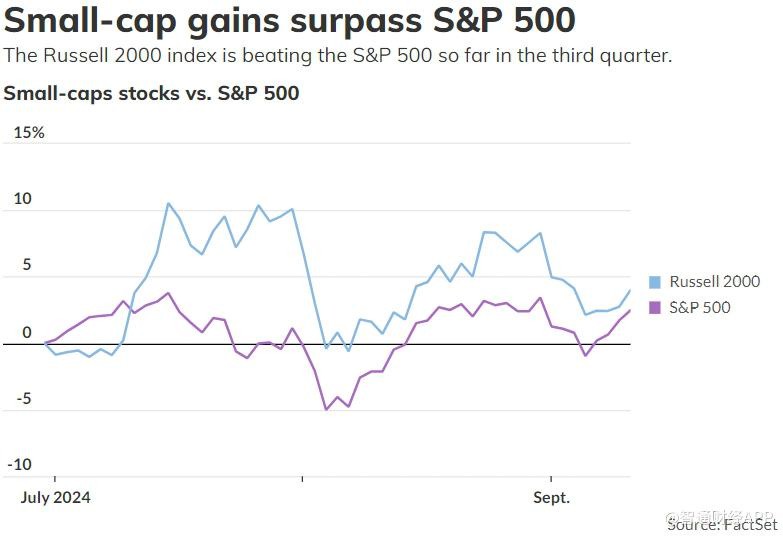

Small-cap stocks are on the rise! The Russell 2000 Index rose 4% in Q3, outperforming the S&P 500 Index

美国小盘股在第三季度表现优于标普 500 指数,罗素 2000 指数上涨 4%。尽管 9 月份遭受冲击,嘉信理财的首席投资策略师 Liz Ann Sonders 指出,美联储的宽松政策提振了小盘股。她表示小盘股在降息周期中表现良好,但目前并未处于经济衰退。投资者预计美联储将下调基准利率,市场对降息幅度的预期有所调整。

智通财经 APP 获悉,即使在 9 月份遭受的冲击比大盘股更严重,美国小盘股在第三季度的表现仍优于标普 500 指数。

嘉信理财 (SCHW.US) 的首席投资策略师 Liz Ann Sonders 在周四的电话采访中表示:“总体而言,美联储在 8 月底的杰克逊霍尔经济研讨会上明确表示将采取更宽松的政策,这让小盘股得到了提振。” 她解释称:“小盘股通常在降息周期中表现良好,尤其是在美联储为了应对衰退而降息时,投资者希望为经济复苏做好准备。”

但 Sonders 也指出:“我们目前并未处于经济衰退之中。” 尽管经济放缓,她补充道:“经济表现还是不错的。”

根据 FactSet 的数据,美国小盘股的标尺——罗素 2000 指数本季度上涨了 4%,尽管本月截至周四已下跌了 4%。相比之下,标普 500 指数在第三季度仅上涨了 2.5%,但今年以来标普 500 指数仍大幅跑赢小盘股。

投资者预计,美联储将在周三的政策会议后宣布开始下调其自 2023 年 7 月以来保持在高位的基准利率。美联储此前曾加息以应对美国通胀飙升,通胀在 2022 年达到峰值后,已显著回落至接近 2% 的目标。

根据 CME FedWatch 工具的数据,截至周四,联邦基金期货市场的交易员预计美联储有 69% 的概率将在此次会议上将政策利率下调 25 个基点,至 5% 至 5.25% 的目标区间。

对于希望美联储进行更大幅度降息的投资者,Sonders 提醒道:“要小心你所期望的。” 她解释说,较大幅度的降息通常发生在经济衰退或金融危机期间。

最近小盘股的反弹在一定程度上 “停滞”,因为交易员将对降息幅度的预期从 50 个基点调整回 25 个基点。Sonders 表示,这 “可能会触发小盘股的获利了结,因为总体来看,小盘股受益于降息的幅度通常大于大公司。”

不过,Sonders 也提醒道,小盘股市场非常庞大,且并非 “同质化”。在罗素 2000 指数内部,股票表现存在极大的差异,通常低质量股票和高质量股票的表现不尽相同。

Sonders 指出,“经济正在放缓,并未进入加速阶段。” 因此,如果投资者希望在小盘股中寻找机会,应当 “关注高质量公司。”

标普小盘 600 指数通常包含比罗素 2000 指数更高质量的股票,因为它采用了 “盈利过滤器”,Sonders 表示,投资者在筛选投资机会时,可以将其作为基准。

周四,小盘股的表现超过了标普 500 指数。罗素 2000 指数上涨了 1.2%,标普小盘 600 指数同样上涨了 1.2%,两者均跑赢了标普 500 指数 0.7% 的涨幅。

周四美国股市普遍上涨,蓝筹股指标道琼斯工业平均指数上涨近 0.6%,而以科技股为主的纳斯达克综合指数上涨 1%。截至 2024 年,标普 500 指数已累计上涨 17.3%,远超罗素 2000 指数年初至今略超 5% 的涨幅,尽管 9 月份表现不佳。根据 FactSet 的数据,标普 500 指数本月截至周四下跌了 0.9%,而罗素 2000 指数 9 月份下跌了 4%。