North American traders return from holiday to continue betting on the US dollar. The US dollar index has risen for five consecutive days

北美交易員假期歸來後,美元指數已連續五日上漲,主要因預期經濟數據將支撐美元反彈。週一因美國勞動節市場休市,週二美元兑十國集團貨幣普遍上漲。市場對即將公佈的製造業、非農就業和失業率數據充滿關注,並預計美聯儲將於本月降息 25 個基點的概率超過 60%。投資者對美元持樂觀態度,若製造業數據向好,可能進一步推高美元匯率。

智通財經 APP 獲悉,衡量美元兑一籃子主權貨幣的強弱指標——美元指數連續五個交易日反彈,北美金融市場的交易員們從 “美國勞動節” 假期迴歸,迎接新一週的經濟數據,並且押注美元在這些經濟數據推動下有望延續近日的反彈之勢。在週一,美國和加拿大股票市場因美國勞動節而處於休市狀態,北美金融市場的交易員們週一也休假一日。

最新交易數據顯示,週二,美元兑大多數十國集團貨幣上漲,彭博美元現貨指數上漲 0.2%,ICE 美元指數上漲 0.1%。在主要主權貨幣中,澳元匯率表現不佳,主要因鐵礦石期貨價格下跌,以及該國國內生產總值的關鍵投入項目低於經濟學家普遍預期。

投資者與專業交易員們正在焦急等待美國經濟數據,其中包括週二將公佈的製造業數據、週四服務業數據和週五至關重要的非農就業數據以及失業率數據,以判斷金融市場對美聯儲政策寬鬆的降息定價幅度是否合理,而這種定價幅度的變動將影響包括美元、黃金以及股債等大類金融資產的整體趨勢。

掉期市場交易員們普遍押注美聯儲將於本月將基準利率下調 25 個基點,押注數據顯示這一降息幅度的概率超過 60%,但是交易員們仍然押注年前美聯儲有望降息 100 個基點,意味着 9-12 月的三次會議上有一次將降息 50 個基點。

以 Saktiandi Supaat 為首的 Malayan Banking Bhd 市場策略師們在一份報告中寫道,“如果美國製造業數據意外上行,並且刺激美聯儲降息押注進行更實質性的重新定價,交易員們對於美元匯率仍有可能進一步看漲。”“週五發佈的 8 月非農就業報告仍然是房間裏的大象。”

華僑銀行駐新加坡外匯和利率策略主管 Frances Cheung 表示:“我們預計美國國債收益率將出現一定程度的中期反彈,因此美元也將反彈。”“因為投資者正在等待勞動力市場數據,就業以及失業率數據符合預期可能足以讓市場短期內降低美聯儲年內降息的預期。”

據瞭解,華爾街外匯交易員與經濟學家們普遍押注,本週晚些時候將公佈的美國 8 月非農就業數據有望較 7 月明顯改善,這可能會加大歐元、澳元以及日元等主權貨幣的下行壓力,因為有所改善的就業數據將緩和人們對美聯儲在未來幾個月大幅降息的預期,進而可能刺激 2024 年前降息押注從 100 個基點明顯縮減至 75 個基點附近,這將有助於近日持續反彈的美元繼續上漲之勢,並打壓全球第二大儲備貨幣歐元的漲勢。

經濟學家們普遍預計,8 月美國非農新增就業人數有望回升至 16.3 萬人,失業率有可能從 4.3% 降至 4.2%,為 3 月以來首次下降。也有分析認為,如果美國勞動力市場相較於經濟學家預期意外加劇惡化,可能最終促使美聯儲在 9 月降息 50 個基點。

摩根士丹利分析師 Sam Coffin 近日在一份給客户的報告中指出,7 月失業率達到 4.3% 的一個重要原因是臨時性質的裁員異常增加。隨着得克薩斯州逐漸擺脱颶風貝里爾帶來的裁員衝擊,勞動力市場預計不會上演類似 7 月的 “慘案”。Coffin 帶領的摩根士丹利分析團隊預測,8 月失業率將降至 4.2%,新增非農就業人數預計升至 18.5 萬人。

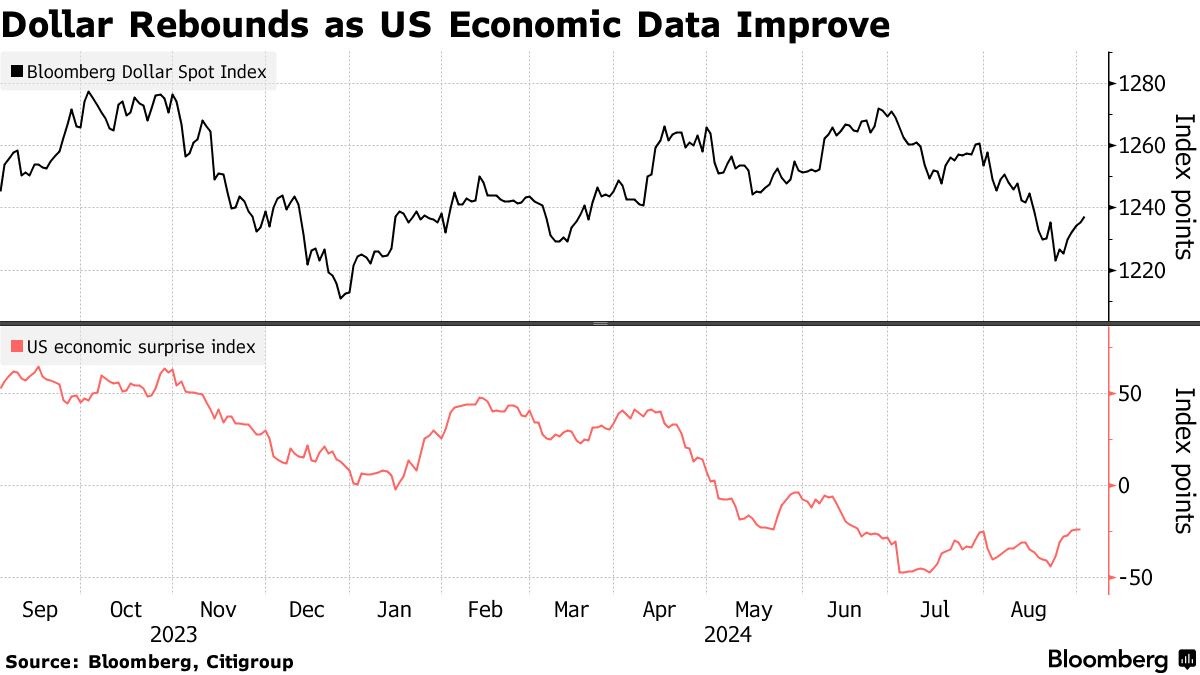

一些外匯交易員仍在質疑美國經濟增長和通脹數據是否已放緩到足以促使美聯儲在當地時間 9 月 17 日至 18 日的會議上宣佈降息 50 個基點的程度。近日公佈的一系列包括 GDP 數據上修在內的暗示美國經濟 “軟着陸” 越來越有可能實現的經濟數據,並且市場降息預期從 7 月非農數據公佈後的 125 個基點降低至 100 個基點附近,乃帶動美元大幅反彈的兩大核心驅動力,推動美元指數連續 5 日上揚。

關於美元后市走勢能否延續近日的強勁反彈態勢,在近日公佈的一份研報中,Daragh Maher 等滙豐分析師們指出,當前的匯率相對於美國利率市場的情況被低估了,預示着美元可能迎來大反彈。“除非經濟實際上出現災難性的惡化,否則美聯儲的實際政策操作可能不會像市場當前預期這樣寬鬆或者更寬鬆。” 滙豐分析師們寫道。

Brown Brothers Harriman 資深市場策略師 Elias Haddad 表示,8 月就業數據偏向穩健可能降低美聯儲在年底前降息 100 個基點的可能性。Haddad 表示:“如果本週的美國就業數據表明軟着陸前景更加樂觀,這將有利於美元走勢,並將導致歐元的淨多頭投機頭寸減少。”