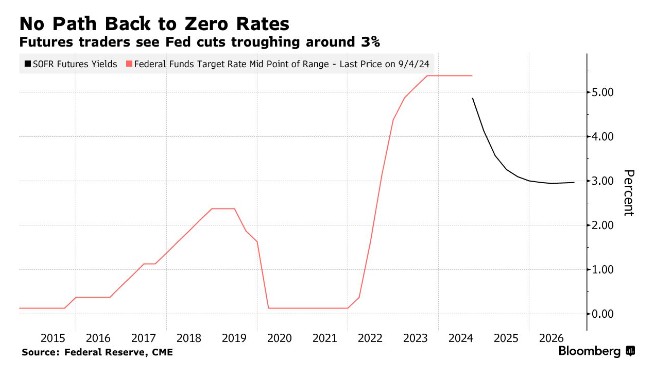

Oaktree Capital's Max: The Federal Reserve is expected to cut interest rates, but rates are not expected to fall below 3%

I'm PortAI, I can summarize articles.

橡樹資本霍華德•馬克斯預計美聯儲將降息至 3% 至 4% 之間。馬克斯在墨爾本的一次會議上表示,儘管降息的速度上存在分歧,但利率不會回到 0% 或 1%。他認為,經濟正在恢復正常,雖然這與過去 40 年的情況不同。橡樹資本管理着 1930 億美元資金。

智通財經 APP 獲悉,橡樹資本 (Oaktree Capital Management, LP) 的霍華德•馬克斯 (Howard Marks) 預計,美聯儲降息後,美國利率將穩定在 3% 至 4% 之間。

這位橡樹資本聯席創始人兼聯席董事長週四在墨爾本舉行的一次會議上表示:“美聯儲將把利率從緊急時的 5.25%、5.5% 下調至 3% 以上。但我的觀點是,我相信利率會停留在 3%,不會回到零、0.5% 或 1%。”

目前,市場普遍預計美聯儲將於本月啓動寬鬆週期。儘管如此,人們對降息的速度仍存在較大分歧。一些利率交易員預計,政策制定者將採取更激進的行動,降息 50 個基點,而另一些人預計,美聯儲官員將在 9 月 17 日至 18 日開會時降息 25 個基點。

馬克斯的觀點與市場對降息幅度的預期基本一致。期貨交易員預計將在 3% 左右停止降息。

馬克斯表示,由於近年來通脹的 “緊急情況”,美聯儲被要求加息。他表示:“我認為,緊急情況已經結束了。”

他補充道:“經濟增長可能會放緩,利潤率可能會被侵蝕。換句話説,我認為我們正在恢復正常,但這種正常與過去 40 年的情況不同。這就是結果。經濟和投資領域的正常情況是由好時光和壞時光交織而成的。”

根據橡樹資本的網站顯示,截至 6 月 30 日,該資產管理公司在信貸、私募股權、房地產和上市股票策略方面管理着 1930 億美元資金。