Non-farm payrolls affecting the cryptocurrency circle! If employment rebounds, will it drive Bitcoin up?

加密貨幣和股票指數之間的相關性越來越高。當今晚市場對 8 月非農就業數據做出反應時,加密貨幣的價格或將隨之波動。市場普遍認為,即將公佈的就業數據會顯示出積極的信號,美國經濟正趨於穩定。

加密貨幣和股票市場之間的關係正在變得越來越緊密,尤其是受到近期經濟數據的影響下。

彭博社彙編的數據顯示,加密貨幣和 MSCI 世界股票指數之間的相關係數接近 0.6,為過去兩年來的最高水平之一。該讀數為 1 表示資產同步移動,而負 1 表示反向變動。這意味着這兩個市場之間的走勢正越來越相近。

也就是説,當今晚市場對 8 月非農就業數據做出反應時,加密貨幣的價格也會隨之波動。市場普遍認為,即將公佈的就業數據會顯示出積極的信號,美國經濟正趨於穩定。

今晚的非農數據將是決定比特幣價格的關鍵

投資者對即將公佈的美國 8 月非農就業數據非常關注。如果就業數據表現不佳,則意味着美國經濟陷入衰退,美聯儲可能會採取更加激進的降息措施來刺激經濟。上個月出人意料的疲軟就業報告引發了全球市場波動,加密貨幣也隨之暴跌。

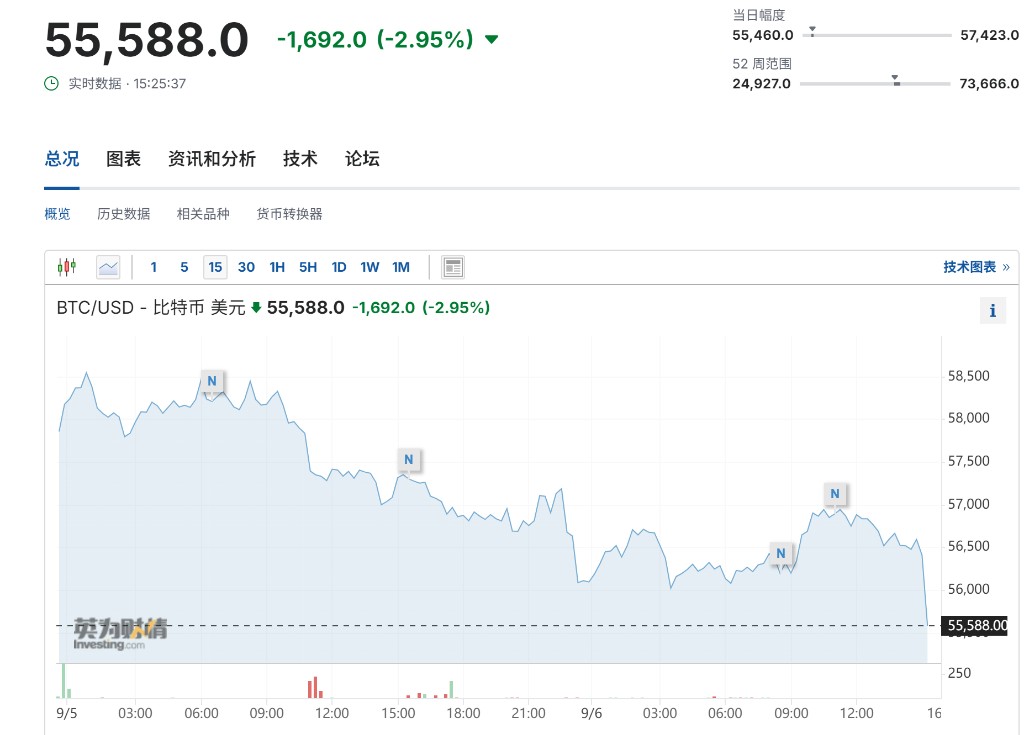

Magnet Capital 聯合首席投資官 Benjamin Celermajer 表示:“在面對宏觀經濟事件時,比特幣一直以與股票高度相關。過去兩週市場情緒 ‘相當糟糕’,55000 美元是值得關注的關鍵比特幣支撐位。”

截止發稿,比特幣價格小幅下跌至 55588 美元,交易價格比 3 月份創下的歷史高點低約 17000 美元。以太幣和 Solana 等較小的代幣小幅走低。美國股票期貨震盪,表明市場在 8 月就業數據之前持謹慎態度。

分析指出,美國現貨比特幣交易所交易基金的流入刺激了今年早些時候比特幣價格的上漲,形成了一波牛市,但這種上漲趨勢並沒有持續下去。最近,投資者開始從比特幣 ETF 中撤出資金,導致比特幣價格下跌。

“今晚就業報告的細節將是一個關鍵所在。” 區塊鏈諮詢公司 Venn Link Partners 的創始人 Cici Lu McCalman 説,“該數據足以削弱對美聯儲降息的押注。”

當前美聯儲寬鬆的貨幣政策通常被認為有利於加密貨幣等投機性資產。市場分析師普遍認為,即將公佈的就業數據會顯示出積極的信號,比如招聘人數增加或失業率下降。這標誌着在 7 月數據引發增長恐慌後,經濟正趨於穩定。