Yen arbitrage reverses the volatile market, experts predict that rate hikes will intensify volatility and favor Japanese bonds

日本央行的貨幣緊縮政策對全球資本流動產生深遠影響。隨着 7 月份加息引發日元套利交易逆轉,阿里夫·侯賽因警告投資者市場波動尚未結束。他指出外資回流可能加劇市場動盪,並提醒投資者關注更大趨勢。美聯儲降息的可能性及日本央行進一步加息的暗示,使得外匯策略師重新評估日元走勢,預計年底日元兑美元價格將下調至 138-135。

智通財經 APP 獲悉,普信固定收益主管阿里夫·侯賽因曾對去年日本利率上升提出預警,將其比作 “金融界的聖安德烈亞斯斷層”。如今,他的市場動盪風險預測得到了驗證。在日本 7 月份加息引發日元套利交易劇烈逆轉後,侯賽因警告投資者,他們 “剛剛目睹了這一斷層的首次變動,未來還會有更多”。

侯賽因指出,儘管日本央行的堅定立場和對美國經濟放緩的憂慮在 8 月 5 日激發了對日元的強烈需求,但投資者可能忽略了全球股市、貨幣和債券市場低迷的深層原因。這包括大量海外投資的日本資金,隨着日本這個世界第四大經濟體的利率上升,這些資金可能會回流國內。

侯賽因強調,將日元套利交易視為替罪羊忽視了一個更大趨勢的開始。他寫道,日本央行的貨幣緊縮政策及其對全球資本流動的影響將在未來幾年產生深遠影響。他的公司管理着約 1.57 萬億美元的資產。

圖 1

日元套利交易的突然停止導致日經 225 指數創下自 1987 年以來的最大跌幅,並推動股市波動率指數 VIX 飆升。經濟學家曾預測美聯儲可能需要降息半個百分點或在會議期間採取行動,這通常是危機時期的應對措施。

值得一提的是,美聯儲主席鮑威爾上個月在傑克遜霍爾表示,降息的 “時機已經到來”,而日本央行也在兩份研究報告中暗示可能進一步加息,行長植田和男在國會的評論中也表達了這一觀點。這些消息促使外匯策略師重新評估日元的走勢。

華僑銀行外匯策略師 Christopher Wong 表示,這些事件增強了他們下調美元兑日元預期的信心,將年底目標價從 141 調整至 138。他解釋稱,美聯儲的降息週期意味着與日本央行的政策利率差異將縮小。

麥格理集團有限公司,作為看好日元的機構之一,將其美元兑日元年底目標價從 142 下調至 135,這是自 2023 年 5 月以來的最低水平。

渣打銀行預計美元兑日元今年年底將達到 140,2025 年第一季度將降至 136。

儘管日元兑美元匯率在 140 左右波動,但市場波動性依然很高。美聯儲預期的降息和日本央行可能的進一步緊縮政策可能很快再次引發市場震動。

擁有近三十年投資經驗的侯賽因,傾向於增持日本政府債券,因為他認為隨着收益率上升,資本可能會回流日本。他還建議減持美國國債,理由是隨着日本機構資金回流,美國國債可能面臨壓力。

侯賽因認為,日本債券收益率上升可能會吸引國內龐大的壽險和養老基金投資者從其他優質政府債券轉向日本國債,這將重新調整全球市場的需求。

太平洋投資管理公司日本分公司 (Pimco Japan Ltd.) 也準備積極投資日本超長期政府債券,這些債券的價值已經得到修正。該公司的日本債券投資組合經理 Tadashi Kakuchi 表示,儘管 8 月份金融市場動盪,但日本央行貨幣政策正常化的方針未變,預計 “下次加息最早在明年 1 月”。

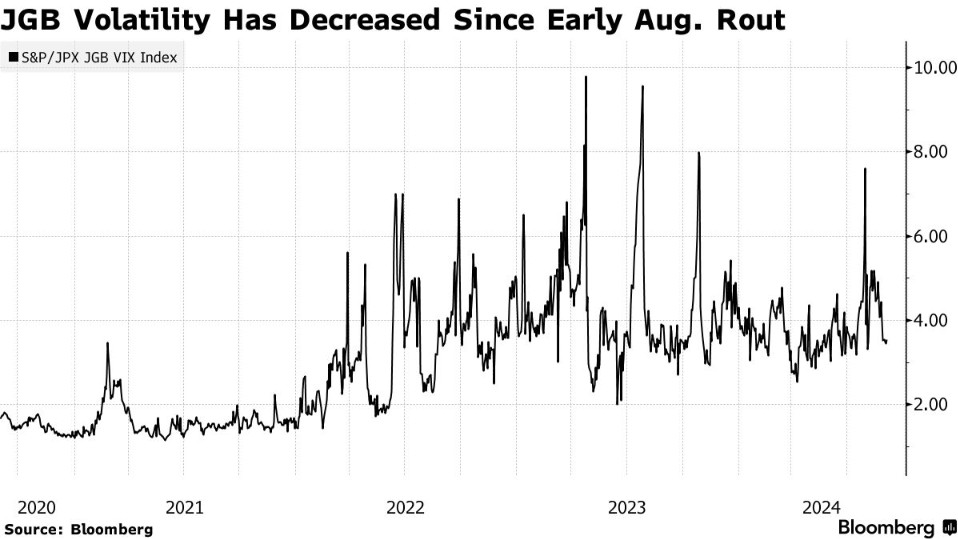

自 2013 年日本央行實施量化寬鬆政策以來,超長期債券的遠期利率首次超過 3%。Kakuchi 指出,收益率曲線依然陡峭,購買較長期政府債券的時機已成熟。他提到,儘管波動性最近有所緩和,但 “仍將高於日本央行開始政策正常化之前”,對於積極管理者而言,波動性的存在是有益的。

圖 2

由於投資需求減弱和日本央行減少購買國債,超長期債券的供需平衡正在惡化。財務省也在考慮縮短國債發行期限,預計六個月後需求增加將帶來市場的穩定。

圖 3