什么信号?交易员再度疯狂押注美联储本周降息 50 个基点

債券交易員再次押注美聯儲在本週會議上降息 50 個基點的可能性超過 25 個基點。掉期定價顯示,降息 50 個基點的概率已超過 50%。這導致兩年期美國國債收益率降至兩年最低,美元指數跌至今年最低。分析師對美聯儲的決策存在分歧,荷蘭合作銀行預計降息 25 個基點,而法國興業銀行認為市場可能迫使美聯儲降息 50 個基點。渣打銀行警告,降息 50 個基點的風險更大,可能導致失業率上升。

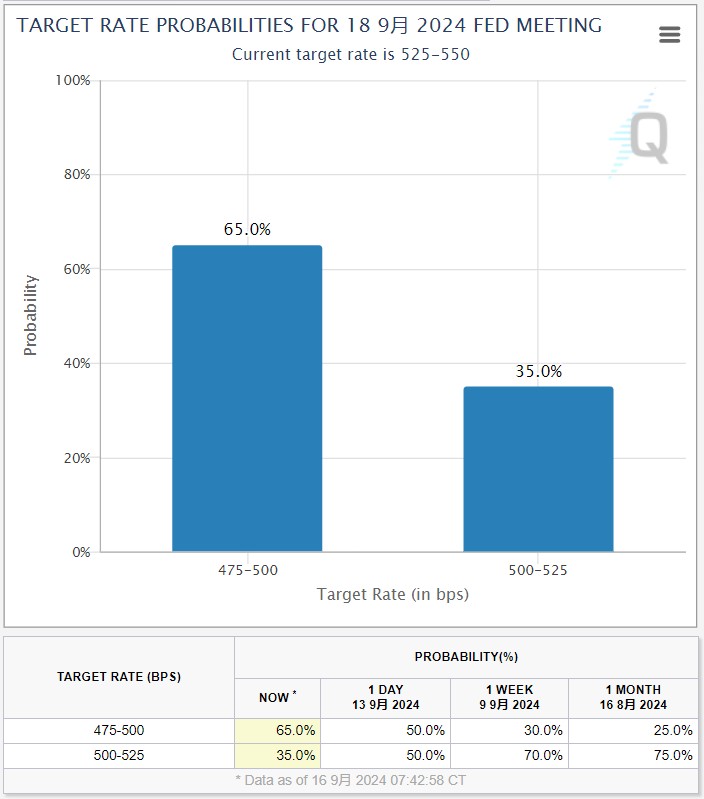

智通財經 APP 獲悉,債券交易員又一次認為,美聯儲政策制定者在本週會議上降息 50 個基點的可能性大於 25 個基點。

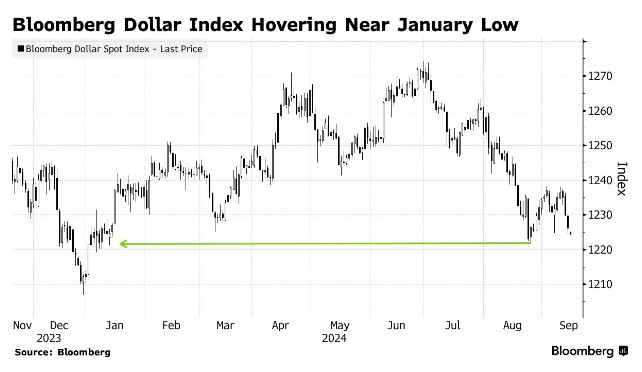

與美聯儲當地時間週三利率決議相關的掉期定價顯示,在上週幾乎完全排除了降息 50 個基點的這一選項後,概率再次超過 50%。這使得兩年期美國國債收益率回到兩年來的最低水平,並拖累美元指數跌至今年 1 月以來的最低水平。

過去幾個交易日的定價逆轉增加了 9 月 18 日決定的風險。投資者對經濟需要多少政策支持,以及美聯儲以大幅降息開啓寬鬆週期的決定將發出什麼信號感到矛盾。

荷蘭合作銀行高級美國策略師 Philip Marey 寫道:“這是一個難分伯仲的決定。” 他預計美聯儲將降息 25 個基點。“鮑威爾缺乏指引可能表明 FOMC 尚未達成共識。更重要的是,週二的零售銷售仍有可能改變這一計算結果。”

法國興業銀行宏觀策略師 Kit Juckes 表示,市場有可能迫使美聯儲降息 50 個基點。他補充道,未來幾天美國的零售銷售和工業生產數據可能會影響人們的看法。他説,如果零售銷售疲軟推高了定價,FOMC可能會擔心跟不上形勢。

然而,有大行表示對美聯儲降息 50 個基點保持警惕。渣打銀行週一發表聲明稱,FOMC 在即將到來的會議上降息 50 個基點可能會比降息 25 個基點更糟糕。

該機構指出:“經濟數據並沒有為在即將召開的會議上降息 50 個基點提供令人信服的理由。” 渣打銀行接着補充道:“降息 50 個基點並犯錯可能比降息 25 個基點並出錯更糟糕。”

該行強調,鮑威爾和美聯儲不能讓市場失望。該公司認為,降息 50 個基點的風險更大,因為這樣就有可能在 9 月份看到失業率上升。

渣打銀行認為,降息 25 個基點可能會產生影響,並附上一個明確的信息:“FOMC 將密切關注降息 50 個基點的情況。”

市場動盪

這一切都是在美國政治局勢日益緊張的背景下發生的。美國聯邦調查局正在調查一起針對前總統特朗普的明顯暗殺企圖,就在兩個月前,這位共和黨總統候選人在賓夕法尼亞州的一次集會上遭遇槍擊。

週一,兩年期美國國債收益率一度下跌 4 個基點,至 3.54%,延續了收益率從 4 月底逾 5% 的高點暴跌後的漲勢。美國三大股指期貨漲跌不一。

由於美聯儲成員在 9 月 17 日至 18 日的政策會議之前處於空白期,交易員幾乎沒有什麼數據可以依賴,包括週二公佈的 8 月零售銷售數據。

與此同時,對預期的重新定價也對美元造成了影響,過去一個月美元兑多數主要貨幣走弱。日元是漲幅最大的貨幣之一,週一突破了備受關注的 1 美元兑 140 日元的水平。

澳大利亞國民銀行策略師 Rodrigo Catril 表示:“我們認為,美聯儲即將迎來新一輪的寬鬆週期,這對美元來説是一大不利因素。隨着美聯儲明年放鬆貨幣政策,將基金利率調降至中性,甚至低於中性,美元將開始週期性下跌。”

儘管一項技術指標顯示,隨着動能轉為看跌,美元將得到支撐,但市場絕大多數都認為美元將走弱。一項對分析師的調查顯示,預計到明年這個時候,歐元、日元、加元和澳元兑美元匯率都將走強。