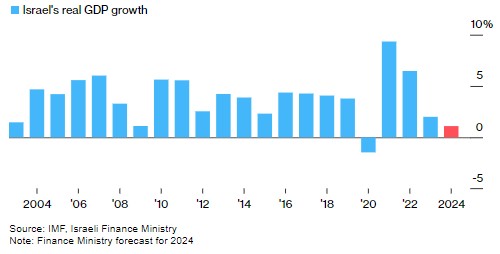

The Gaza conflict severely hit the Israeli economy, with GDP growth expected to plummet to 1.1%

以色列財政部大幅下調了今年 GDP 增速預期至 1.1%,反映出加沙戰爭對經濟的重大影響。2025 年經濟增長預測也下調至 4.4%。該國信用評級遭遇歷史性下調,債券收益率上升,投資者情緒緊張。預計戰爭相關開支可能達 660 億美元,佔 GDP 的 12% 以上。惠譽將以色列債務評級降至 A,預測財政赤字將達到 GDP 的 7.8%。雖然經濟放緩,央行可能維持 4.5% 的基準利率不變。

智通財經 APP 獲悉,以色列財政部近期大幅下調了該國今年的經濟增長預期,這一調整反映了近一年來加沙戰爭對以色列經濟造成的顯著壓力。根據最新數據,預計以色列國內生產總值 (GDP) 的增長率將僅為 1.1%,遠低於先前預測的 1.9%。對於 2025 年的經濟增長預測也從 4.6% 降至 4.4%。

這一新的預測是基於第二季度經濟增長數據 “弱於預期” 的情況,意味着以色列今年的經濟增長可能創下自 2009 年金融危機以來的最低水平,不包括 2020 年新冠疫情的影響。

同時,以色列的信用評級歷史上首次遭遇下調,儘管它仍然維持着 A 級投資級評級。此外,該國政府的本幣債券收益率相對於美國國債也出現了顯著上升,這反映了投資者的緊張情緒。

以色列官員估計,到明年年底,戰爭相關的開支可能達到 660 億美元,佔 GDP 的 12% 以上。國際評級機構惠譽 (Fitch Ratings) 上個月將以色列的債務評級從 A+ 下調至 A,指出加沙衝突可能會持續到 2025 年,並有可能擴散到其他戰線。惠譽還預測,以色列今年的財政赤字可能達到 GDP 的 7.8%,高於 2023 年的 4.1%。

值得一提的是,儘管經濟增長放緩,但以色列央行可能不會在明年之前降低其 4.5% 的基準利率。近幾個月,以色列的通貨膨脹率有所上升,最新數據顯示年通脹率為 3.2%,超出了 1%-3% 的目標區間。

以色列央行副行長安德魯·阿比爾 (Andrew Abir) 上個月表示,他懷疑是否會在今年年底前具備貨幣寬鬆的條件。他指出:“令人驚訝的是,戰爭已經持續了這麼長時間。”