"The last important data before the Fed decision": US August retail sales increased by 0.1% month-on-month, beating expectations

I'm PortAI, I can summarize articles.

7 月份數據上修 0.1 個百分點至 1.1%。零售銷售額意外上升,表明美國消費者需求依然強勁,美國經濟軟着陸再添新證據。

美國 8 月零售銷售額意外上升,表明美國消費者需求可能依然強勁,美國經濟軟着陸再添新證據。然而,這能阻止美聯儲在本週三大幅降息嗎?

9 月 17 日週二,美國人口調查局公佈數據顯示:

美國 8 月零售銷售環比增加 0.1%,好於預期的下降 0.2%,7 月份數據上修 0.1 個百分點至 1.1%。

核心零售額(不包括汽車)環比增長 0.1%,低於預期的增長 0.2%;如果不包括汽車和汽油,8 月零售銷售額環比增加 0.2%,不及預期的 0.3%,但為連續第四個月增長。

相較於去年同期,8 月零售額同比增速放緩至 2.1%,剔除汽車的零售額核心同比增長 3.9%,增速小幅反彈。

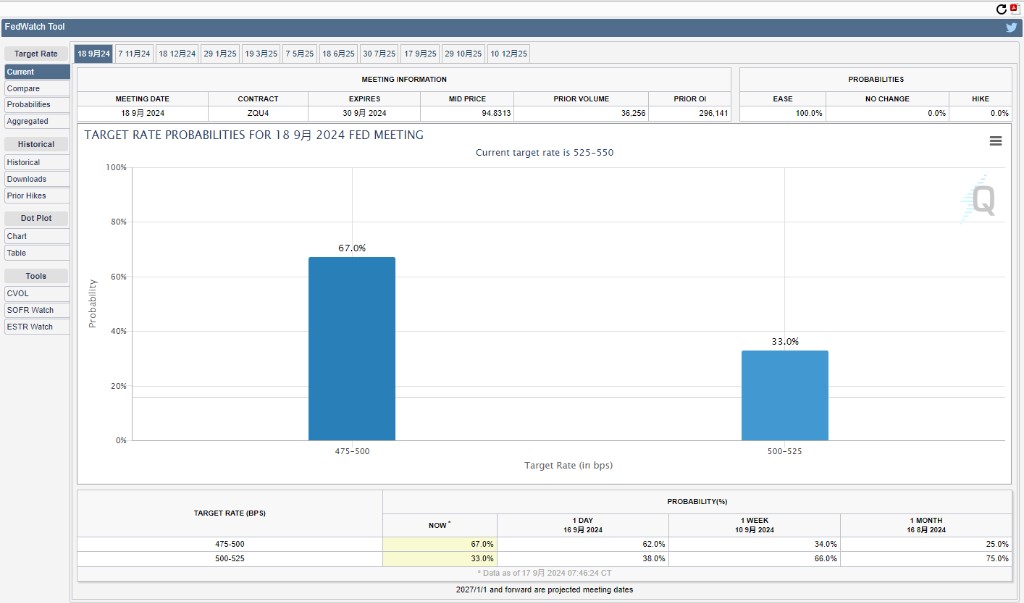

數據公佈後,美元指數短線拉昇約 10 點,美股期貨、美債、現貨黃金短線波動不大。市場對於本週大幅降息的預期仍然堅挺,芝商所美聯儲觀察工具顯示,降息 50 基點的可能性仍為 67%,較零售數據公佈前基本沒有變化。

汽車、傢俱、服飾等銷售萎靡,線上零售商銷售創新高

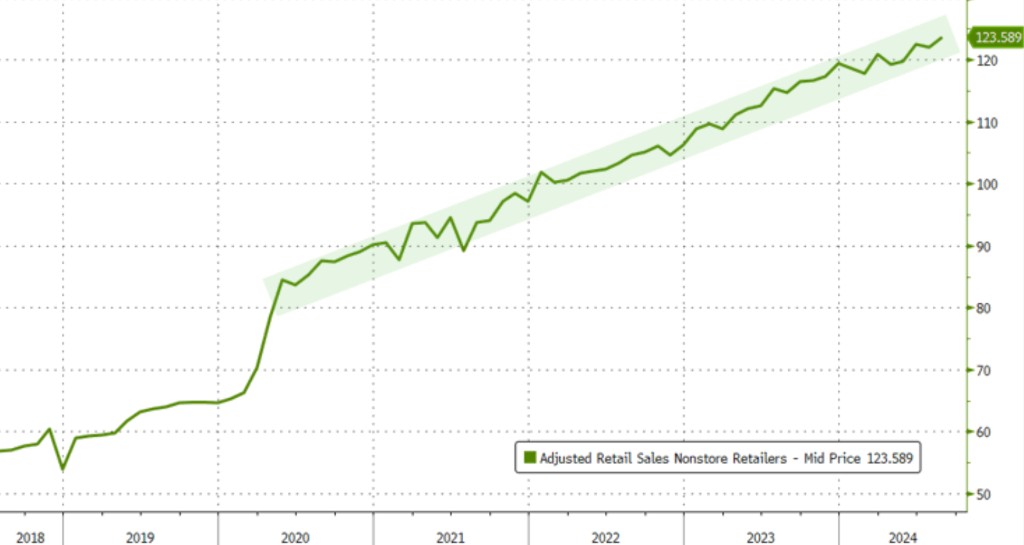

分部門來看,8 月零售數據主要受線上零售商、醫療保健支撐,零售額分別環比增加 1.4% 和 0.7%。

線上零售商銷售額(經調整)創下歷史新高。

電子產品、汽車均出現萎縮,零售額分別下降 1.1%、0.1%,傢俱、服飾、食品飲料銷售均下降 0.7%。

在經歷了上個月的激增之後,汽車銷售環比(經調整)基本持平,二手車價格下滑在一定程度上支撐了銷售。