U.S. August non-farm payroll growth falls short of expectations, market increases bets on the Fed cutting interest rates by 50 basis points in September

美國 8 月非農就業數據未達預期,新增就業 14.2 萬人,市場對此加大押注,認為美聯儲在 9 月將降息 50 個基點的概率接近 50%。儘管失業率降至 4.2%,但由於高借貸成本及不確定性,企業擴張計劃推遲。醫療和建築業招聘帶動就業增長,參與率維持在 62.7%。該數據標誌着美國經濟就業增長放緩,為美聯儲降息創造條件。

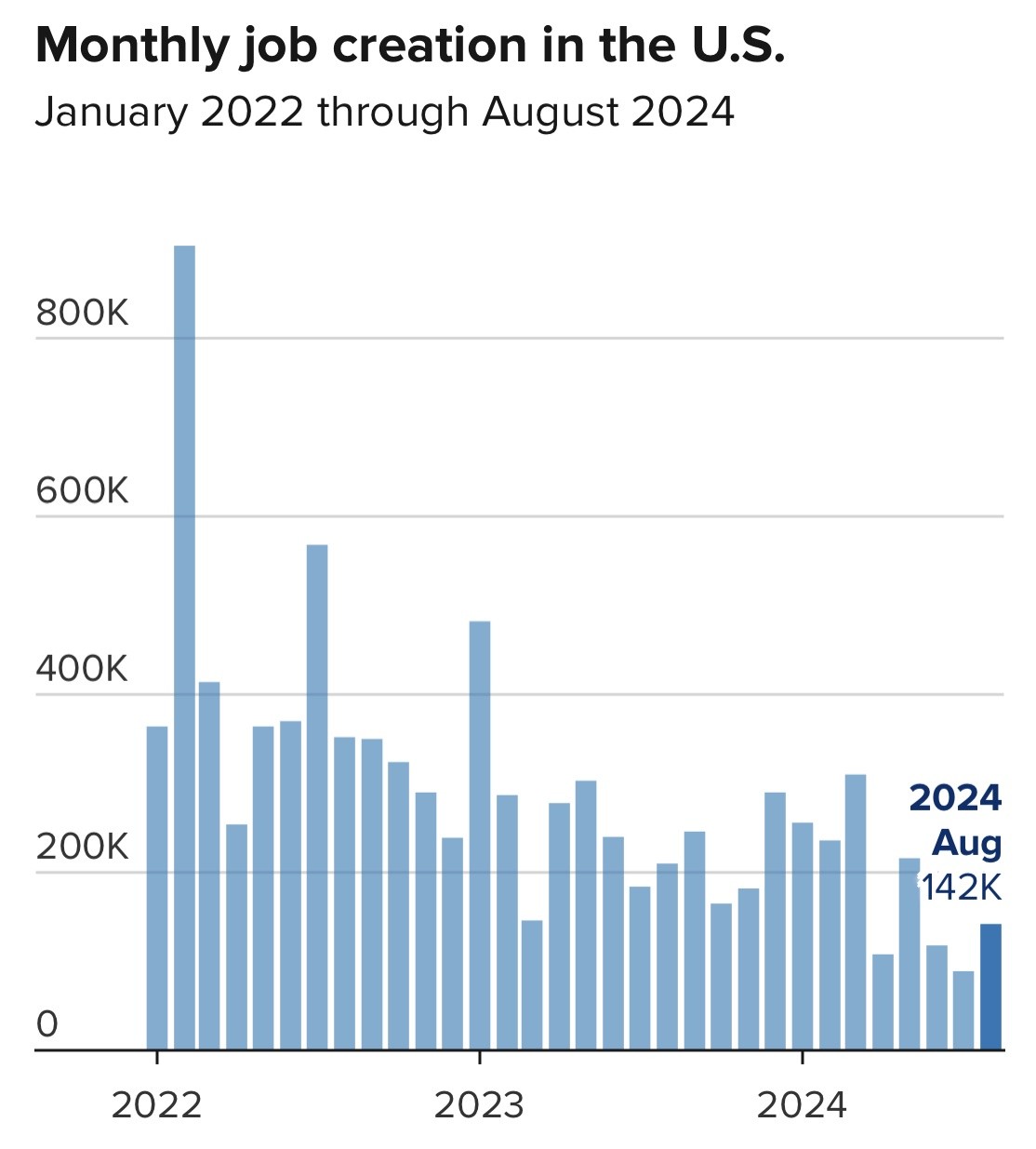

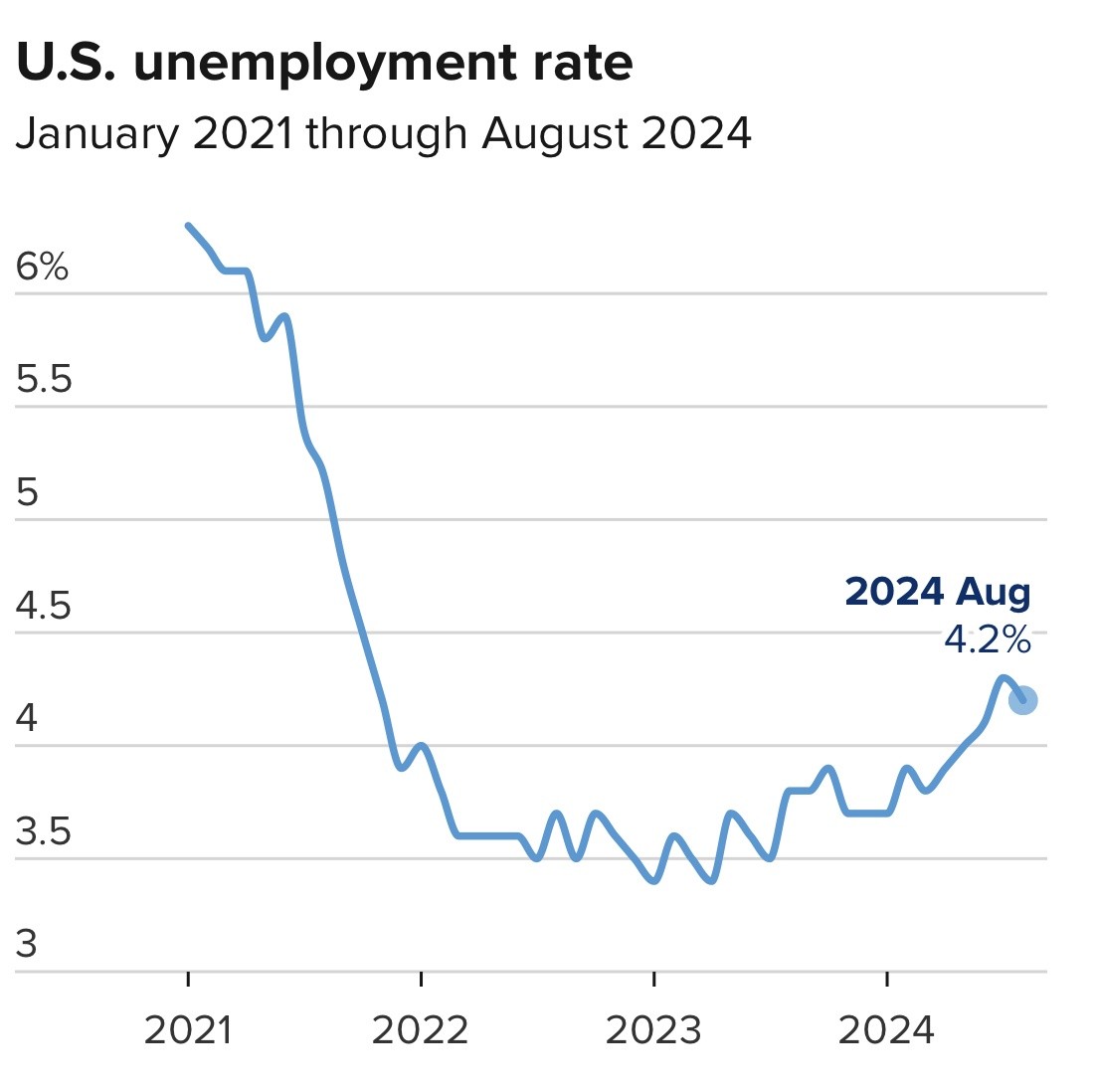

智通財經獲悉,美國 8 月非農新增就業不及預期,市場加大對 9 月降息 50 個基點押注。美國 8 月季調後非農就業人口 14.2 萬人,預期 16 萬人。與此同時,前值由 11.4 萬人修正為 8.9 萬人,6 月份非農新增就業人數從 17.9 萬人修正至 11.8 萬人;修正後,6 月和 7 月新增就業人數合計較修正前低 8.6 萬人。美國 8 月失業率錄得 4.2%,符合市場預期,創今年 6 月來新低,為連續四個月上升以來首次下降。

雖然裁員在很大程度上仍然受到抑制,但由於借貸成本高企和 11 月總統大選前的不確定性,許多公司正在推遲擴張計劃。醫療保健和社會援助部門的招聘帶動了就業人數的增長。建築業和政府部門的招聘人數也有所增加。衡量就業增長廣度的擴散指數有所上升。8 月份的參與率保持不變,為 62.7%。25-54 歲年齡段工人的參與率自 3 月份以來首次走低。

美國經濟在 8 月份創造了略少於預期的就業崗位,這反映了勞動力市場正在放緩,同時也為美聯儲在本月晚些時候下調利率鋪平了道路。數據公佈後,交易員們加大了對美聯儲 9 月將實施 50 個基點降息的押注,概率升至近 50%。美國 10 年期國債收益率降至 3.657%,為 2023 年 6 月以來最低水平;美國 2 年期國債收益率下跌 11 個基點,降至 3.63%。

該報告出爐之際,市場對美聯儲的下一步行動感到不安。自 2023 年 7 月以來,美聯儲在實施了一系列大幅加息以降低通脹後,一直維持利率不變。在數據公佈之前,市場一直認為美聯儲將在 9 月 17 日至 18 日的會議上可能開始降息,唯一的問題是降息規模。

Principal Asset Management 首席全球策略師 Seema Shah 表示:“對美聯儲來説,這一決定歸根結底是決定哪一種風險更大:如果降息 50 個基點,將重新引發通脹壓力;如果只降息 25 個基點,將威脅到經濟衰退。總的來説,在通脹壓力減弱的情況下,美聯儲沒有理由不謹慎行事,提前降息。” 除了非農,本週公佈的其他經濟數據也顯示,經濟持續增長,但勞動力市場放緩。就業數據處理公司 ADP 週四報告稱,8 月份私營企業僅增加了 9.9 萬個就業崗位,而職業介紹公司挑戰者報告稱,8 月份裁員大幅增加,招聘速度達到至少自 2005 年以來的最低。

大多數美聯儲官員都表示,他們也預計利率會下降。美聯儲主席鮑威爾在傑克遜霍爾會議上發表的關鍵年度演講中宣稱,調整政策的 “時機已經到來”,但他沒有具體説明這意味着什麼。

道明證券指出在美聯儲明確表態前,市場將繼續為降息幅度掙扎。道明證券美國利率策略主管 Gennadiy Goldberg 表示,9 月降息 25 個基點還是 50 個基點?市場真的在為這個問題而苦苦掙扎。8 月非農報告處於可以用作降息 25 或 50 個基點理由的中間。如果你認為美聯儲扮演了更激進的角色,8 月非農新增就業人數可以用作降息 50 個基點的理由。如果你認為美聯儲希望更有分寸一點,那用作降息 25 個基點的理由更合理。因此,在美聯儲以某種方式表示對 25 或 50 個基點的支持之前,市場將真正保持平衡。我們確實看到,勞動力市場不僅真正開始平衡,而且確實開始大幅降温,這可能會讓美聯儲相當緊張。