。荷蘭國際集團預計一個月後將達到 1.12 美元,然後回落至 1.10 美元,美國銀行預計到年底將達到 1.12 美元。

BCA Research 首席歐洲投資策略師 Mathieu Savary 表示,“自 2023 年第二季度以來,我的觀點是在交易區間內交易。你在 1.05 美元時買入歐元,在突破 1.10 美元時賣出。”

對一些人來説,這甚至可能是為了獲得收益。Amundi Investment Institute 發達市場策略主管蓋伊•斯蒂爾 (Guy Stear) 表示:“這是從現在到年底期間歐元應該達到的最高水平。” 他認為,歐洲央行進一步降息的情形比美聯儲更有説服力。

近期歐元區經濟反彈顯示出放緩跡象,8 月德國投資者信心指數錄得兩年來最大降幅。相比之下,下一輪美國就業數據或將顯示,7 月疲弱的就業數據只是颶風貝麗爾導致的暫時現象。

另一個複雜的因素是 11 月 5 日的美國總統大選。雖然有很多因素在起作用,但分析人士表示,共和黨候選人唐納德·特朗普的高關税和低税收政策或將導致更高的通脹,這意味着美聯儲將收緊政策,美元會走強。

荷蘭合作銀行 (Rabobank) 外匯策略主管 Jane Foley 指出,歐元近期走強之際,特朗普的民主黨對手、美國副總統哈里斯在民調中目前取得了優勢。

她説,“真正可能推動歐元兑美元擊穿 1.10 美元並守住該水準的因素是哈里斯的勝利和美國經濟放緩。”