上周两篇报道撼动市场后,又一资深央行记者发声:应该降息 50 基点!

资深央行记者 Greg Ip 认为,当前的实际短期利率已经达到 3.2% 至 3.5%,而美联储官员认为的 “中性” 实际利率范围仅为 0.5% 至 1.5%。美联储应该在 7 月就开始降息,如果此次只降 25 基点,未来若有更多疲软的数据出台,美联储将更加落后于市场预期。

随着通胀逐步降温和劳动力市场的快速冷却,美联储本周的利率决策比以往任何时候都更加复杂。

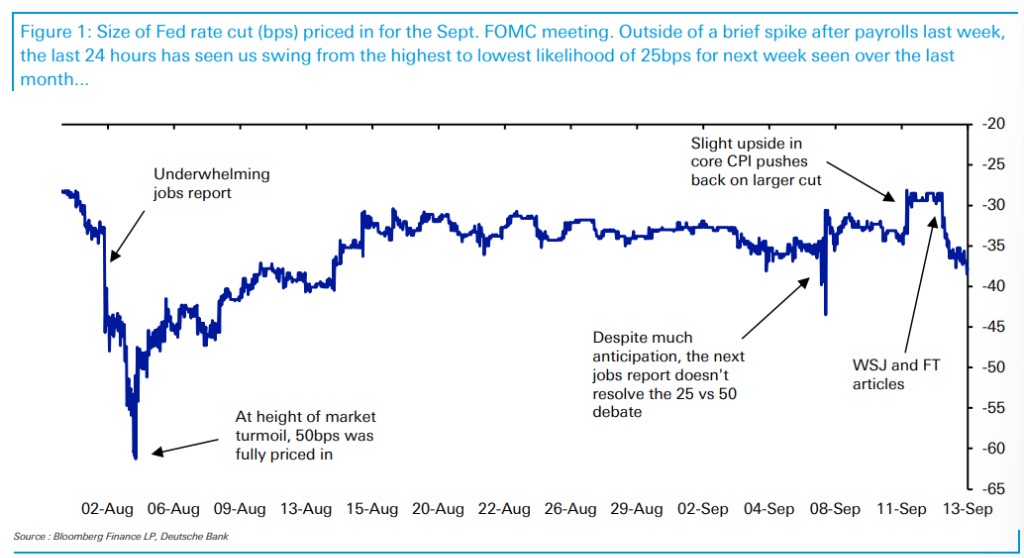

目前,市场对美联储降息幅度的预测依然各执一词。上周,“新美联储通讯社” Nick Timiraos 发表了一篇文章,认为 25 个基点和 50 个基点的降息是一个 “接近的抉择”。德意志银行的 Matt Luzzetti 认为,文章倾向于支持更大幅度的降息。

金融时报的 Colby Smith 也发表了类似观点的文章,Matt Luzzetti 的解读是,文章倾向于反对更大幅度的降息。

8 月的美国 CPI 数据发布后,市场普遍预期降息 25 个基点(bps)的可能性较大。然而,华尔街日报和金融时报的文章引发了市场对降息幅度的重新评估,降息 50 个基点的概率上升。

15 日,《华尔街日报》资深央行记者 Greg Ip 根据当前的经济形势分析,认为美联储进一步降息的需求愈加明显,他呼吁降息 50 个基点。CNBC 记者 Carl Quintanilla 评论称:“意见领袖放话了!”

通胀已接近美联储的 2% 目标

Greg Ip 认为,如今的经济环境已经发生了显著变化,“通胀胜利已成定局”,已经有足够的理由支持美联储大幅降息。

根据最新数据显示,部分核心通胀指标已回落至 3% 以下,甚至接近美联储的 2% 目标。以剔除食品和能源价格波动的核心通胀率为例,从去年 8 月的 4.2% 下降至 2.7%。

哈佛大学经济学家 Jason Furman 计算得出的一个与 PCE 等值的基础通胀率也显示,当前的基础通胀水平正在接近 2.2%,这是自 2021 年初以来的最低点。

因此,通胀水平的持续下降使得美联储有更宽松环境下降息。

此外,Greg Ip 认为,油价的变化也是影响通胀的重要因素。7 月份油价曾达到每桶 83 美元,而近期已经跌至 70 美元以下。油价下降不仅会直接降低整体通胀率,还会间接压低核心通胀率,因为石油作为关键生产投入品会影响到各行各业的成本。

据加州大学洛杉矶分校的一项研究,石油价格波动可以解释 16% 的核心通胀变化,且其影响在两年内逐步显现。

利率或应回归中性

不仅是当下的通胀已经放缓,市场对未来的通胀预期也进一步下降。根据通胀挂钩债券和衍生品的数据显示,未来 12 个月的 CPI 预计将仅上涨 1.8%,未来五年的平均通胀预期为 2.2%。这表明投资者对美联储实现 2% 通胀目标充满信心。

然而,这种通胀预期的下滑也意味着实际利率正在上升。当前的实际短期利率已经达到 3.2% 至 3.5%,而美联储官员认为的 “中性” 实际利率范围仅为 0.5% 至 1.5%。Greg Ip 认为,这表明当前的利率水平对经济活动的抑制作用显著超过必要水平。因此,美联储更加有理由大幅降息。

2022 年,美联储曾以半个基点和四分之三基点的幅度加息,因为当时的实际利率为负值,远低于中性水平。如今,在通胀缓和的背景下,采取同样的逻辑应该反过来适用。

劳动力市场降温

除此之外,Greg Ip 表明,目前劳动力市场出现了一些降温迹象。

数据显示,今年 7 月,美国失业率升至 4.3%,这一增幅曾引发市场恐慌,因为历史上类似的失业率上升往往意味着经济衰退;到了 8 月,失业率小幅回落至 4.2%。其他经济指标如消费者支出、失业保险申请等都显示经济依然保持韧性。

此外,每名失业者对应的职位空缺数量从 2022 年初的两倍下降至目前的 1.1 倍,低于疫情前的水平。过去三个月,私营部门的月度新增就业岗位数量平均为 9.6 万个,同样低于疫情前的水平。这意味着随着就业机会减少,工资增长的速度很可能会放缓,通胀威胁依旧不大。

美联储的抉择:哪一个风险更大?

美联储在每一次利率决策时都面临两难境地:过早降息可能导致经济过热,保持高利率则可能加剧经济疲软。问题在于,哪种选择带来的风险更大?

Greg Ip 认为:降息 50 个基点并非毫无风险。

当前,长期国债收益率已经低于短期利率,形成了所谓的 “收益率曲线倒挂”,并且可能进一步下降,从而拉低抵押贷款利率。股票可能会变成泡沫。这将刺激消费。

然而,如果只降息 25 个基点,风险可能更大。

全球经济的疲软已显而易见,汽车贷款和信用卡违约率也在上升,高利率正在对消费者形成压力。事实上,许多分析人士认为,美联储应该在 7 月就开始降息。如果此次只降 25 基点,未来若有更多疲软的数据出台,美联储将更加落后于市场预期。