最有观点券商半年报现身,“新锐” 国联证券 “激扬文字”

资产管理及投资业务是相对的增长亮点。

8 月 30 日,国联证券披露 2024 年半年度报告。

作为业内 “新锐”,国联证券一直以近年少见的魄力在革新和推进业务。本次半年报中,它也有许多不同于同行的新颖表达。

国联证券在 “管理层讨论和分析” 提及,进入 2024 年,国内外宏观经济环境复杂,全球各国经济增长动能转换。美国经济动能从 2023 年的强劲增长中逐步衰减,欧洲经济由衰退边缘边际回暖,全球通胀形势继续保持分化状态。

国联证券还提及:从证券行业竞争格局看,近年来,头部证券公司净利润增速明显优于行业平均,头部券商整体净利润波动性更小,更具备穿越周期的盈利能力。

2024 年 4 月中国证监会提出适度拓宽优质机构资本空间,支持头部机构通过并购重组、组织创新等方式做优做强,新一轮证券行业自上而下的供给侧改革已经开启,行业格局将加速演变。

与此同时,在行业发展方面,中国证监会提出,要引导中小机构结合股东特点、区域优势、人才储备等资源禀赋和专业能力做精做细,实现特色化、差异化发展,为区域性券商发展壮大指明了方向。

国联证券还在半年报提及,该公司有 “独特的区位优势”、“A+H 股两地上市提高公司市场竞争力和抗风险能力”、“行业经验丰富的管理团队”、以及 “稳健、高效的经营管理和审慎的风险管控” 等优势。

半年报还显示,报告期内,国联证券营业收入 10.86 亿元,同比下降 39.91%;归属于股东的净利润 0.88 亿元,同比下降 85.39%。

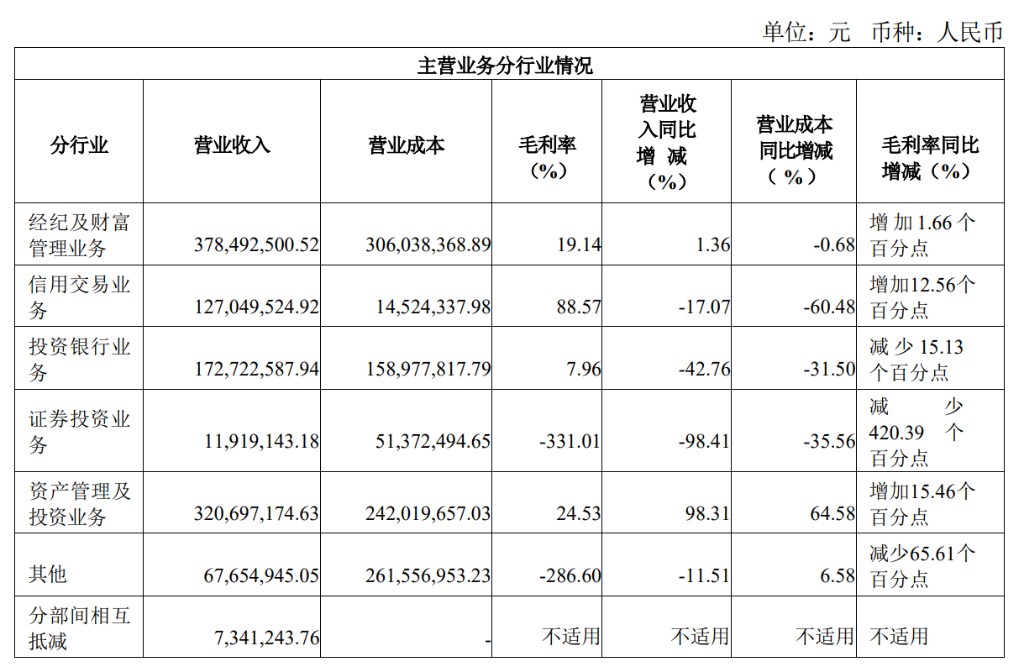

此外,经纪及财富管理业务实现收入 3.78 亿元,同比增长 1.36%;投资银行业务实现收入 1.73 亿元,同比下降 42.76%;信用交易业务实现收入 1.27 亿元,同比下降 17.07%;证券投资业务实现收入 0.12 亿元,同比下降 98.41%。

占主营业务收入比重最大(近 35%)的经纪及财富管理业务,能够小幅增长,也相当不易。其中,资产管理及投资业务是相对的增长亮点,期间,资产管理及投资业务实现收入 3.21 亿元,同比增长 98.31%。

另外,报告期内国联新增客户数 11.94 万户,累计总客户数 185.58 万户,同比增长 10.06%。

截至报告期末,基金投顾总签约客户数 31.94 万户,同比增长 13.35%,授权账户资产规模 69.58 亿元,同比基本持平,累计上线合作渠道 30 家。

金融产品销售方面,公司通过加大产品保有量考核,引导产品销售理念向配置型销售转变。报告期内,公司金融产品销售规模(除现金管理产品 “现金添利” 外)96.47 亿元,同比减少 14.24%,期末金融产品保有量 193.70 亿元,同比基本持平。

公告显示,国联证券 2024 年半年度未拟定利润分配或公积金转增股本预案。