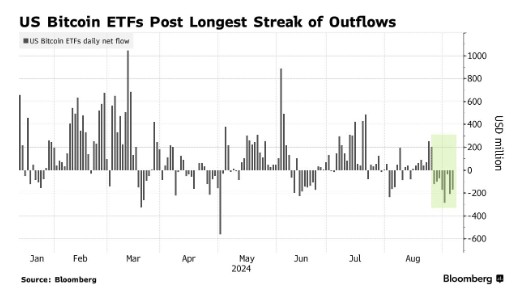

8 日合计撤出 12 亿美元!美股比特币 ETF 创最长净流出记录

美國比特幣 ETF 自年初上市以來出現了最長的每日淨流出,總金額近 12 億美元,反映投資者正從高風險資產中撤出。統計顯示,八個交易日中,股市和大宗商品因經濟增長憂慮而動盪。比特幣 9 月表現不佳,跌幅約 7%,但近日小幅上漲至約 54800 美元。分析師指出,市場反彈部分是由於知名人士的空頭平倉,以及支持加密貨幣的候選人在民意調查中的改善所致。

智通財經 APP 獲悉,美國比特幣 ETF 出現了自今年年初上市以來持續時間最長的每日淨流出,這是在全球市場面臨挑戰之際,投資者普遍從高風險資產撤出的一部分。

機構彙編的統計數據顯示,在截至 9 月 6 日的八個交易日裏,投資者從 12 只美股 ETF 中總共撤出了近 12 億美元。此次下跌正值股市和大宗商品市場因對經濟增長的擔憂而經歷動盪時期。

美國喜憂參半的就業數據等因素都對交易員造成了影響。這種不確定性正在衝擊加密貨幣市場,由於兩者之間的短期相關性日益增強,加密貨幣市場的波動與股市走勢的聯繫變得更加緊密。

比特幣在 9 月表現不佳,跌幅約 7%。但這一最大的數字資產在上週末小幅上漲,截至發稿,該代幣週一上漲約 1%,至 54800 美元左右。

對沖需求增加

流動性提供商 Arbelos Markets 的交易主管 Sean McNulty 表示:“市場小幅反彈似乎部分是受一些知名影響力人士空頭平倉的推動。” 他列舉了 BitMEX 交易平台聯合創始人 Arthur Hayes 最近在社交媒體上發佈的一篇帖子作為例子。

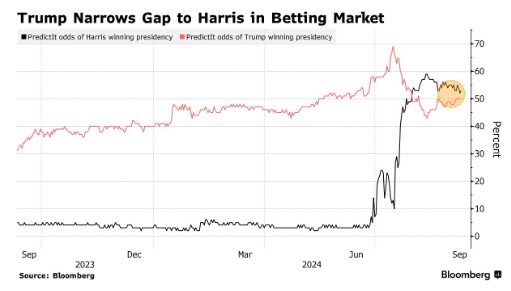

McNulty 表示,支持加密貨幣的美國總統選舉共和黨候選人特朗普在民意調查和預測市場上的表現有所改善,也可能發揮了一定作用。他報告稱,對期權對沖的需求增加,以防週二特朗普和民主黨候選人副總統哈里斯之間的辯論引發波動。哈里斯尚未詳細説明她對加密貨幣的立場。

據瞭解,直接投資於原始加密貨幣的美國比特幣 ETF 於今年 1 月大張旗鼓地推出。出乎意料的強勁資金需求推動該代幣在 3 月創下 73798 美元的歷史新高。資金流入隨後放緩,比特幣今年迄今的漲幅已降至 30% 左右。

數字資產衍生品交易流動性提供商 Orbit Markets 的聯合創始人 Caroline Mauron 表示,在美國週三公佈消費者價格數據之前,比特幣的交易價格可能會在最近的 53000 至 57000 美元之間徘徊。通脹數據可能會影響對美聯儲貨幣寬鬆步伐的預期。