Barclays: Market overestimates the extent of the Fed rate cut + underestimates August retail sales data, the dollar is expected to rebound by 1%

I'm PortAI, I can summarize articles.

巴克萊外匯策略師 Skylar Montgomery Koning 表示,市場高估了美聯儲降息幅度,低估了即將公佈的 8 月零售銷售數據,預計美元將反彈 1%。她認為,強於預期的零售銷售數據將促使市場調整降息預期,可能使美元上漲。儘管市場普遍預計降息,但對降息幅度存在分歧。

智通財經 APP 獲悉,巴克萊外匯策略師 Skylar Montgomery Koning 表示,由於交易員高估了美聯儲本週降息的幅度、且低估了週二即將公佈的美國 8 月零售銷售數據,美元有望反彈。

美聯儲將於北京時間本週四凌晨公佈 9 月利率決議。儘管交易員普遍預計美聯儲將開啓降息週期,但對於降息 25 個基點還是 50 個基點仍存在分歧。而美國 8 月零售銷售數據將是美聯儲公佈利率決議之前的最後一項重磅數據。

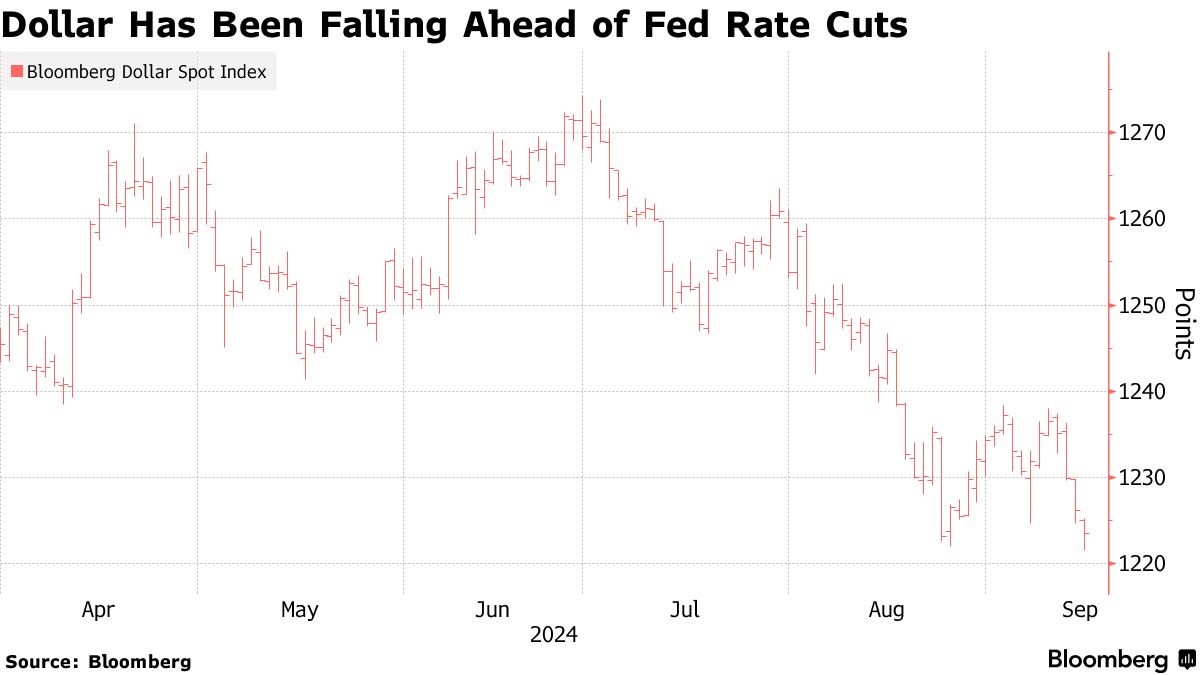

Skylar Montgomery Koning 預計,強於預期的零售銷售數據將使市場押注較小幅度的降息,從而提振美元。她表示:“我們預計 8 月零售銷售數據將強於市場預期,上個月的零售銷售數據也非常強勁。”“這可能會讓市場定價更傾向於降息 25 個基點。” Skylar Montgomery Koning 預測,受此影響,Bloomberg 美元現貨指數可能會上漲 1%。

市場目前預計,在汽車銷售疲軟的背景下,美國 8 月零售銷售將環比下降 0.2%。如果最終公佈的數據符合市場預期,將支持最近勞動力市場放緩將導致消費者更加謹慎的觀點。

不過,Skylar Montgomery Koning 表示,當涉及到降息預期時,市場往往反應過度。她表示:“在那些軟着陸時期,如果你看看歷史,大多數時候市場總是高估美聯儲的降息幅度。”“當預期出現拐點時,美元就會反彈。”