US stocks quickly recover from August volatility, economists warn: Investors may not be so lucky next time

国际清算银行 (BIS) 的经济学家分析了 8 月 5 日全球金融市场崩溃的原因,尽管市场迅速恢复,但风险仍高。报告指出,推动市场波动的因素并没有显著变化,而交易者因低波动性而加大杠杆,这再次引发市场的脆弱性。虽然日元套利和其他投资策略导致了初步抛售,但其影响在于整体杠杆使用,清算机构要求更高资本以覆盖风险,引发追加保证金通知。

国际清算银行 (BIS) 的经济学家决定深入探讨 8 月 5 日全球金融市场崩溃的原因。尽管市场动荡不安,他们发现市场表现得相当稳健。然而,投资者下一次可能就没那么幸运了,而几乎可以肯定的是,下一次动荡迟早会到来。随着波动性的减弱,交易者们又不失时机地匆忙投入到一些导致最初大跌的杠杆赌注中。BIS 团队表示,最终,市场的根本因素并没有真正改变。

智通财经 APP 获悉,该团队在周二发布的 BIS 公报中指出:“推动波动性飙升和市场大幅波动的因素并没有显著变化。金融市场的风险承担依然处于较高水平。”

BIS 团队还表示,基于低波动性和廉价日元融资的一些交易仅部分平仓。涉及更不流动资产的更广泛的日元融资交易可能会更加缓慢地平仓。

但这些经济学家并没有过多停留在未来的风险上。相反,他们集中精力分析了 8 月 5 日事件的具体演变过程。结果是,这份报告成为了关于当天全球市场状况的最全面的记述之一。

虽然日元套利交易的解除最初被认为是抛售的主要原因 (并且确实如此),它并不是唯一一个在市场去杠杆化浪潮中受到影响的热门策略。对股票和期权的过度押注也受到了影响。

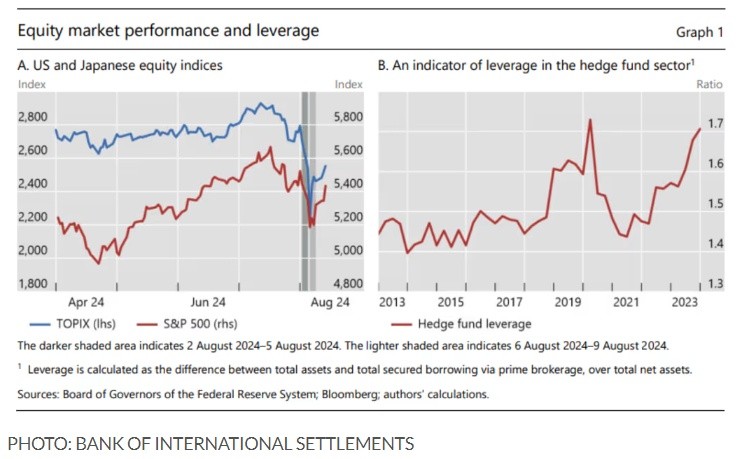

这些策略有一个共同点:交易者为了追逐市场动能,越来越多地使用杠杆,而这一切都被一段时间的低波动性所推动。随着 7 月下旬和 8 月初波动性攀升,市场的 “堡垒” 开始崩塌。

来自银行主经纪业务的数据显示,杠杆在此次抛售中发挥了重要作用。数据显示,对冲基金在事件发生前加大了借款的使用。随着 8 月 5 日波动性飙升,清算所要求交易者提供更多资本以覆盖风险,这引发了一系列追加保证金通知的恶性循环。

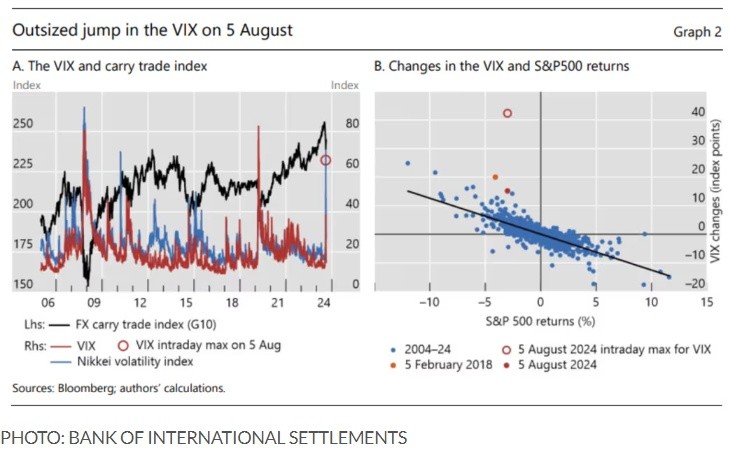

BIS 团队指出,货币市场的套利交易受到了特别严重的打击。但层层叠叠的追加保证金通知也推动了股市隐含波动率的前所未有的日内飙升,芝加哥期权交易所波动率指数 (VIX) 一度飙升至 65 以上。根据道琼斯市场数据,VIX 在美国市场的盘前交易中短暂地飙升至 65 以上。

在仔细分析了所有可用数据后,BIS 团队未能确定抛售前日元套利交易的确切规模。然而,他们得出了一个粗略的估计:总体来看,超过 1 万亿美元可能已用于抛售前的日元套利交易。

这一数据基于日本银行与外国借款人之间的贷款流量,以及 BIS 对对冲基金使用货币远期的估计。这一数字还包括日元货币期货的空头头寸,尽管这仅占整体数字的一小部分,它并未完全涵盖复杂交易者可能用于押注日元的衍生品的全部范围。

BIS 团队指出,除了专业领域,日本的散户货币交易者大军,也就是被称为 “渡边太太” 的群体,同样在大量做空日元。

当天比特币价格的下跌表明,散户交易者同样受到了追加保证金通知的影响,可能被迫平仓其他头寸以弥补损失。BIS 团队表示,回过头来看,引发抛售的导火索似乎相当温和,进一步凸显了杠杆作用在夸大崩溃中所起的作用。

事实上,这次危机是由两件事引发的:7 月 31 日,日本央行发出了比预期更为鹰派的加息信号。几天后,美国劳工部公布的数据显示,失业率上升,新增就业岗位数量放缓。

根据道琼斯的数据,8 月 5 日标普 500 指数最终下跌 3%,创下自 2022 年 9 月以来的最大单日跌幅。日本日经 225 指数下跌超过 12%,创下自 1987 年 10 月 20 日 “黑色星期一” 以来的最大单日跌幅。

美元兑日元汇率下跌 2.8%,至 142.54 日元。自那以后,股市已经恢复了大部分损失,截至周三,标普 500 指数距离 7 月中旬创下的历史最高收盘价仅差一个百分点。