Goldman Sachs found that the monthly traffic of ChatGPT has plummeted sharply, what does this mean?

这并不代表行业增长不会强劲,下一波受益者可能来自,基于 AI 基础模型创建的新产品和服务。高盛报告称,科技行业基本面强劲,但集中度风险很高,建议寻求多元化投资,不错过其他行业由 AI 技术驱动的增长机会。

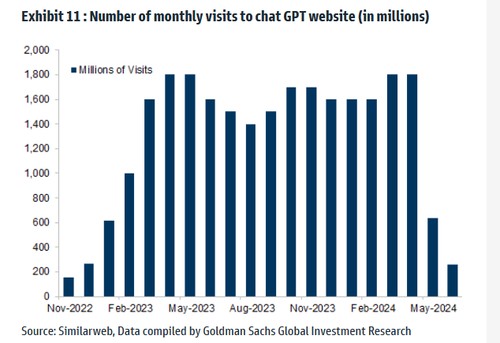

OpenAI 掀起的 ChatGPT 狂热持续一年多之后似乎正在迅速 “退烧”,网站月度流量数据似乎反映了这点。

在本周四发布的报告重,高盛全球投资研究驻欧洲的宏观研究主管兼首席全球股票策略师 Peter Oppenheimer 援引分析机构 Similarweb 的最新数据显示,ChatGPT 网站的月度访问总量从春季到仲夏急剧下降。报告写道:

“就月度用户而言,对 ChatGPT 最初的 ‘兴奋’ 正在消退。当然,这并不意味着相关行业的增长率不会强劲,但它确实表明,下一波受益者可能来自,可以基于这些基础模型创建的新产品和服务。”

每月访问量暴跌并不意味着 OpenAI 的终结。客户可能对 GPT-4 感到厌倦,或者转向由科技巨头提供支持的其他大语言模型(LLM),例如马斯克旗下 xAI 的 Grok。一些用户很可能发现,没有必要将 AI 聊天机器人融入他们的日常生活。

新近消息显示,随着 OpenAI 的 LLM 更先进,ChatGPT 将得到改进,OpenAI 将推出新的高端聊天机器人,向白领收取远高于 GPT-4 每月 20 美元的费用。

Oppenheimer 上述报告发布的同一天,也是在本周四,科技媒体 The Information 报道,OpenAI 的高管讨论了新的定价模式,即将推出的高端 LLM 每月收费高达 2000 美元,例如以推理为重点、名为 “草莓”(Strawberry)的新 LLM,以及名为 Orion 的新主打 LLM。

报道援引了解 OpenAI 提议订阅价格人士的消息称,OpenAI 可能很快向部分用户收取使用高端 LLM 每月 2000 美元的费用,目前还没有最终确定价格,暗示这让人 “强烈怀疑最终价会不会这么高。”

虽然最终收费可能达不到 2000 美元,但 The Information 指出:

“这是一个值得注意的细节,因为它表明,就算主要来自每月 20 美元订阅价格的 ChatGPT 付费版本最近有望创造 20 亿美元的年收入,可能它的增长速度也不足以负担运营该服务的巨额成本。这些成本包括每月数亿人使用免费套餐的费用。”

ChatGPT 狂热消退意味着什么?本周五的华尔街见闻文章提到,在最近 Oppenheimer 参与执笔的报告指出,科技行业基本面强劲,但集中度风险很高,建议寻求多元化投资,这不仅能够降低集中风险,还能使投资者在享受科技行业增长的同时,不错过其他行业由 AI 技术驱动的增长机会。

报告数据显示,虽然头部科技公司的估值不及其他泡沫时期的头部公司,它们的市场份额却是几十年以来最高的,占到标普总市值的 27%,体现了前所未有的高集中度。

报告整理了 1980 年以来,在 1-10 年内买入并持有前十大股票所能获得的平均总回报,发现虽然占主导地位的公司的绝对回报仍然不错,但这些强劲的回报会随着时间的推移而逐渐消失,而且它们往往仍然是稳健的 “复合型公司”。更重要的是,如果投资者买入并持有优势公司,而其他增长较快的公司出现并跑赢大盘,则优势公司的回报通常会转为负值。

综合以上因素,高盛认为:

- 占主导地位的公司不太可能成为未来十年增长最快的公司。

- 目前标普指数中的股票特定风险非常高,通过多元化可以增加回报。