鲍威尔暗示 9 月降息,全球资产大狂欢,股债商数字货币全线涨,美元一年最低

鮑威爾講話的重磅鴿派轉向令標普逼近新高,小盤和芯片股指漲約 3%,全周主要指數齊漲超 1%,小盤最佳。週五特斯拉和英偉達漲超 4.5%,地區銀行股 ETF 一度漲超 6%。短期美債收益率兩位數跳水,美元周跌 1.7%,現貨黃金漲超 1% 重上 2510 美元,英鎊近兩年半最高,日元漲超 1%,離岸人民幣漲超 300 點,石油漲超 2% 但全周跌。

美聯儲主席鮑威爾在傑克遜霍爾全球央行年會上發出迄今為止最明確的信號,暗示美聯儲將於 9 月開始降息。他還認為美國經濟正在以 “穩健的速度” 增長,緩解了經濟衰退的擔憂。他對通脹降至 2% 的信心增強,未提及 “漸進” 降息,為更大幅度的政策調整留下空間。

有分析稱,美聯儲將根據接下來的經濟數據進行衡量,如果 8 月非農數據顯示勞動力市場疲軟程度超預期,應會刺激美聯儲更快、更大幅度地降息。美聯儲官員也齊 “放鴿”,2024 年票委、亞特蘭大聯儲主席博斯蒂克稱,現在可能傾向年內降息不止一次。費城聯儲主席哈克表示,現在是開始降息的時候了,這個過程應該 “有條不紊”。

降息預期升温,芝商所美聯儲觀察工具顯示,9 月降息 50 個基點的可能性從週四的 24% 上升至 36.5%。掉期交易員目前預計今年的降息幅度將超過 100 個基點,這意味着到 12 月為止,每次剩餘的 FOMC 政策會議都會降息,包括一次 50 個基點的大幅降息。

鮑威爾講稿出爐後,風險偏好上行,美股市場高開高走,美元指數大幅下挫,美債收益率全線下跌,兩年期美債收益率盤中一度下行逾 10 個基點。大宗商品市場同樣受到提振,黃金價格刷新日高,石油價格也同步上漲。

歐洲央行也表現出降息的傾向,芬蘭央行行長 Rehn 支持 9 月降息。經濟學家預測,歐元區通脹有望在 8 月降至 2.2%,為進一步降息提供支持。此外,美國 7 月新屋銷售增速創一年多新高。

小盤股收漲 3.19% 領跑,道指最高漲近 500 點一度升破 4.1 萬點,標普大盤逼近歷史最高,納指最高漲 1.8%,芯片股指張 2.8%,特斯拉和英偉達均漲超 4.5%:

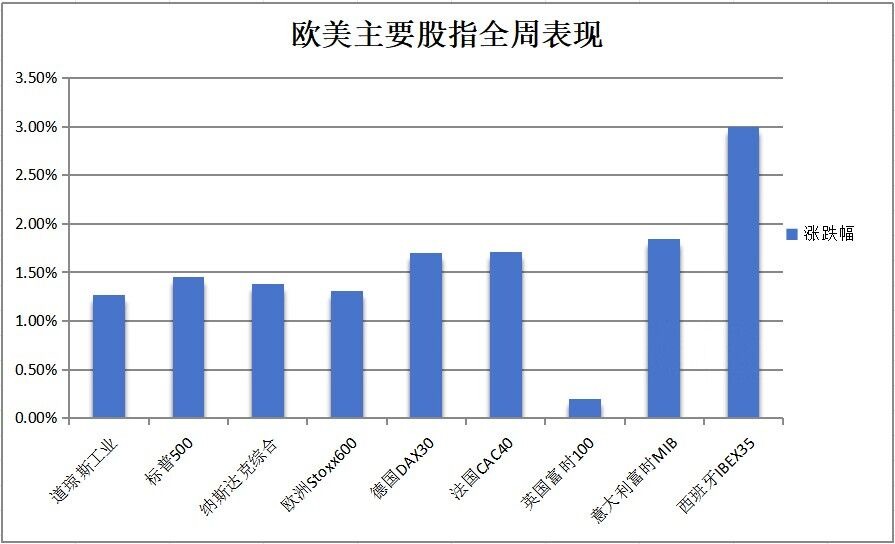

- 美股指數全線上漲,並收於日高附近:標普 500 大盤收漲 1.15% 至 5634.61 點,本週累漲 1.45%。與經濟週期密切相關的道指收漲 1.14% 或 462.3 點至 41175.08 點,本週累漲 1.27%。科技股居多的納指收漲 1.47% 至 17877.79 點,本週累漲 1.38%。納指 100 收漲 1.18%。衡量納指 100 科技業成份股表現的納斯達克科技市值加權指數(NDXTMC)收漲 1.37%。對經濟週期更敏感的羅素 2000 指數收漲 3.19%,本週累漲 3.54%。恐慌指數 VIX 收跌 9.63%,報 15.86。

- 全周,道指累漲近 1.3%,標普大盤漲 1.5%,納指漲 1.4%,小盤股指漲 3.6%,芯片股指漲 1.1%。

- 在鮑威爾 “轉向” 之際,美股銀行股全線上漲,地區銀行指數表現亮眼,創八個月最大盤中漲幅。SPDR 標普地區銀行 ETF(KRE)漲 6.4% 後收漲 5.1%,本週漲超 5%。

小盤股大漲 3.19% 漲幅居前

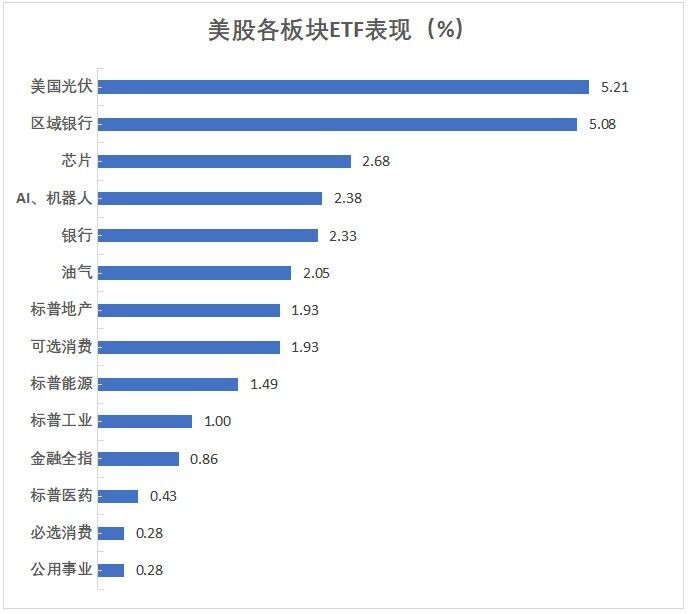

美股行業 ETF 收盤全線上漲。區域銀行 ETF 漲超 5%,銀行業 ETF 漲超 4%,全球航空業 ETF 漲超 3%,半導體 ETF 及可選消費 ETF 各漲 2% 上下,全球科技股 ETF、科技行業 ETF、能源業 ETF、網絡股指數 ETF 以及生物科技指數 ETF 漲幅也都超過 1%。

- 標普 500 指數的 11 個板塊全線收漲,房地產板塊收漲 2%,可選消費板塊漲 1.7%,信息技術/科技板塊漲 1.66%,能源板塊漲 1.48%,電信板塊漲 0.5% 表現倒數第三。全周,對利率敏感的房地產板塊漲幅居前。

- “科技七姐妹”僅 Meta 跌。特斯拉收漲 4.59%,本週累計上漲 1.94%,延續上週反彈 8.06% 的表現;英偉達漲 4.55%,本週累漲 3.84%,延續上週漲 18.93% 的表現;谷歌 A 漲 1.11%,本週累漲 1.63%;蘋果漲 1.03%,本週累漲 0.35%,延續上週漲 4.66% 的表現。亞馬遜漲 0.52%,本週累跌 0.01%,上週反彈 6.06%;微軟漲 0.3%,本週累跌 0.4%;Meta 則跌 0.74%,本週累漲 0.11%,此前三週先後漲 4.82%、6.07%、1.86%。

- 蘋果計劃在 9 月 10 日辦秋季新品發佈會,發佈新款 iPhone、AirPods 和 Watch。Meta 取消原定 2027 年推出高端混合頭顯的計劃。

- 芯片股集體上漲。費城半導體指數收漲 2.79%;行業 ETF SOXX 收漲 2.68%;英偉達兩倍做多 ETF 收漲 8.7%。安森美半導體收漲 4.08%,高通收漲 2.66%,科磊收漲 2.42%,Arm 控股收漲 4.56%,英特爾收漲 2.19%。AMD 收漲 2.16%,本週累漲 4.32%。應用材料收漲 1.23%。博通收漲 2.48%。台積電 ADR 收漲 2.91%,本週累跌 1.87%。而阿斯麥 ADR 收跌 0.05%,美光科技收跌 1.35%。

- AI 概念股普遍上漲。Snowflake 收漲 0.56%,BigBear.ai 收漲 6.17%,英偉達持股的 AI 語音公司 SoundHound AI 收漲 2.03%,戴爾科技收漲 2.78%,CrowdStrike 收漲 1.46%,C3.ai 收漲 1.74%,“AI 妖股” 超微電腦收漲 1.39%,甲骨文收漲 0.8%,Serve Robotics 收漲 0.94%,而 Palantir 收跌 0.44%,BullFrog AI 收跌 5.19%。

中概股漲跌不一。納斯達克金龍中國指數收漲 0.28%,全周累跌 1.5%。ETF 中,中國科技指數 ETF(CQQQ)收漲 1.37%。中概互聯網指數 ETF(KWEB)收漲 0.88%。

熱門中概股中,阿里巴巴總市值超過拼多多。B 站收漲 15.28%,阿特斯太陽能漲超 9.8%,億航智能漲約 5.4%,晶科能源漲超 4.8%,阿里巴巴漲超 2.9%,再鼎醫藥漲約 2.7%,萬國數據漲約 2.4%,蔚來汽車和鬥魚漲超 2.2%,貝殼漲約 1.5%,小鵬漲超 1.4%,唯品會漲超 1.3%,大全新能源、京東、亞朵、好未來、Boss 直聘至多漲超 0.8%,騰訊音樂、百度、華住、汽車之家、網易、理想、奇富科技、盛大科技、攜程至多收跌 0.99%,名創優品、百勝中國、中通快遞至多跌超 1.9%,新東方跌約 2.2%,愛奇藝、百家雲、中進醫療至少跌 10%。

- 減肥藥概念股普遍收漲,Ventyx Biosciences 收漲 14.72%,“平價減肥藥” 供應商 Hims、碩迪生物 ADR、安進至少漲超 1.6%,諾和諾德 ADR 也漲不到 0.1%,禮來則收跌超 0.1% 脱離收盤歷史最高位,本週累漲 3.32%,此前兩週先後漲 10.85% 和 3.56%。

- 波動較大個股中,有家保險收跌 92.63%,截至週四收盤,該股自 3 月上市以來漲逾 500%。Sequans Communications 收漲 111.71%,旗下 4G 物聯網技術獲高通收購。沃氪醫療科技集團(WOK)美國 IPO 首日開盤破發,下跌 64%,報 3.60 美元,此前給出的 IPO 發行價為每股 10.00 美元。

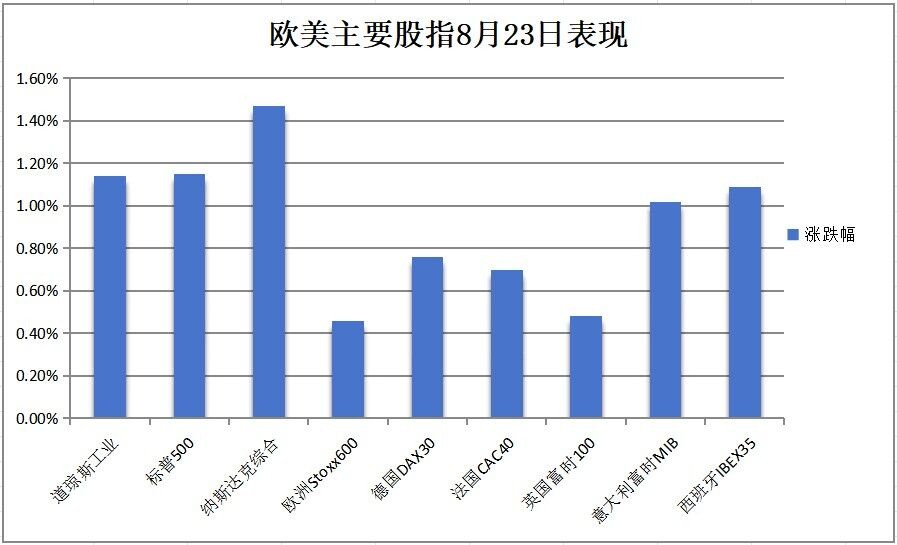

鮑威爾提振美聯儲降息預期,歐股連續第三日反彈,本週累漲 1.3%,創 3 月底以來最長連漲週數:

泛歐 Stoxx 600 指數收漲 0.46%,8 月 5 日收盤以來累計反彈 6.38%,本週累計上漲 1.31%,連續第三週上漲。成分股雀巢股價收平,由於公司業績不佳,雀巢首席執行官 Mark Schneider 離職。

德國股指收漲 0.76%,本週累漲 1.70%,連續第三週上漲。法國股指收漲 0.70%,本週累漲 1.71%。英國股指收漲 0.48%,本週累漲 0.20%。意大利股指收漲 1.02%,本週累漲 1.84%。荷蘭股指收漲 0.02%,本週累漲 0.32%。西班牙股指收漲 1.09%,本週累漲 3%。

“鮑威爾轉向日” 美債收益率大幅下挫。短端美債收益率跌幅突出,鮑威爾講稿出爐後,兩年與10 年期美債收益率盤中分別下行逾 10 個基點和 6 個基點,歐債收益率追隨美債顯著下挫:

- 美債:尾盤時,對貨幣政策更敏感的兩年期美債收益率跌 9.46 個基點,報 3.9090%,盤中一度跌近 11 個基點並失守 3.90%,本週累跌 13.86 個基點,跌穿 4% 關口。美國 10 年期基準國債收益率跌 5.50 個基點,報 3.7971%,本週累計下跌 8.55 個基點,且均接近抹去 8 月 5 日以來全部漲幅。

- 歐債:歐元區基準的 10 年期德債收益率跌 2.0 個基點,本週累計下跌 2.2 個基點,整體上大致呈現出 V 型走勢。兩年期德債收益率跌 2.4 個基點,本週累跌 5.9 個基點。法國 10 年期國債收益率跌 2.6 個基點,本週累跌 4.8 個基點。意大利 10 年期國債收益率跌 5.0 個基點,本週累跌 6.5 個基點。西班牙 10 年期國債收益率跌 3.5 個基點,本週累跌 7.0 個基點。希臘 10 年期國債收益率跌 4.5 個基點,本週累跌 6.0 個基點。兩年期英債收益率跌 4.4 個基點,本週累跌 0.4 個基點。英國 10 年期國債收益率跌 4.8 個基點,本週累跌 1.4 個基點。

美債收益率大幅下挫,短期國債收益率領跌(兩年期週五下行 10bps,本週下跌 14bps,30 年期週五下行 2bps)

美元指數跌超0.8%創13個月新低,非美貨幣在“鮑威爾轉向日”普遍走強,英鎊近兩年半最高,日元漲超1%漲向144,離岸人民幣大漲305點:

- 美元:衡量兑六種主要貨幣的一籃子美元指數 DXY 跌 0.82%,報 100.678 點,北京時間 22:00 發佈美聯儲主席鮑威爾的講稿之後顯著跳水,一度跌至 100.602 點,跌穿 2023 年 12 月 28 日底部 100.617 點,逼近 2023 年 7 月 14 日底部 99.578 點,本週累跌 1.74%,整體呈現震盪下行走勢。

彭博美元指數跌 0.97%,報 1223.14 點,02:16 跌至 1222.53 點,逼近 2023 年 12 月 28 日底部 1206.93 點,本週累跌 1.24%,整體跌幅在鮑威爾講話後顯著擴大。

美元跌至年內低點

- 非美貨幣普漲。歐元兑美元漲 0.75%,報 1.1193,本週累漲 1.54%;英鎊兑美元漲 0.95%,報 1.3216,創 2022 年 3 月來最高,本週累漲 2.10%;美元兑瑞郎跌 0.54%,報 0.8477,本週累跌 2.18%;商品貨幣對中,澳元兑美元漲 1.37%,報 0.6797,本週累漲 1.90%,紐元兑美元漲 1.61%,報 0.6236,本週累漲 3.01%,美元兑加元跌 0.79%,報 1.3510,本週累跌 1.24%。

- 分析稱,英國 PMI 數據的相對韌性表明連續降息的可能性極低。未來幾周,英鎊還有獲得進一步支撐的空間。當前英鎊是表達做空美元投資觀點的首選貨幣。

- 日元:日元兑美元漲 1.31%,報 144.37 日元,03:36 刷新日高漲至 144.05 日元,本週累漲 2.21%。日元兑歐元漲 0.57%,報 161.60 日元,本週累漲 0.74%;日元兑英鎊漲 0.35%,報 190.786 日元,本週累漲 0.15%。

- 消息面上,週五日本央行行長植田和男在 “黑色星期一” 後首度發聲稱,日央行不打算倉促加息,但若經濟走向符合預期,將繼續調整貨幣政策。分析稱,植田和男此言保持中立謹慎,非鴿非鷹,以免擾亂市場。日本財務大臣鈴木俊一表示,將對匯率突然波動進行有條件的外匯干預。

- 離岸人民幣:離岸人民幣(CNH)兑美元尾盤漲 305 點,報 7.1162 元,盤中整體交投於 7.1488-7.1132 元區間,本週累計上漲大約 470 點。

- 加密貨幣多數上漲。市值最大的龍頭比特幣尾盤漲 5.91%,報 63915.00 美元,鮑威爾講稿打破市場沉寂,漲幅迅速擴大,本週累漲 6.54%,整體震盪上行。現貨比特幣最近七個自然日(上週五結束交易以來)累計上漲超 8.5%,至 64300 美元上方,整體漲幅於鮑威爾講話後顯著擴大。第二大的以太坊尾盤漲 5.50%,報 2760.50 美元,本週累漲 4.74%。

比特幣一路飆升,上逼 6.4 萬美元

降息可刺激經濟增長並利好油需,美油和布油連續第二日反彈,週五漲超2.3%,但兩者本週仍累跌,因此前停火協議推進有助緩解供應擔憂,以及石油需求前景放緩。歐洲天然氣期貨本週累跌超7%:

- 美油:WTI 10 月原油期貨收漲 1.82 美元,漲幅 2.49%,報 74.83 美元/桶。本週累計下跌 2.37%。美股午盤後最高漲超 2.8% 至 75.06 美元/桶,創 8 月 19 日以來盤中新高。

- 布油:布倫特 10 月原油期貨收漲 1.80 美元,漲約 2.33%,報 79.02 美元/桶。本週累計下跌 0.83%。美股午盤後最高漲近 2.7% 至 79.27 美元/桶。

華爾街大行觀點,ING 分析師指出,OPEC+ 仍然擔憂油市近期的疲軟,將有可能不得不放棄從 10 月開始增加原油供應的計劃,當然這將取決於油市九月底的交易情況。摩根士丹利週五表示,石油庫存下降支撐油價。過去四周石油庫存每天減少約 120 萬桶,預計第三季度繼續維持這種狀況。有分析稱,此前下跌導致油市接近超賣區域。美國 CFTC 表示,WTI 原油看漲情緒創十一週新低。

- 天然氣:美國 9 月天然氣期貨收跌近 1.51%,報 2.0220 美元/百萬英熱單位。本週累計下跌 4.76%。歐洲基準的 TTF 荷蘭天然氣期貨跌 0.34%,報 36.700 歐元/兆瓦時,本週累跌 7.15%,整體震盪下行。ICE 英國天然氣期貨漲 0.55%,報 88.000 便士/千卡,本週累計下跌 7.64%,整體呈現出震盪下行走勢。

油價也大幅上漲,從 8 月初的低點進一步反彈

美元及美債收益率走軟支撐貴金屬走高,現貨黃金盤中最高漲近 1.4%,白銀一度漲超 3.1%,倫敦工業基本金屬集體上漲,倫銅收漲 1.73%,倫鋅單週漲幅為 4 月份以來最佳:

- 黃金:COMEX 12 月黃金期貨尾盤漲 1.20%,報 2546.80 美元/盎司,本週累漲 0.39%。鮑威爾講稿出爐後,現貨黃金漲近 1.4%,刷新日高至 2518.36 美元/盎司,逼近 8 月 20 日所創歷史新高 2531.75 美元,本週累漲 2.27%。

- 白銀:COMEX 9 月白銀期貨尾盤漲 2.78%,報 29.855 美元/盎司,本週累漲 3.50%。鮑威爾講稿出爐後,現貨白銀短線拉昇,美股早盤刷新日高漲超 3.1% 上逼 30 美元關口,最終收漲 2.86%,報 29.8157 美元/盎司,本週累漲 2.89%。

- 分析指出,鮑威爾鴿派信號引發金價再次飆升,預計在 9 月美聯儲會議前,黃金將繼續走高。受降息預期推動,金價有望攀升至 2550 至 2600 美元區間。美國 CFTC 數據顯示,黃金看漲情緒創四年新高。

- 倫敦工業基本金屬集體上漲。經濟風向標 “銅博士” 收漲 1.73%,報 9288 美元/噸,本週累計上漲超過 1.88%。倫鉛漲約 3.12%,本週累漲約 3.98%。倫錫漲超 1.84%,本週累漲超 3.16%。倫鋁漲 2.50%,本週累漲約 7.44%。倫鋅漲約 1.89%,本週累漲 5.43%。倫鎳漲超 0.93%,本週累漲 2.35%。倫鈷收平,本週累跌約 2.41%。

【以下為 8 月 23 日 23:00 以前更新內容】

8 月 23 日週五,美聯儲主席鮑威爾在傑克遜霍爾全球央行年會上 “放鴿” 稱,是時候調整政策了,不尋求或歡迎就業市場繼續降温,我對通脹降至 2% 的信心已經增強,坐實了市場對於鮑威爾將發表 “偏鴿派” 講話的預期。

分析稱,美聯儲主席鮑威爾的轉向政策已經完成,鮑威爾在講話中表現出了全面的鴿派,兩年前他還在同一時期表示,美聯儲將接受經濟衰退作為恢復通脹的代價。

鮑威爾講稿出爐後,降息預期大幅升温,提振風險偏好上行,美股高開後加速上漲,美元指數大幅下挫,美債收益率全線跳水,推動大宗商品價格,現貨黃金觸及新高,油價同樣上漲。

美股高開後加速上漲:

- 科技股居多的納指高開 153.37 點或漲 0.87%,現漲幅一度擴大超 1.8%;標普 500 大盤高開 31.85 點或漲 0.57%,現漲幅一度擴大超 1.2%;與經濟週期密切相關的道指高開 166.34 點或漲 0.41%,現漲幅一度擴大超 1%;羅素 2000 小盤股指一度漲逾 2.7%。

- 美股盤初,主要行業 ETF 多數走高,區域銀行 ETF、半導體 ETF、全球科技股指數 ETF 等均漲超 1%。

- “科技七姐妹” 集體走高。英偉達漲幅擴大超 4.6%,特斯拉一度漲逾 5%,蘋果一度漲超 1.6%,亞馬遜一度漲超 1.5%,“元宇宙” Meta 漲逾 1.4% 後漲幅砍半,谷歌 A 一度漲逾 1.3%,微軟一度漲逾 0.8% 後回吐多數漲幅。

- 芯片股加速上漲。費城半導體指數一度漲超 3.5%。高通漲逾 3.1%,博通漲逾 3.6%,英特爾漲逾 3.9%,台積電ADR 漲逾 4%,而美光科技一度跌逾 2.4%,現跌幅砍半。

- AI 概念股多數上漲。BullFrog AI 一度跌逾 2.9%,甲骨文跌超 0.3%,而英偉達持股的 AI 語音公司 SoundHound AI 一度漲超 3.6%,“AI 妖股” 超微電腦漲逾 3.3% 後回吐多數漲幅。

- 中概股漲多跌少。納斯達克金龍中國指數一度漲逾 0.7%。熱門中概股中,嗶哩嗶哩一度漲逾 14%,阿里巴巴漲超 3.3%,而拼多多一度跌逾 6.1%。

- 值得注意的是,阿里巴巴總市值超過拼多多。

- 鮑威爾講稿發佈後,美元指數大幅下挫,利好 G10 貨幣。ICE 美元指數從 101.50 點上方跳水至 100.90 點下方,日內整體跌幅擴大至超過 0.6%,逼近 2023 年 12 月 28 日底部,彭博美元指數跌約 0.8%。非美貨幣上漲,日元兑美元漲超 0.7% 升破 145。英鎊兑美元漲超 0.6%,報 1.32,創 2022 年 3 月份以來新高。

- 美債 “牛市加劇”,美債收益率全線跳水。鮑威爾講稿出爐後,美國 10 年期國債收益率從 3.8350% 跳水至接近 3.8%,日內整體跌幅擴大至超過 5 個基點。兩年期美債收益率從 4% 整數位心理關口上方跳水至 3.9450% 下方,日內整體跌約 6 個基點。

- 美元及美債收益率攜手走軟提振大宗商品價格,黃金價格短線拉昇。現貨黃金漲超 1.2%,刷新日高至 2515.55 美元/盎司,鮑威爾講稿出爐後上揚超過 15 美元。白銀上逼 30 美元關口。油價也上漲,美油一度漲逾 2.4%。

【以下為 21:50 以前更新內容】

傑克遜霍爾全球央行年會已開幕,多位美聯儲官員支持 9 月降息,今日鮑威爾將發表重磅講話。

等待鮑威爾關於降息的信號,今日美股盤前,美股三大指數期貨走高,中概股普漲,嗶哩嗶哩漲近 6%,芯片股上漲。

美股三大指數集體高開,嗶哩嗶哩漲 9%,英偉達漲 2%。

歐股小幅高開,德國 DAX 指數漲 0.24%。

亞太股指多數收漲,日經 225 指數漲 0.4%,越南 VN 指數漲 0.2%

美債收益率小幅走低,美國亞特蘭大聯儲主席博斯蒂克表示美聯儲 “接近” 降息。

現貨黃金日內漲 0.66%,再度站上 2500 美元以上。

油價上漲,WTI 原油一度漲 2%。

【以下內容為 21:30 更新】

美股小幅高開,納指漲 0.9%,道指漲 0.4%,標普 500 指數漲 0.6%。

導體股、中概股普漲,嗶哩嗶哩漲約 9%,英偉達漲約 2%,京東漲約 1%。

部分猴痘概念股上漲,GeoVax Labs 漲約 5%。

有家保險跌約 83%,截至週四收盤,該股自 3 月上市以來漲逾 500%。

Sequans Communications 漲逾 210%,旗下 4G 物聯網技術獲高通收購。

【以下內容為 20:50 更新】

美債收益率小幅走低,此前美國亞特蘭大聯儲主席博斯蒂克表示美聯儲 “接近” 降息。

數字服務提供商有家保險在盤前交易中一度暴跌89%,延續了前一天的跌勢。該股在截至週三的 11 個交易日裏飆升 396%,並創下歷史新高。截至週四收盤,該股自 3 月上市以來上漲了 538%。

WTI 原油日內漲幅一度達到 2%,現報 74.25 美元/桶;布倫特原油日內漲幅現為 1.3%,報 77.25 美元/桶。

現貨黃金日內漲 0.66%,再度站上 2500 美元以上。

【以下內容為 16:10 更新】

美股三大指數期貨上漲,納斯達克指數期貨漲 0.6%。

半導體股多數上漲,英偉達漲逾 1%,台積電漲 1.5%。

中概股普漲,嗶哩嗶哩漲近 6%,阿里巴巴漲逾 2%,京東漲近 2%。網易盤前波動不大,隔夜二季報公佈後美股收跌 11%。

歐洲主要股指小幅高開,歐洲斯托克 50 指數開盤上漲 0.14%,德國 DAX 指數漲 0.24%,英國富時 100 指數漲 0.27%,法國 CAC 40 指數漲 0.13%。目前歐股維持開盤漲勢。

亞太股指多數收漲,日經 225 指數收盤上漲 0.4%,報 38364.27 點。越南 VN 指數收盤漲 0.2%,報 1285.32 點。韓國首爾綜指收盤下跌 0.2%。

主要大宗商品上漲,現貨黃金維持在 2500 美元附近。瑞銀預計,隨着美聯儲開始降息,黃金的持有成本下降,黃金 ETF 的資金流入將會進一步增加。

見聞日曆顯示,北京時間,今日 22:00,美聯儲主席鮑威爾在傑克遜霍爾年會上就經濟前景講話,美國 7 月新屋銷售數據將發佈;23:00 時,英國央行行長貝利在傑克遜霍爾年會講話,美國費城聯儲主席哈克(Patrick Harker)接受彭博採訪;次日 00:30,美國芝加哥聯儲主席 Goolsbee 在 CNBC 講話。