After a night of shock, the market regains faith in AI. Expectations of interest rate cuts are expected to continue to drive the rise of US stocks

週四市場情緒回暖,因投資者相信人工智能革命仍在持續,並預計美聯儲將降息 100 個基點。雖然英偉達本季度指引不如預期,股價盤後一度大跌超 8%,但整體市場對其前景仍持樂觀態度,標普 500 指數期貨上漲 0.2%。此外,歐洲股市表現強勁,德國 DAX 再創歷史新高。投資者對英偉達的 AI 引擎需求充滿信心,認為技術領域的投資仍然合理。

智通財經 APP 注意到,儘管英偉達公司 (NVDA.US) 公佈的第二財季銷售收入繼續翻倍超預期增長,但本季度的指引未能達到華爾街最樂觀的預期,並有消息稱其大肆宣傳的 Blackwell 芯片的生產出現了問題。這足以讓市場在一夜之間陷入混亂,隨後,該公司股價盤後一度大跌超 8%。但週四早盤市場表現較為冷靜,因為投資者猜測人工智能革命仍未消退,貨幣市場押注美聯儲今年的降息幅度可能達到 100 個基點,這讓他們感到安慰。

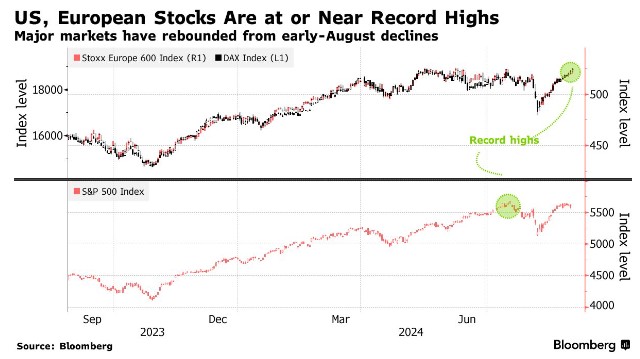

儘管英偉達股價在盤前跌幅降至 3%,但標普 500 指數 (比其歷史最高點低約 1.3%) 有望上漲,期貨上漲 0.2%。在歐洲,斯托克 600 指數徘徊在歷史高點附近,而德國 DAX 指數則升至歷史新高。

英偉達營收超過 300 億美元,利潤率超過 50%,並承諾未來幾個季度利潤率將進一步提高。投資者希望這家公司能有更多表現,因為該公司的業績已連續六個季度超出分析師預期。

不過,這些數字足以讓投資者推測,各行各業對英偉達人工智能引擎的需求仍然強勁,足以證明在技術領域進行更多押注是合理的。

Kairos Partners 投資組合經理 Alberto Tocchio 表示:“如果有人擔心人工智能需求可能令人失望,那麼現在這種擔憂已經消失。當然,我們談論的是一隻漲幅很大的股票,但我們可以肯定的是,該行業仍然有需求。”

近幾周,通脹降温、經濟相對穩健以及美聯儲降息的樂觀情緒提振了市場人氣。週五,市場將迎來下一個指標個人消費支出指數,這也是美聯儲最青睞的通脹指標。

技術因素也對股市產生了更廣泛的幫助。高盛集團全球市場董事總經理兼戰術專家 Scott Rubner 週一預測,標普 500 指數本週將創下歷史新高,理由是系統性資金和企業回購的大量流入。

事實上,股票期權交易顯示,在 8 月初因擔心美國經濟衰退而引發的拋售之後,投資者一直在為獲利做準備。

野村跨資產策略師 Charlie McElligott 表示,標準普爾 500 指數的看漲偏度 (衡量交易員願意為看漲敞口支付多少錢的指標) 正在快速上升,這表明在美聯儲主席鮑威爾在傑克遜霍爾發表鴿派講話後,抓住看漲期權具有一定的緊迫性。

與此同時,波動率交易員正在向期權交易商提供超額承銷、包銷和直接波動率賣出。這意味着交易商持有多頭伽馬頭寸,這起到了市場穩定器的作用,因為他們需要在股市下跌時買入期貨。

週四納斯達克 100 期貨的反彈延續了本週的走勢,即該合約在正常交易時段下跌,然後在隔夜反彈。然而,這是一個看跌信號,市場的整體走勢仍處於下行趨勢。納斯達克 100 指數比 7 月份創下的歷史高點低 6% 以上。

就對英偉達的反應而言,盛寶英國高級銷售交易員 William Marsters 表示,週三股價下跌可能是 “反應過度”。

“投資者已經對出色的業績習以為常,”Marsters 表示,“真正的考驗將是今天的正常交易時段,這將更清楚地反映出客户的反應。”

美聯儲降息押注也有助於減少市場對大型科技股表現的依賴。例如,小型股和無盈利科技股已經出現資金流入,因為較低的借貸成本將提高它們的盈利。標準普爾 500 指數的擴大在去除市值偏見的版本中顯而易見。上週,等權重指數創下了歷史新高。

Piper Sandler & Co. 首席市場技術員 Craig Johnson 表示:“隨着市場不斷擴大,期貨價格也不斷走高。現在不再只是七巨頭股票的問題,而且英偉達沒有錯過嚴重推遲的 Blackwell 發佈,這讓人鬆了一口氣。”