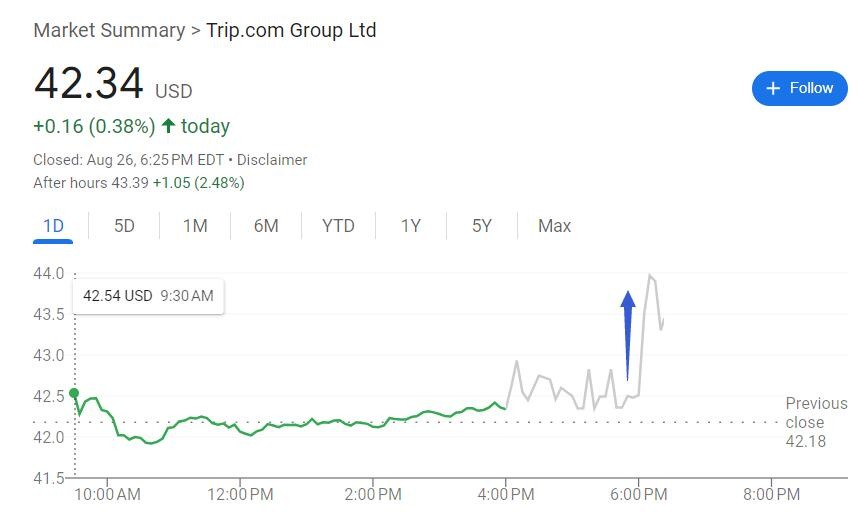

Trip.com's second-quarter profit exceeded expectations, surging by over 40%. Strong travel demand led to a nearly 4% increase in after-hours trading | Financial Report Insights

二季度攜程盈利和收入均保持兩位數增長,營收超預期增長 14%,EPS 增長近 42%;國內網站住宿預訂增長 20%,出境酒店和機票預訂全面恢復至 2019 年疫情前水平,國際平台總收入增 70%。

二季度攜程繼續得到強勁的旅遊需求支持,保持兩位數收入增長,國際業務繼續增長強勁,體現旅遊消費的韌性。

美東時間 8 月 26 日週一美股盤後,攜程公佈今年第二季度和上半年的未經審計的財務數據。

1)主要財務數據:

營業收入:上半年攜程總營業收入 247.09 億元人民幣,同比增長 20.7%,其中二季度總營收 127.9 億元人民幣(約 17.6 億美元),同比增長 14%,分析師預期 127.5 億元。

EPS:上半年調整後每份 ADS 收益(EPS)為 13.24 元,同比增長 61.5%,其中二季度為 7.25 元,同比增長約 41.8%,分析師預期 5.22 元。

毛利:上半年毛利潤為 207.21 億元,同比增長 19.8%,其中二季度毛利潤為 104.6 億元,同比增長 13%,符合分析師預期。

2)細分數據

酒店預訂:二季度酒店預訂業務營收 51.4 億元人民幣(約 7.07 億美元),同比增長 20%,分析師預期 49.5 億元。

交通票務:二季度交通票務營收 48.71 億元,同比增長 1.2%,分析師預期 49.7 億元。

旅遊度假:二季度旅遊度假營收 10.25 億元,同比增長 42%,分析師預期 10.2 億元。

商旅:二季度商旅業務營收 6.33 億元,同比增長 8.4%,分析師預期 6.345 億元。

財報公佈後,週一收漲近 0.4% 的在美上市中概股攜程盤後加速上漲,盤後漲幅一度接近 4%,後漲幅收窄到 3% 以內。

國內網站住宿預訂增長 20% 國際平台總收入增 70%

財報數據顯示,今年前兩個季度,攜程每季的總收入均兩位數超預期增長,二季度在歷史高基數基礎上同比增速較一季度有所放緩,仍實現穩健增長。

主要業務中,住宿預訂一季度和二季度的營收每季至少增長逾 20%。旅遊度假二季度的同比增速較一季度的 129% 明顯放緩。攜程稱,住宿預訂和旅遊度假業務均主要受到旅遊需求、尤其是假日期間的需求更強勁驅動。

交通票務二季度的增速不但較一季度的 20% 放緩,而且放緩程度超出分析師預期。攜程稱,二季度該業務主要受到機票價格波動影響。

攜程稱,二季度國內和國際業務均保持增長。其中,攜程國內網站的住宿預訂同比增長約 20%,受益於國內遊和出境遊均強勁增長。跨境遊帶動攜程出境、入境及海外平台業務高速增長。

二季度,攜程出境酒店和機票預訂量已全面恢復至 2019 年同期疫情前水平,國際航班運力恢復率超過全行業的 70% 以上水平。

國際業務保持顯著增長,攜程國際 OTA 平台 Trip.com 總收入同比增長約 70%,一季度增長約 80%。

攜程的聯合創始人、董事局主席梁建章表示:“在旅遊需求,尤其是跨境旅遊需求的強勁增長下,2024 年第二季度,我們實現了持續增長。這一強勁的表現彰顯了我們在動態市場中的適應能力。展望未來,我們將全力以赴,運用人工智能(AI)進行旅遊業的創新,為客户創造卓越的價值體驗。”

財報會議中,攜程在行業首次應用 AI Agent,展現公司對於創新,以及採用新技術推動旅遊業變革的堅定承諾,並介紹 AI 落地的具體成果——兩款內容產品。

攜程 CEO 孫潔表示:“我們很高興看到中國旅遊消費的強勁增長和韌性。這種樂觀的前景激發了我們對創新和新舉措的熱情。通過與合作伙伴的合作,我們有能力取得更大的成功。”