BlackRock: Profit growth exceeds expectations, will the US stock market continue to rise?

貝萊德表示,在市場波動加劇的背景下,美國企業盈利仍具韌性,二季度標普 500 指數成分公司整體盈利增長 13%,超出預期。貝萊德看好持續盈利增長和自由現金流的優質公司,尤其是與人工智能相關的行業。儘管科技公司領先,但其他公司盈利增長差距縮小,預示美股漲勢有望擴大。貝萊德微調對日本股票的觀點,保持超配,但對短期美債持低配觀點。

智通財經 APP 獲悉,貝萊德發文稱,美股波動加劇是由多重因素導致的:部分經濟數據走弱導致市場對美國經濟衰退的憂慮重燃、美國大選前的緊張情緒、以及投資者為新股發行騰出資金而獲利賣出。然而,美國企業盈利仍具韌性,所有行業二季度盈利均超預期,帶動利潤率整體迎來改善。相關數據顯示,二季度標普 500 指數成分公司整體盈利增長 13%,超過普遍預期的 10%。

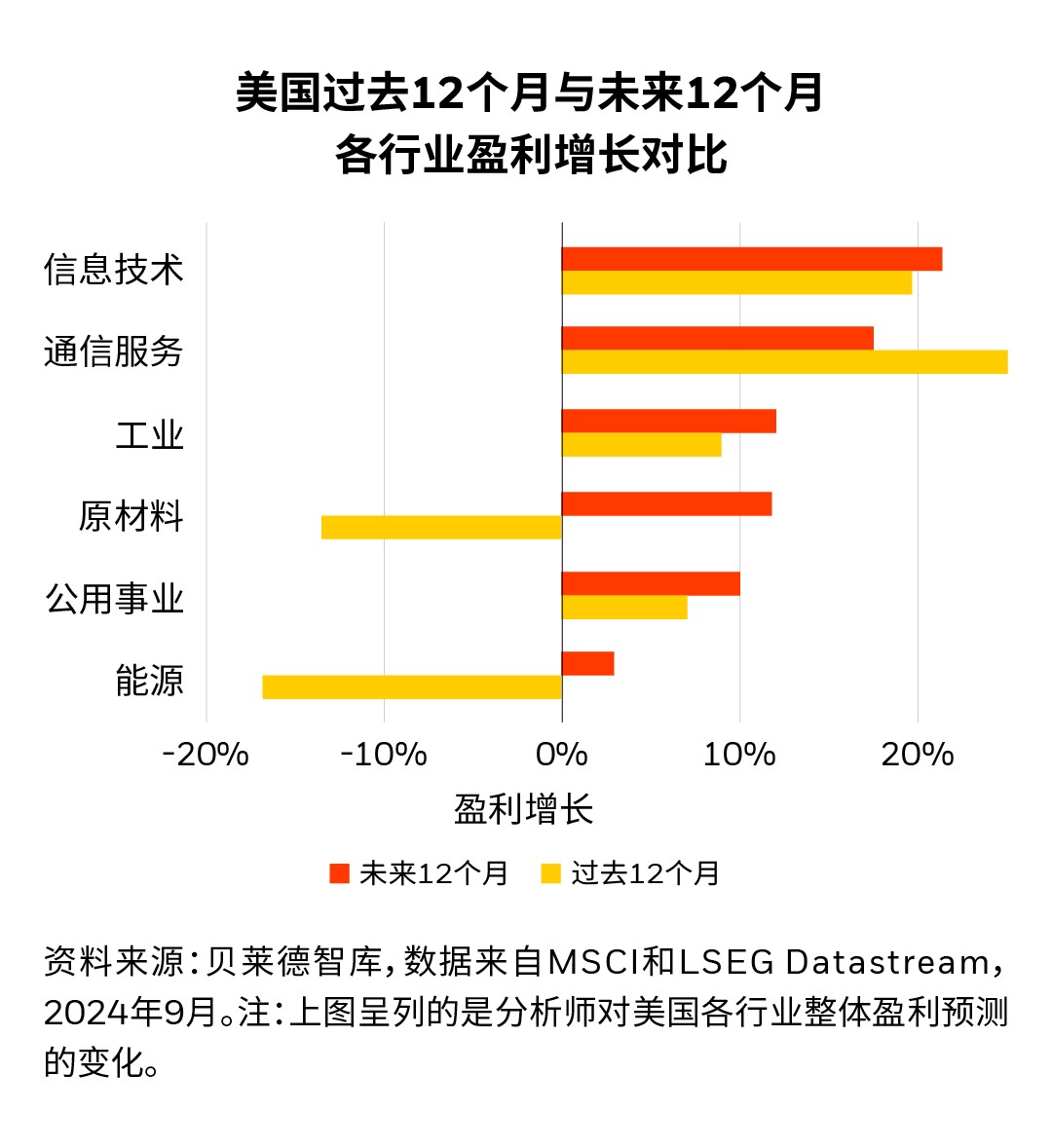

如下圖所示,分析師預測未來 12 個月美股有望迎來廣泛的盈利增長,尤其是與人工智能主題相關的行業。儘管科技公司在盈利方面的領先地位持續,但其他公司與美國科技公司之間的盈利增長差距正在縮小,這表明美股漲勢範圍有望擴大。在市場波動持續的背景下,貝萊德表示看好仍能取得持續盈利增長和自由現金流的優質公司。

貝萊德表示不只關注美國科技股,而是擴大到更廣泛的人工智能建設相關領域。此外,該機構微調了對日本股票的觀點,但仍保持超配。對短期美債持低配觀點,但看好中期美債和優質信用債。

貝萊德仍看好人工智能主題相關機會,但微調了配置。在目前人工智能發展的第一階段,投資者質疑主要科技公司的人工智能資本支出規模,以及人工智能的應用是否會加快。雖然密切關注相關信號以適時調整觀點,但需要保持耐心,因為人工智能的建設還有很長的路要走。不過,市場對這些公司的情緒轉變可能會使其估值承壓。所以,貝萊德轉向關注人工智能發展第一階段的受益者,包括提供關鍵投入的能源和公用事業公司,以及與人工智能建設相關的房地產和資源公司。除美國之外,貝萊德微調對日本股票的觀點,但仍保持超配。由於日元升值對企業盈利造成拖累,以及日本央行在通脹高於預期後發出一些模稜兩可的政策信號,下調對日本股票的看好程度,但預計日本的企業改革仍將繼續提升股東回報。

美國企業盈利增長不再侷限於早期的人工智能贏家,這表明美國經濟比市場定價所反映的更具韌性。如市場預期,美國經濟增長正在放緩,但市場對經濟數據走弱表現出的極端反應有些過度。相比情緒數據所暗示的情況,目前美國經濟活動其實仍保持着較好態勢。失業率上升是由於移民增加帶來的勞動力供應增加,而非需求下降。從中期維度看,勞動力不斷減少、美國鉅額財政赤字以及地緣政治分化等顛覆性趨勢都將導致通脹居高不下。

儘管最近美國通脹正朝着美聯儲的目標回落,但中期內通脹上升將限制美聯儲降息的幅度。對經濟增長的憂慮以及通脹降温,使得美國 10 年期國債收益率下降至 15 個月來的低位,因為投資者預期美聯儲年內將降息 100 多個基點,未來 12 個月將降息約 240 個基點,這意味着美聯儲將對經濟衰退做出回應。如此一來,政策利率或低於貝萊德預期的中性利率,即不刺激也不阻礙經濟增長的利率水平。貝萊德對短期美債持低配觀點,並在發達市場的其他領域尋找收益機會,比如短期歐元區債券和信用債。