The Fed's "favorite" inflation indicator is coming tonight, will it "add fuel" to the rate cut expectations?

美國即將公佈美聯儲青睞的核心 PCE 物價指數,預計將影響 9 月份降息的決策。經濟學家預測核心 PCE 物價指數將環比上升 0.2%,年化率降至 2.1%。此外,美國 7 月個人支出預計增加 0.5%,反映經濟韌性。市場普遍認為數據基本符合預期,將不妨礙美聯儲在下次會議上實施降息。分析師指出,近期通脹數據持續增長,但不會影響美聯儲的整體觀點。

智通財經獲悉,美聯儲青睞的通脹指標將於週五晚些時候公佈,這一數據可能會影響 9 月份的降息決定,儘管目前通脹報告的影響已經不及就業報告來得重要。

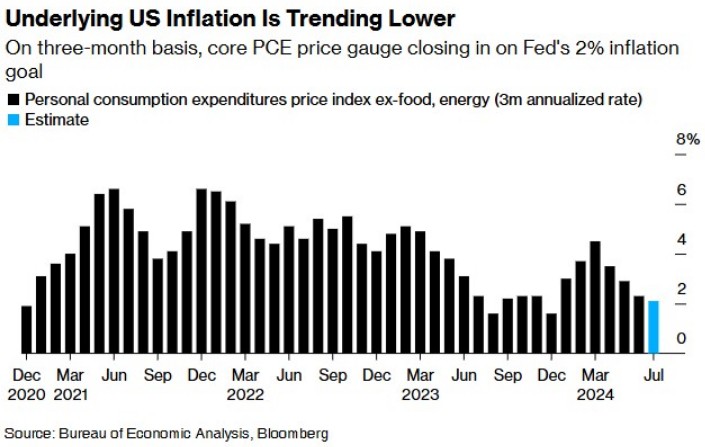

美國商務部將於北京時間 20:30 公佈美國 7 月 PCE 物價指數,這是一個衡量消費者為各種商品和服務以及他們的支出偏好的龐大指標。經濟學家預計,美聯儲青睞的衡量潛在通脹的指標——核心 PCE 物價指數——將在 7 月連續第二個月環比上升 0.2%,這將使所謂的三個月核心通脹年化率降至 2.1%,略高於美聯儲 2% 的目標;還預計整體 PCE 物價指數將環比上升 0.2%,同比上升 2.6%。

雖然美聯儲使用一整套指標來衡量通脹,但 PCE 物價指數是其首選數據點,也是成員們發佈季度預測時唯一的預測工具。決策者在做出利率決定時尤其關注核心 PCE 物價指數指標,該指標不包括食品和能源。美聯儲更青睞個人消費支出,而不是美國勞工部公佈的 CPI 指數,因為前者考慮了消費者行為的變化,比如替代購買,而且範圍更廣。

經濟學家還預計,美國 7 月個人支出將環比上升 0.5%,這將是四個月以來的最大漲幅,7 月份個人收入將增長 0.2%。由於消費者支出是美國經濟增長的關鍵驅動力,因此這份數據預計將顯示美國經濟增長的韌性。

對於 7 月份的數據,道瓊斯普遍認為近期趨勢不會有什麼變化,如果這些數據與預期大致相符,應該不會阻止美聯儲官員在 9 月 17 日至 18 日的政策會議上實施備受期待的降息。

U.S. Bank 首席分析師 Beth Ann Bovino 表示:"在我看來,這只是又一個證據,證明美聯儲看到通脹數據正以可持續的速度增長。任何輕微的上升實際上都只是基數效應,不會改變美聯儲的觀點。”

週四公佈的數據也顯示,美國通脹穩步降温。美國商務部發布的修正數據顯示,美國二季度整體 PCE 物價指數年化季環比修正值為 2.5%,較前值 2.6% 下調 0.1 個百分點;剔除食品和能源價格後,二季度核心 PCE 物價指數年化季環比修正值為 2.8%,較初值 2.9% 小幅下修,低於預期的 2.9%。

美聯儲官員尚未宣佈戰勝通脹,不過最近的聲明顯示前景更為樂觀。儘管自 2022 年 2 月以來,PCE 數據從未低於美聯儲目標水平,但美聯儲主席鮑威爾上週表示,“我的信心已經增強”,通脹正在回到目標水平。但鮑威爾也表達了對勞動力市場放緩的一些保留意見,美聯儲現在似乎正在從對抗通脹的角色轉向更多地關注支持就業形勢。鮑威爾稱:“通脹的上行風險已經減弱。就業的下行風險已經增加。”

這一觀點被視為政策制定者將更加關注防止就業市場逆轉和整體經濟放緩的跡象。這可能意味着市場不再那麼關注週五的 PCE 物價指數等通脹數據,而是更多地關注將於 9 月 6 日公佈的 8 月非農就業報告。

Bovino 表示:"美聯儲的焦點將集中在就業方面。他們似乎更關心的是就業方面是否會變得更弱。我認為這是他們貨幣政策的重點。”

在上週的傑克遜霍爾央行年會上,美聯儲主席鮑威爾承認了近期在通脹方面取得的進展。鮑威爾表示,“政策調整的時候到了”,且美聯儲 “不尋求也不歡迎勞動力市場進一步降温”。

鮑威爾的言論標誌着美聯儲對抗通脹的兩年鬥爭的一個關鍵轉折點,並突顯出其關注重點已轉向勞動力市場風險——這是美聯儲雙重使命的另一部分,就業增長有助於保持消費者支出,這是確保經濟擴張的關鍵。

經濟學家 Anna Wong 等人表示:“鮑威爾在傑克遜霍爾年會上的鴿派演講對市場參與者來説是悦耳的。他承諾,美聯儲將盡其所能支持強勁的勞動力市場,以為經濟提供支撐。我們認為,有必要進行一些現實檢查。”

在週四公佈優於預期的 GDP 與申請失業金人數之後,掉期交易員略微下調了對美聯儲寬鬆政策的押注。目前,CME“美聯儲觀察工具” 顯示交易員們普遍押注 9 月美聯儲將降息 25 個基點 (概率為 67%),但仍預計 2024 年將降息約 100 個基點。