The market expectations are very aggressive. What will happen if the Federal Reserve does not cut interest rates by 50 basis points on Wednesday?

有分析稱,對於市場而言,本週唯一重要的事情是美聯儲選擇降息 25 個還是 50 個基點。如果降息幅度小於 50 個基點,可能會製造失望情緒並引發股債市場拋售,製造巨大的 “金融狀況緊縮衝擊”。

短短兩週前,降息 50 個基點會被視為美聯儲在恐慌,而如今,如果美聯儲 “令人失望、僅降息 25 個基點”,那麼風險資產可能會遭遇劇烈(儘管短暫)的下行衝擊。

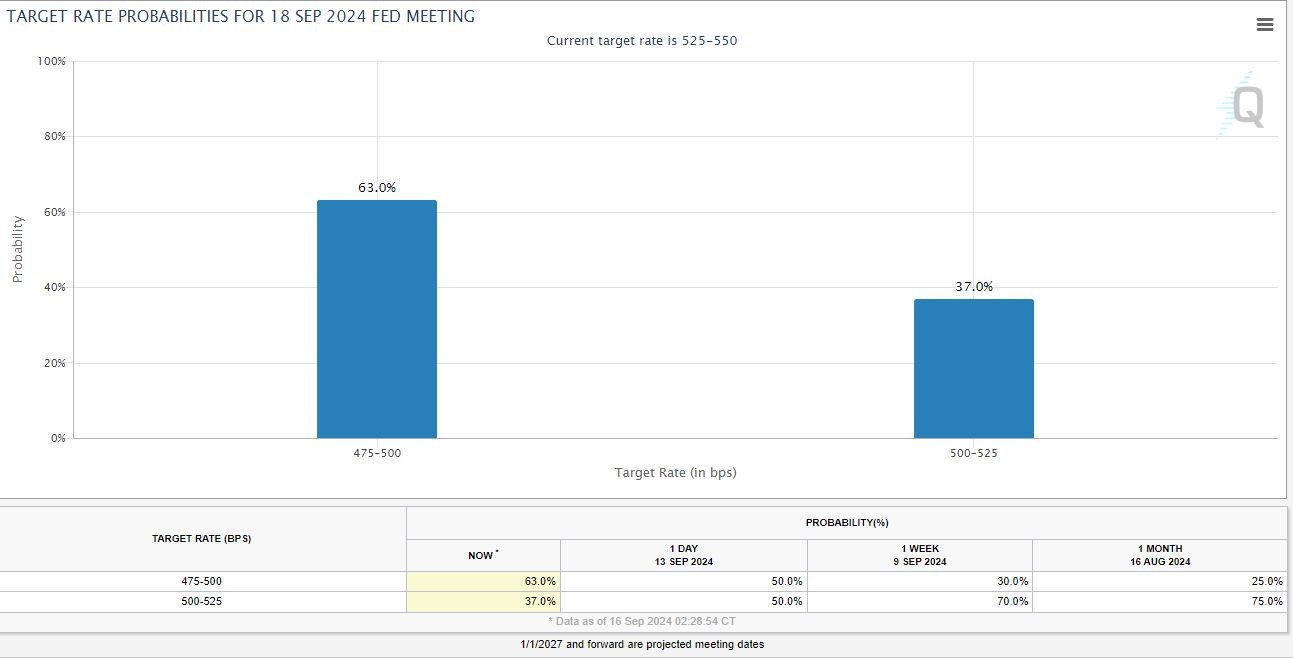

據芝加哥商交所的 “美聯儲觀察” 工具,期貨市場對週三的美聯儲降息規模定價為:大幅降息 50 個基點的概率高達 63%,遠超一週前的 30%,“常規” 降息 25 個基點的可能性僅為 37%。

也就是説,在經過上週四的 “美聯儲通訊社” 等多家主流財經媒體觀點文章反覆預熱之後,市場對美聯儲首次降息的幅度預期突然從 25 個基點轉為了 “更有可能大幅降息”,但也仍在搖擺。

有一派觀點認為,美聯儲 “不敢” 冒然大幅降息 50 個基點,當前美國經濟數據並沒有達到適合大幅降息的危機程度,大幅降息反而可能驗證美聯儲在幕後對經濟存有恐慌,從而引發股市拋售。

但與此同時,多位堪稱 “美聯儲風向標” 的媒體都刊文為潛在大幅降息造勢,也是讓人無法輕易忽視的另一派聲浪,也就是説,越來越多的市場人士開始認同降息幅度越大會越好。

正如瑞士私人銀行愛德蒙得羅斯柴爾德(Edmond de Rothschild )的分析師所總結:“鑑於市場上對美聯儲意圖的猜測,很少出現如此大的不確定性。”

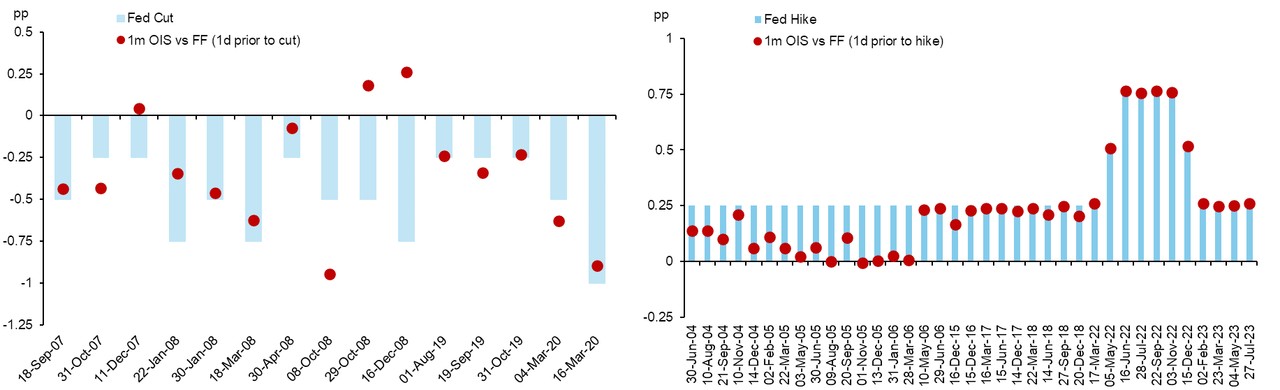

高盛衍生品交易員 Brian Garrett 分析了過去十五年的 “期貨市場定價” 與 “美聯儲實際行動” 的數據,發現在加息週期時,伯南克時期以來的美聯儲通常行動與市場定價一致,而降息週期中存在一定的不確定性,例如 2008 年金融危機和 2020 年新冠疫情期間美聯儲意外更為鴿派,但 2019 年 9 月等某些情況下的降息幅度卻低於市場定價。

德意志銀行在研報中指出,媒體上週起對美聯儲大幅降息 50 個基點的造勢,其實比 2022 年 6 月大幅加息 75 個基點前夕的力度要弱,但當前市場定價的降息幅度接近 40 個基點,令美聯儲在兩天後降息製造意外的概率升至十五年來最高。如果這兩天沒有媒體 “唱反調” 拉平市場預期,那很可能週三真會大幅降息50個基點,“未來 12個小時的媒體言論對鞏固定價至關重要。”

實際上,高盛對沖基金銷售主管 Tony Pasquariello 認為,美聯儲沒有理由選擇降息 50 個基點、而不是 25 個基點,一是因為默期前的美聯儲官員們沒有背書過 “用大幅降息來開啓降息週期”,而且 CPI 數據並不支持大幅降息,“50個基點降息通常只用於壓力很大的環境”,除非美聯儲想在 9月到 11月兩次 FOMC會議期間的 “漫長等待期” 為更差的就業數據 “買上一點保險”。

野村證券的跨資產策略師 Charlie McElligott 指出,週日的重磅媒體文章稱,鑑於利率遠未達到中性水平,且勞動力市場正在降温,最好用大幅降息來開啓新一輪週期,這似乎暗合了美聯儲主席鮑威爾在 8 月傑克遜霍爾年會的講話論調,即美聯儲不尋求也不歡迎就業市場狀況進一步降温。

而且當時鮑威爾還稱 “通脹的上行風險已經減弱”,本就引導市場聚焦勞動力市場降温,這也是為何市場定價的今年降息幅度高達 121 個基點,其中 9 月和 11 月都被認為會降息 50 個基點。這也是為何兩年期美債收益率上週重回兩年低位,收益率曲線也呈現降息後的 “牛市趨陡”。

素來以毒舌著稱的金融博客 Zerohedge 總結稱,自美聯儲官員進入靜默期以來的短時間內,在就業和製造業數據持續欠佳的同時,CPI 和 PPI 等多個核心通脹增超預期,這也是為何 9 月大幅降息的市場預期沒有全面轉為 “板上釘釘” 的原因:

但這給我們帶來了一個有趣的悖論:無論是有意還是無意,美聯儲似乎在通過媒體大肆 “試探性” 預熱降息 50 個基點,這令任何低於這一水平的降息都會引發市場拋售。對大幅降息的預期兩週前還沒被市場認可,正相反,當時把降息 50 個基點視為美聯儲恐慌(的經濟負面徵兆)。

Zerohedge 還提到,如果美聯儲 “令人失望、僅降息 25 個基點”,那麼風險資產可能會遭遇劇烈(儘管短暫)的下行衝擊,G10 國家債市中積累到三年新高的 CTA 多頭趨勢淨敞口可能被觸發止損,製造巨大的 “金融狀況緊縮衝擊”:

“下一個關注點是美聯儲 2025 年利率走勢的 “點陣圖” 如何彌合與市場定價之間的巨大差距。

而寬鬆週期中的市場表現取決於最終目的地:是否會出現經濟衰退。如果避免了衰退,美股大盤將在首次降息後的 12 個月內上漲 14%。若美國在 12 個月內陷入衰退,美股在首次降息後一年內的中值回報率為負 15%。”

稍早,貝萊德集團圍繞債市發出警告,對美國短期國債的評級由 “超配” 跨檔下調至 “低配”,並警告稱市場對美聯儲降息的預期過於激進,不可能 “如願以償”。首席投資策略師主管 Wei Li 為首的略師們認為,“美聯儲在寬鬆問題上等待得太久,現在迫於形勢將加速降息以支持美國經濟” 這種臆測是錯誤的。