First increase in three weeks! The number of initial jobless claims in the United States last week slightly exceeded expectations, rising to 230,000

I'm PortAI, I can summarize articles.

美國上週初請失業金人數三週來首次上升,達到 23 萬人,略超經濟學家預期的 22.6 萬人。續請失業金人數也上升至 185 萬。儘管數據上升,但初請失業金人數仍保持在較低水平。美聯儲官員表示,勞動力市場的惡化將影響降息決策。市場預計美聯儲將在下週會議上小幅降息 25 個基點。

智通財經 APP 獲悉,美國上週初請失業金人數三週來首次上升,這與新增就業人數的逐漸放緩相符。

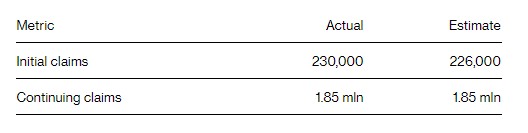

根據美國勞工部週四公佈的數據,截至 9 月 7 日當週,初請失業金人數增加了 2000 人,達到 23 萬人,經濟學家的預期中值為 22.6 萬人。

截至 8 月 31 日當週,續請失業金人數也上升至 185 萬。有助於消除數據波動性的初請失業金人數四周均值上升至 230750,這是五週來的首次上升。

儘管最新數據有所上升,但幾周來初請失業金人數一直保持在較低水平。經濟學家一直在尋找勞動力市場的任何低迷跡象,但到目前為止,在每週的初請失業金人數中還沒有出現這種跡象。

美聯儲官員已經明確表示,就業市場的進一步惡化將是他們考慮降息時的一個主要擔憂。

由於勞動力需求放緩,且 8 月衡量潛在通脹的一項關鍵指標意外上升,市場普遍預計美聯儲將在下週的會議上開啓寬鬆週期,小幅降息 25 個基點。

經季節性影響調整前的初請失業金人數下降了 12968 人,至 177663 人。紐約州的降幅最大,其次是俄亥俄州和佐治亞州。

週四發佈的另一份報告顯示,由於服務業成本反彈,美國 8 月份生產者價格漲幅略高於預期。