Wall Street strategist faces short squeeze: annual forecast turns around, US stock performance exceeds expectations

华尔街策略师在年初的年度预测中低估了美国股市表现,导致年底接近时疯狂提升目标预测。经济专家 Jonathan Levin 指出,自 2020 年以来,主要科技股解释了标普 500 指数一半的表现,而策略师与经济学家普遍错误判断了美国经济的实际增长。尽管许多预测依赖旧的经验法则,但最终结果显示美国经济将持续强劲增长。

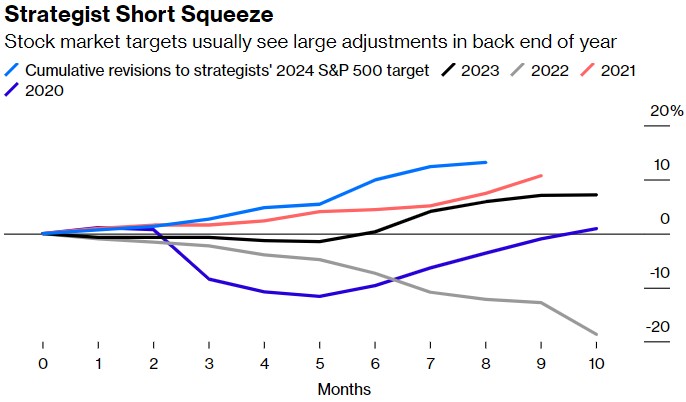

智通财经获悉,美国市场与经济专栏作者 Jonathan Levin 表示,自疫情以来,华尔街策略师在年初时的年度预测中一再低估了美国股市的表现,进而促使他们在下半年接近年底的时候疯狂调高对美股的年度目标预测。一连串的向上修正可能看起来有点像 “轧空”,这是一种交易员被迫快速连续回补看跌押注的情况,通常会加强证券的上行势头。从这个意义上说,策略师们今年已经经历了 10 年来最大规模的轧空,而季节性趋势表明,未来几个月这种情况可能将持续下去。

策略师对标普 500 指数目标价通常在年底大幅调整

Levin 指出,总体而言,市场分析师的预测表现参差不齐,但事实证明,目前的美股市场对策略师来说尤其难以把握。

首先,大型成长股公司的优异表现推翻了解释宏观经济状况和利率与标普 500 指数公允价值之间关系的传统模型。自 2020 年初以来,英伟达 (NVDA.US)、苹果公司 (AAPL.US)、微软公司 (MSFT.US)、Alphabet(GOOGL.US) 和亚马逊公司 (AMZN.US) 这五家公司几乎解释了基准指数一半的表现,这意味着,如果宏观模型不能解释这些公司的特殊情况,包括人工智能主题,那就不够用了。尽管一些股票受益于不断上涨的市盈率,但推动它们走高的主要还是收入和利润的大幅增长。

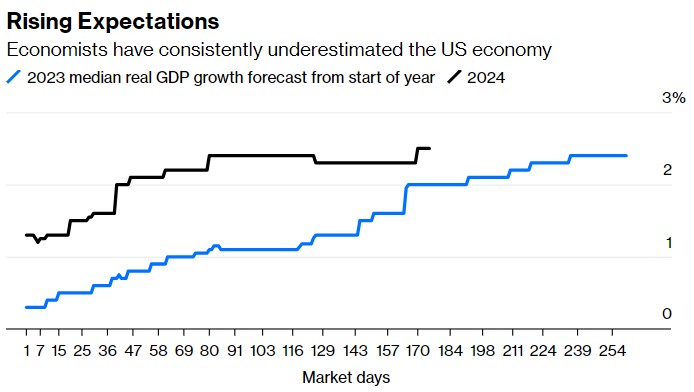

其次,经济学家和策略师们一直错误地判断了美国经济的实力。在 2023 年初,经济学家的预测中值显示,他们认为美国经济勉强能撑过 2023 年。但事实情况与此相反,美国经济增长了 2.5%,而且看起来今年有望再次达到这一水平。大部分预测错误可能是过度依赖旧的经验法则,包括美联储加息通常会导致经济衰退的观点。在 “正常” 的经济周期中,这可能是正确的,但在疫情之后,美国经济的现实情况是雇主囤积劳动力,消费者不顾一切地回到餐馆和音乐会,而且房屋净值很高。经济学家可能还低估了人工智能军备竞赛带来的资本支出以及拜登总统的产业政策对宏观经济的影响。

经济学家近来低估的美国经济的韧性

然而,策略师的平均预测值显示,标普 500 指数今年将下跌约 3%,收于 5469 点 (中值为 5600 点,预测范围为 4200 至 6000 点)——Levin 认为这种预测令人费解,因为 2023-2024 年经济叙事的许多部分基本完好无损,并得到了实时数据的支持。亚特兰大联储的 GDPNow 模型显示,美国经济目前的年化增长率为 2.5%。标普 500 指数成份股公司中,约 81% 的公司在当前财报季的业绩超出了华尔街的预期,其中包括消费行业的领头羊塔吉特公司 (TGT.US) 和沃尔玛公司 (WMT.US)。在美联储可能于 9 月开始降息之前,长期借贷成本已经开始大幅下降。初请失业金人数显示,裁员并没有失控,人工智能芯片制造商英伟达最近的暴跌更多地是由于公司特定的生产障碍,而不是人工智能的长期前景。

与此同时,除了科技巨头们的其他股票似乎正在迎头赶上。剔除前五大成份股,预计到 2025 年,标普 500 指数成份股公司的盈利增长将加速。

美股盈利增长正蔓延到科技巨头之外

Levin 写道,当然,标普 500 指数目前的混合远期收益市盈率为 21.3 倍,处于历史高位;然而,在基本面和精彩故事的支撑下,高估值可以在很长一段时间内保持在高位;鉴于今年秋冬似乎还会出现另一轮策略师轧空,很难想象清算即将到来。